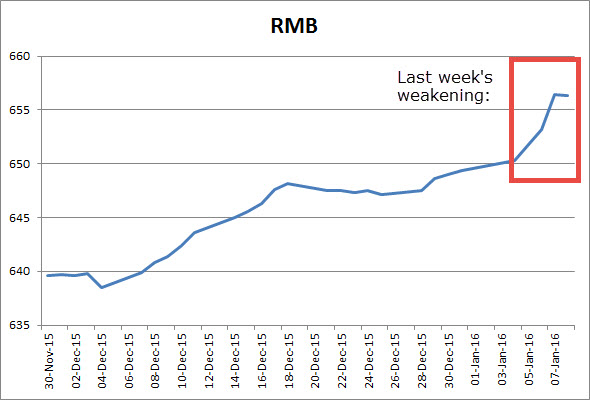

PBOC fixings have become a fixture (at least for the last couple of days). With the big sell-off in the CSI China is trying to inject liquidity into the market and doing so in different ways. For the FX market it’s been a weakening of the reference rate.

Here are the rates over the last couple of days (versus the USD):

Of course the market cottoned on to the PBOC’s desperation, and the rout continued.

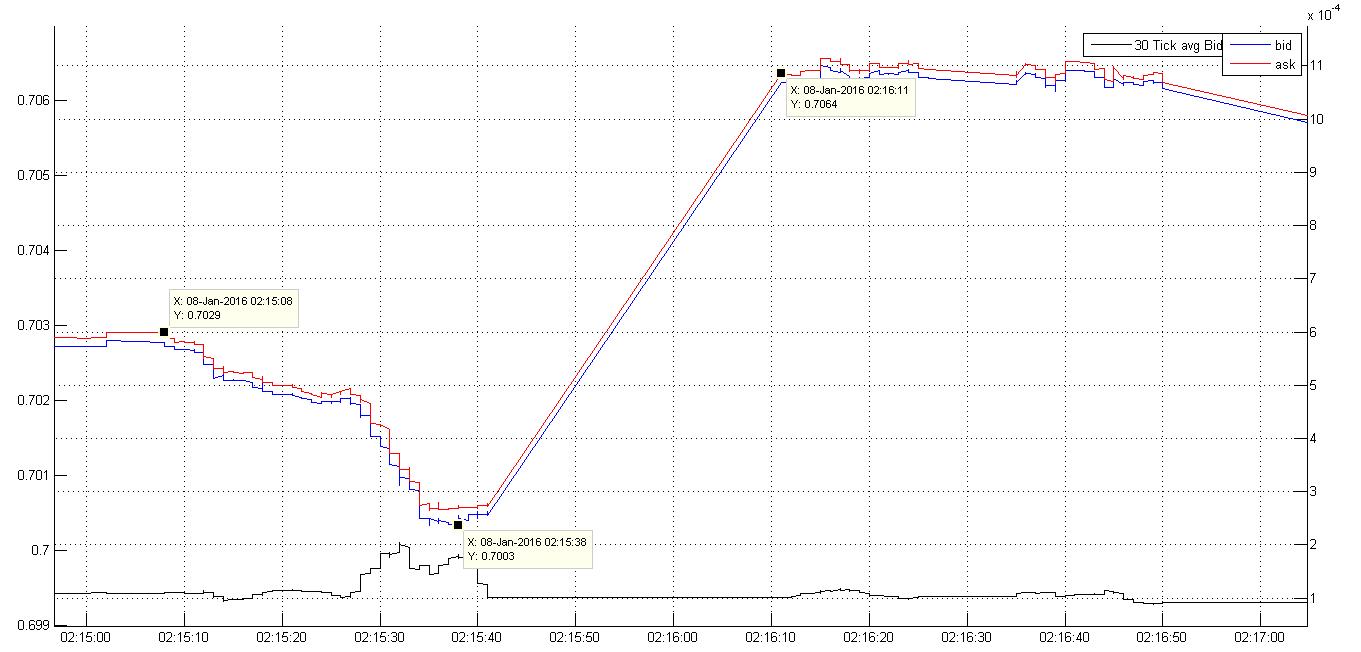

The effect on the Asian time-zone currencies was worth noting. We already covered the AUDUSD pair for the 7th January. The main take-away was that bid/ask spreads had stayed constant into the PBOC announcement time of 01:30 GMT. The dislocation in the market then tripped the short-circuits with the broker, and after a fast move within a short time quoting stopped. It then resumed afterwards. So did the broker adjust its behaviour on the 8th January?

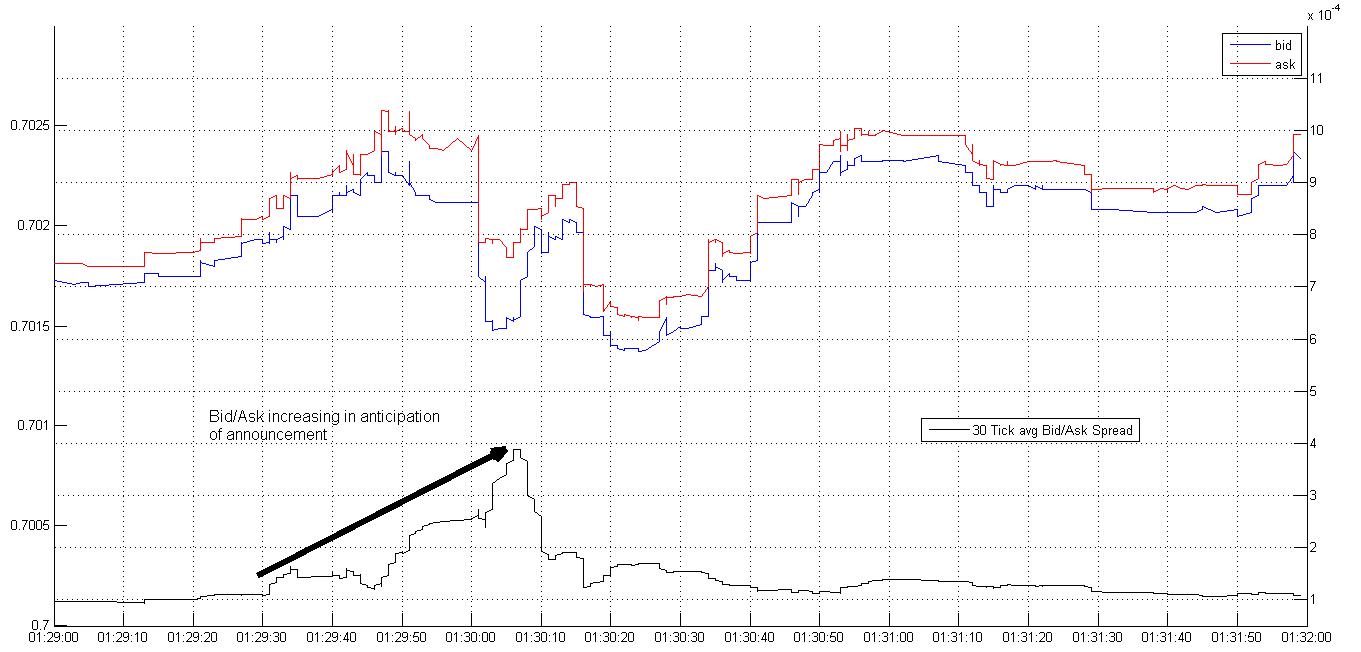

Following is the picture:

Just like before the spread stayed constant, starting to increase only as the AUDUSD start to gap down strongly. As before after a 20 pip downward plunge in very quick time, quoting stopped, and then resumed a FULL 60 pips higher! Now talk about slippage if there ever was any. It is obvious that no trades would have taken place.

It turns out that there were two further outages and the broker started to resume normal quoting by 01:17:21 GMT.

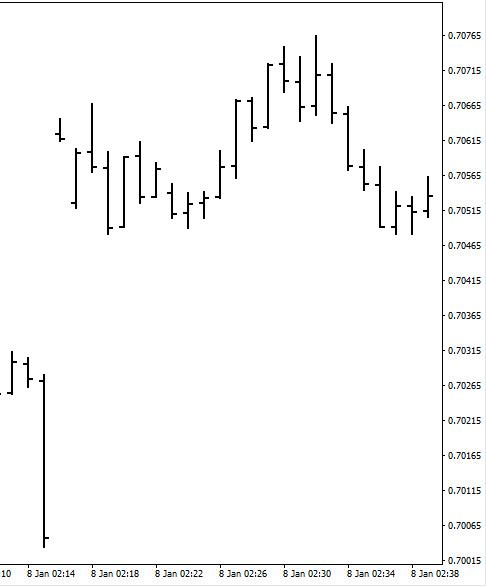

This is what the picture looked like from a minutely chart perspective:

One re-assuring thing: the candles are actually formed using the tick data that was streamed, and the candles weren’t backfilled to create a smooth picture.

And yet the granularity of the tick-data is what counts. Most intra-day trading systems, will spoofed into producing wrong results here. Either the mean-reversion type, that things it will make an outsized 60 pip profit on this dip down, or the breakout-style systems that assume they got have gotten in and out of that minutely bar.

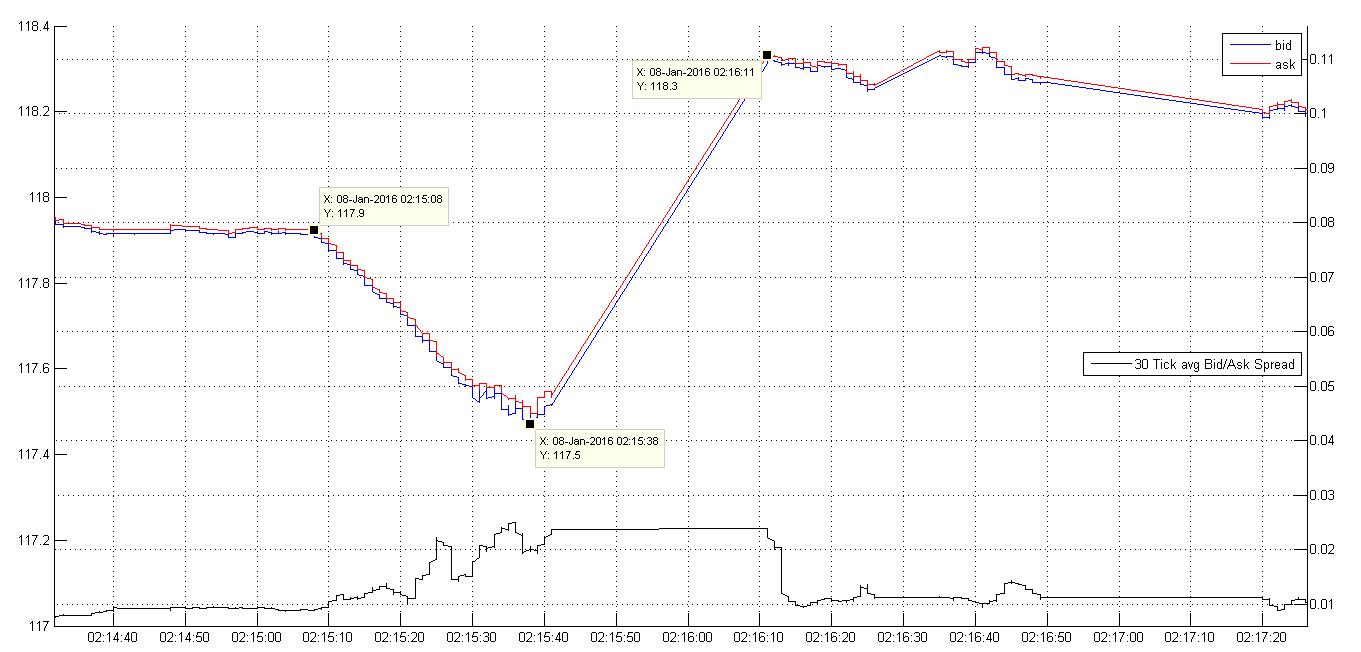

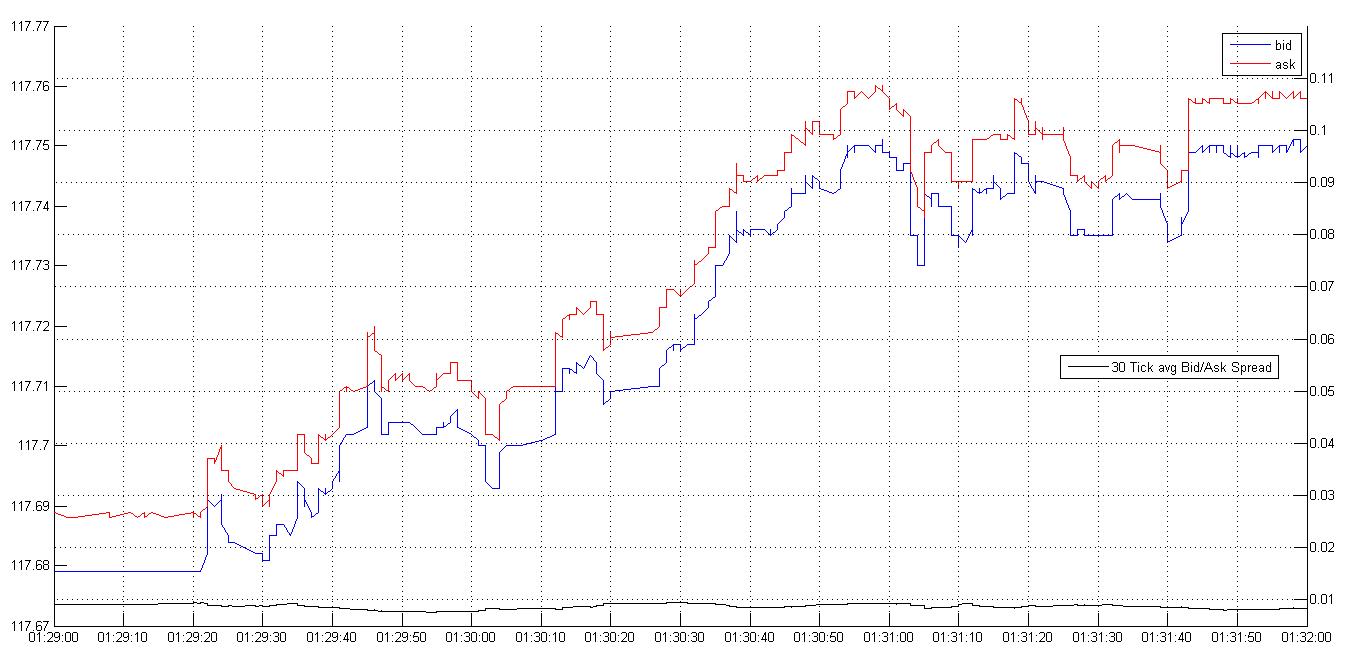

It makes sense to look at the USDJPY, which is the other main liquid pair traded in that time-zone:

Same behaviour, same dynamic. What’s incredibly interesting here: same time-stamps! Talk about information being absorbed across markets instantaneously.

In this particular case USDJPY dropped by 40 pips before being shut-down.

This now leads to a slightly different approach to looking at market impact: rather than focusing on each individual currency pair and looking at its average bid/ask spread over the last N ticks (in the above examples its 30), we can create an ‘aggregate’ bid/ask across the liquid pairs, and tally it up.

One reasoning would be: is the reaction in the market focused only one isolated factor that most likely affects only one pair, or is it market wide pandemonium.

We can check this for the 8th January using the above two currency pairs: AUDUSD and USDJPY. At 00:30AM GMT the Retail Sales number for Australia came out.

The AUDUSD reaction is:

As we saw earlier, the price starts to widen 30 seconds prior to the announcement, maxes out at 4 pips, and then normalizes pretty quickly. The Bid/Ask decays exponentially back to where it was before.

What about the USDJPY:

As expected, nothing of note.

Interesting question now: how quickly does the broker learn of new market behaviour? Given the above, I’d be expecting the 01:15 GMT PBOC fixing to start featuring on the calendar.

I’ll keep an eye out over the coming week.

Leave a Reply