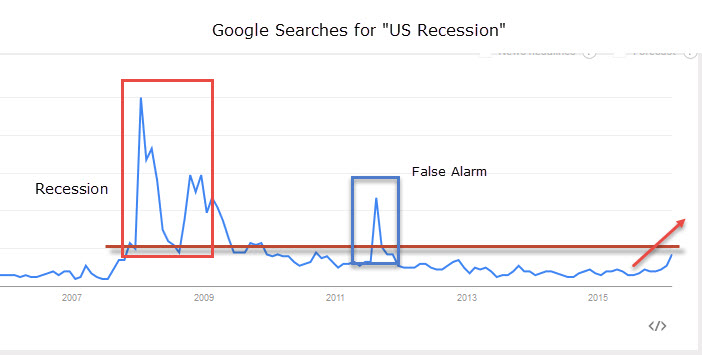

Following on in the series of Market Dynamics the NFPs presented a great opportunity to take a closer look at what happens during important news events.

I’ve learned my lesson by now: don’t trade during news events. And this is especially true of stop orders in these situations. Price will just hop straight through. When it does the fill is awful, and the worst part, as happened on Friday: it reverts very quickly hitting any protective stops.

The outcome?

You book losses which could easily have been avoided. Unfortunately this doesn’t show up in any backtests. Why? Take a look at the EURUSD reaction to the big upside surprise in the NFP numbers:

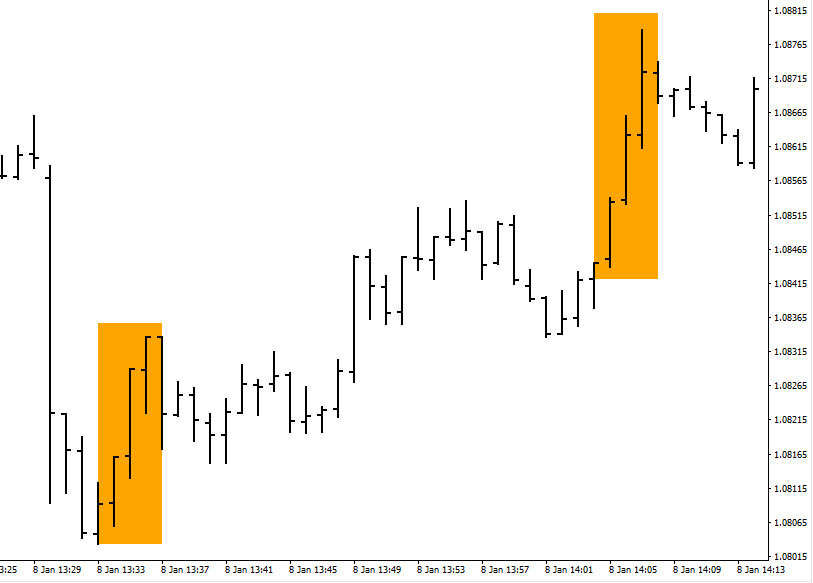

A naive backtest sees a full-bodied candle and makes the assumption that it can trade at every price level of this candle. This isn’t true. A safe approach is to assume that all trades happened at the low of the candle, or even worse.

Granted, the release was a shock to the system, but did this shock cool off quickly? No. Here are two pictures of EURUSD post the event and the minutely candles that go with it.

Half an hour after the news hit, different brokers show different candles. I got caught in the second batch, not so much on the entry but the trailing stops. The effect wasn’t large but still present. Profit in one account and near flat in the second.

So the question is: what actually did happen during these time periods??

We’ll start out with EURUSD. And then show the data for GBPUSD, USDJPY, USDCHF, AUDUSD, EURGBP, and also the impact on the S&P500 March Future. All these are tradeable instruments on my MT4 platform and the ticks indicate live data at the time on a real account (not Demo!). This doesn’t necessarily mean that they were tradeable, as you can see in the previous posts.

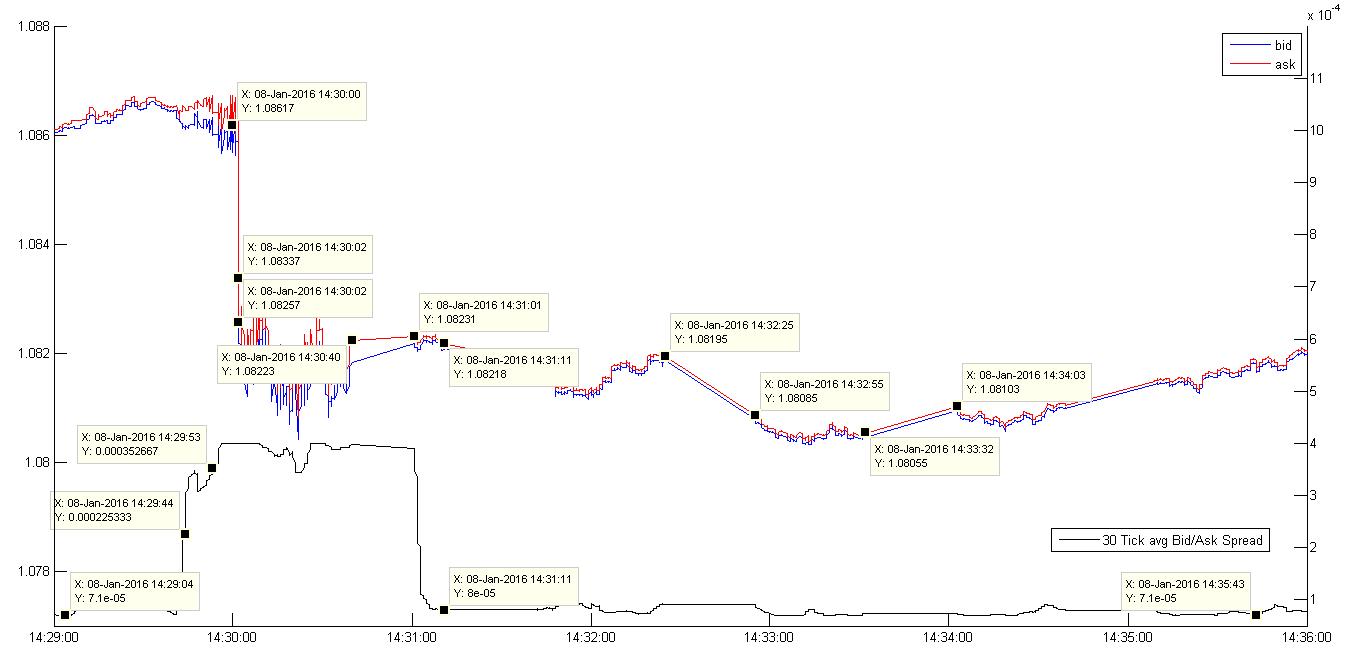

Let’s start with EURUSD:

A couple of seconds prior to the NFP number EURUSD bobbed up and down between 1.08575 and 1.08672, with the bid/ask spread maxing out at 4 pips. The surprise number came out (292K actual versus 203K expected), and at time stamp 13:30:02 price hops instantaneously from 1.08588/1.08628 to 1.08297/1.08337. It only spends one tick there and continues to 1.08217/1.08257. That’s a 40 pip instantaneous re-pricing.

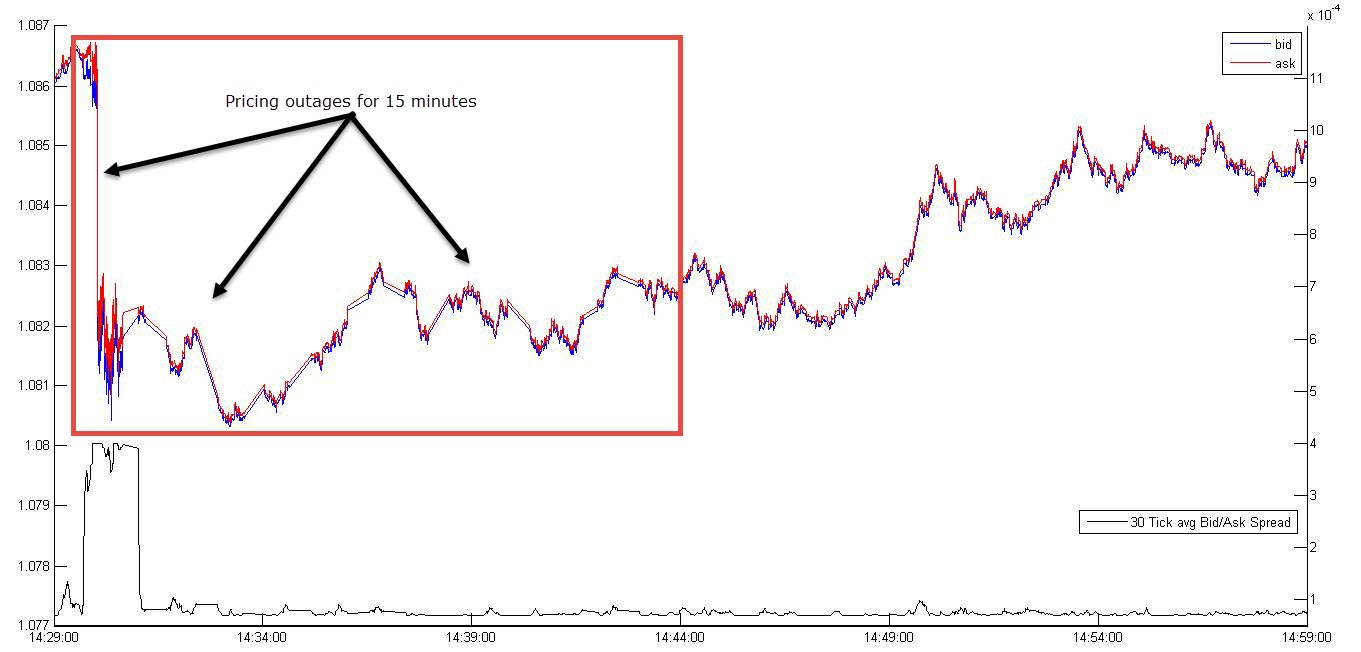

No quote outages were experienced into the NFP announcement. The next 40 seconds were a wild ride and then quoting stopped for 30 seconds. Outages were then intermittent, until 15 minutes later when everything returned back to semi-normal. The bid/ask spread maxed out at 4 pips, but came very quickly back in.

Before we continue with the other currencies here is a rough calculation. BIS (Bank of International Settlements) states that there was a daily average volume of $5.3trn in the FX market in April 2013. $2trn were spot transactions (the rest is in FX Swaps, and a minority in forwards and options). So at 1440 minutes per day, or 86400 seconds per day, that is $23mm notional per second. But hang on, only 33% were EUR trades and 87% were USD. With BIS the totals actually add up to 200% since they take both sides of the cross into account. So let’s just naively say that the actual EURUSD volume is 0.33*0.87/2 = 14% of total notional. So this would bring the notional of EURUSD trades to $3mm per second. Ok, so let’s say that Asia trading is comatose, and that there’s nothing going on there. So that means $6mm per second during London and NY FX market times. That’s 60 lots in MT4 retail parlance. Not a lot, given that every man and his dog is trying to shovel a trade through in those couple of seconds after the announcement. So much for infinite liquidity in the FX Market, and let’s not forget that most of the notional is interbank hedging and off-laying of risk, rather than market participants directly initiating trades.

So is the big move such a surprise? Given the current jitters in the market, the reduction in risk appetite, the confusion surrounding the Fed’s rate hiking cycle: no the big move isn’t surprising. And not really surprising either that it took 15 minutes to peter out, and markets to re-establish themselves.

What is surprising, though, is that I had the discipline to not participate in this gamble! Going back over the pending orders I deleted, I saved myself a tonne of money. The orders came in at 1.0857, several ticks below the price level prior to the gap. I’m estimating my fill would have been at 1.0815 (on average). So there: keep the gamble for the day after.

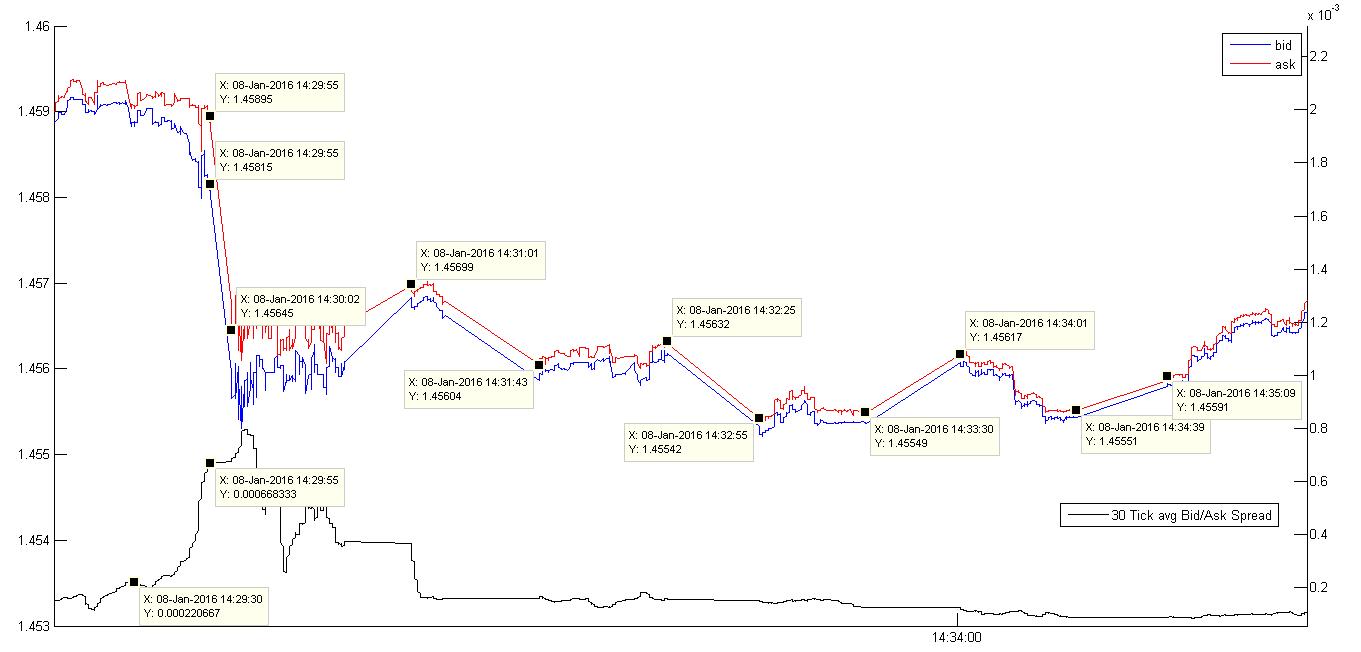

Ok, now for the same charts for the other currency pairs, starting with GBPUSD:

Interestingly there was a quote outage prior to the NFP announcement (5 seconds!). The jump itself was 30 pips, and the max average spread was 8 pips. It took 15 minutes as well to get back to ‘normal’ market conditions.

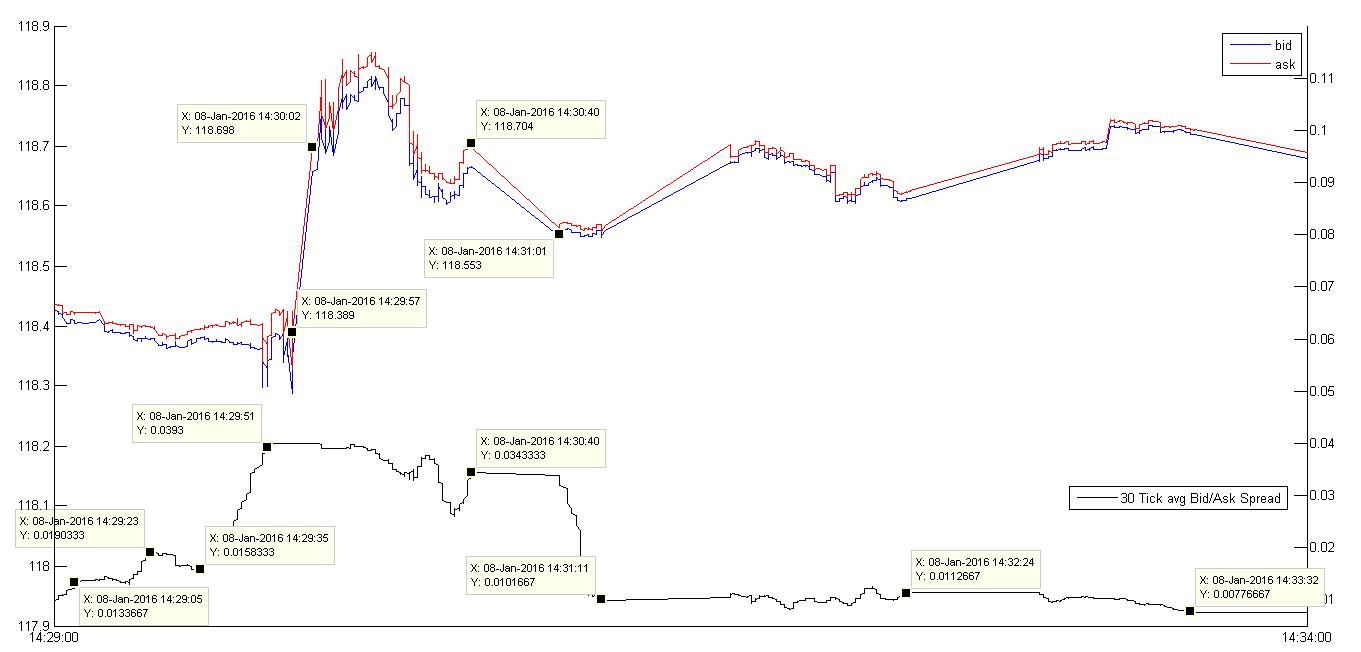

For USDJPY:

Similar to GBPUSD, quoting for USDJPY stopped prior to the announcement. Slightly later in this case: 3 seconds prior. By that time the bid/ask maxed out at 4pips. It took 1 minute to get the bid/ask back to its normal average of 1pip or so, but another 15 minutes to get back to normal markets, i.e. no more outages.

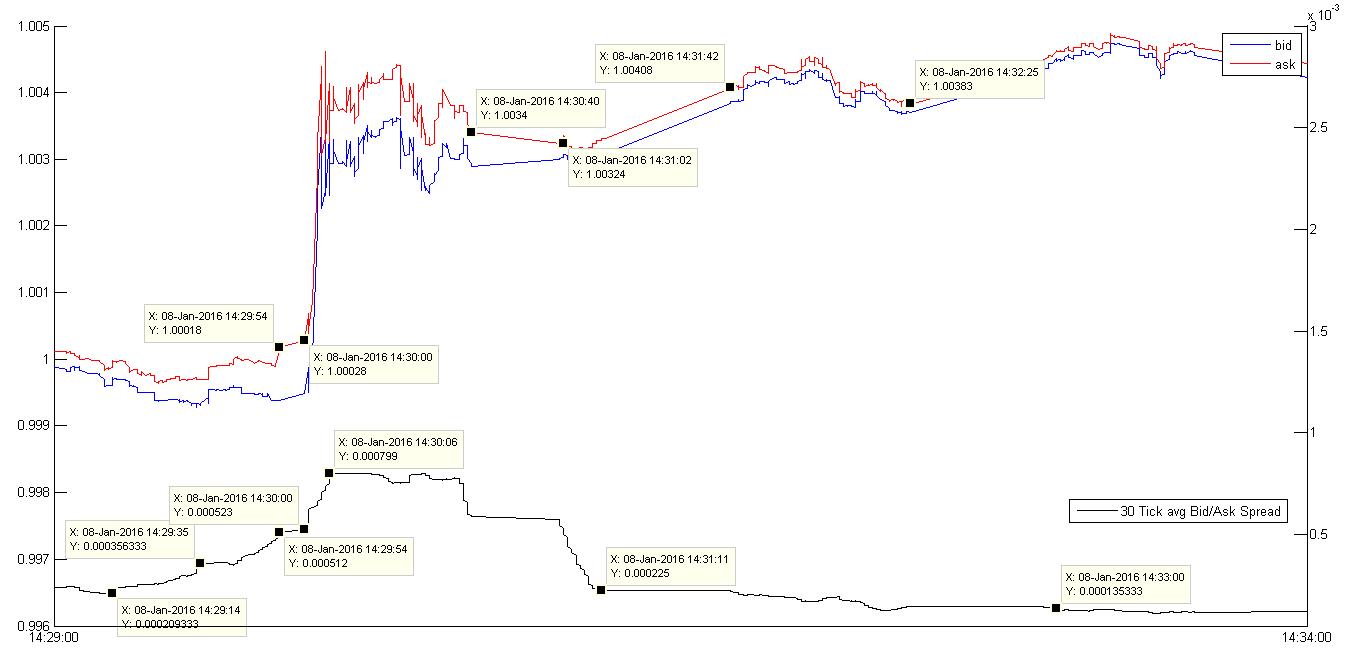

For USDCHF:

Pricing went right into the announcement, with the bid/ask peaking at 8 pips after. You did have a 6 second pricing outage prior to the announcement and several outages afterward. And again it took 15 minutes to revert back to normal trading.

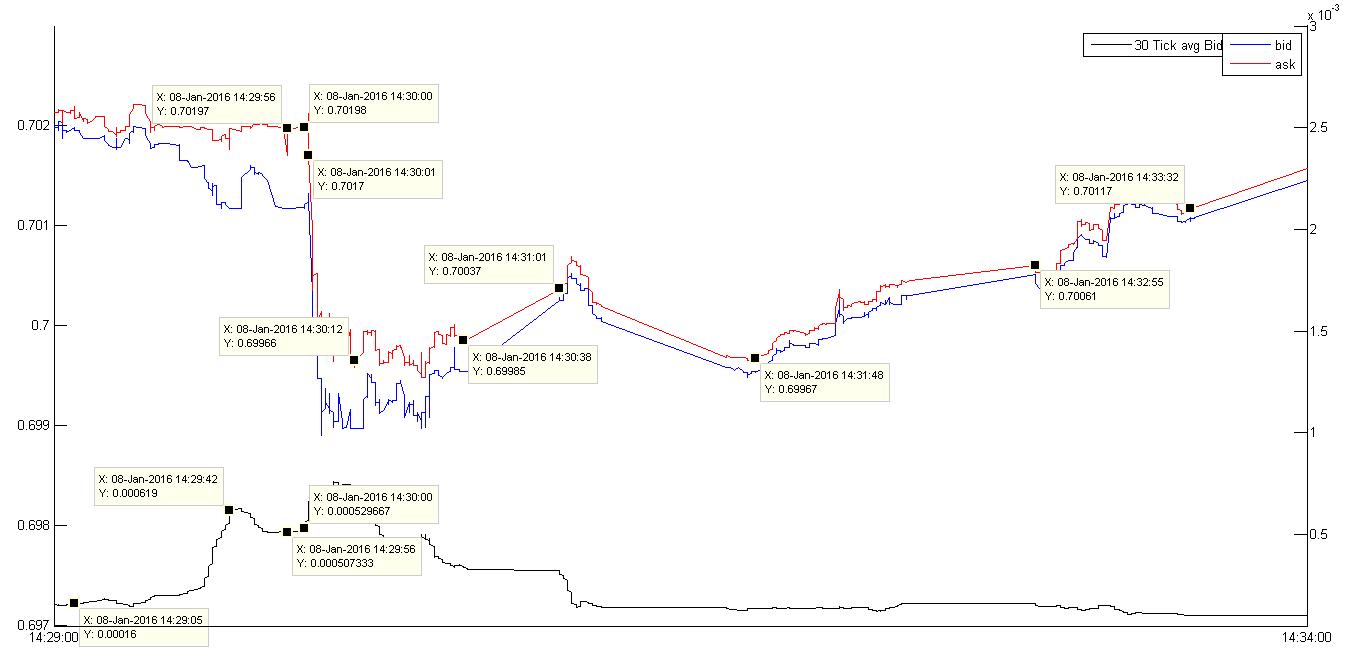

For AUDUSD:

It’s much more patchy than for the previous currencies, no surprise, as liquidity is less. Outages take longer, and the bid/ask as a percentage of price is the highest (at 7 pips average over 30 ticks). And quote outages continued for hours after the event.

Indeed a crummy currency to trade during such fast markets.

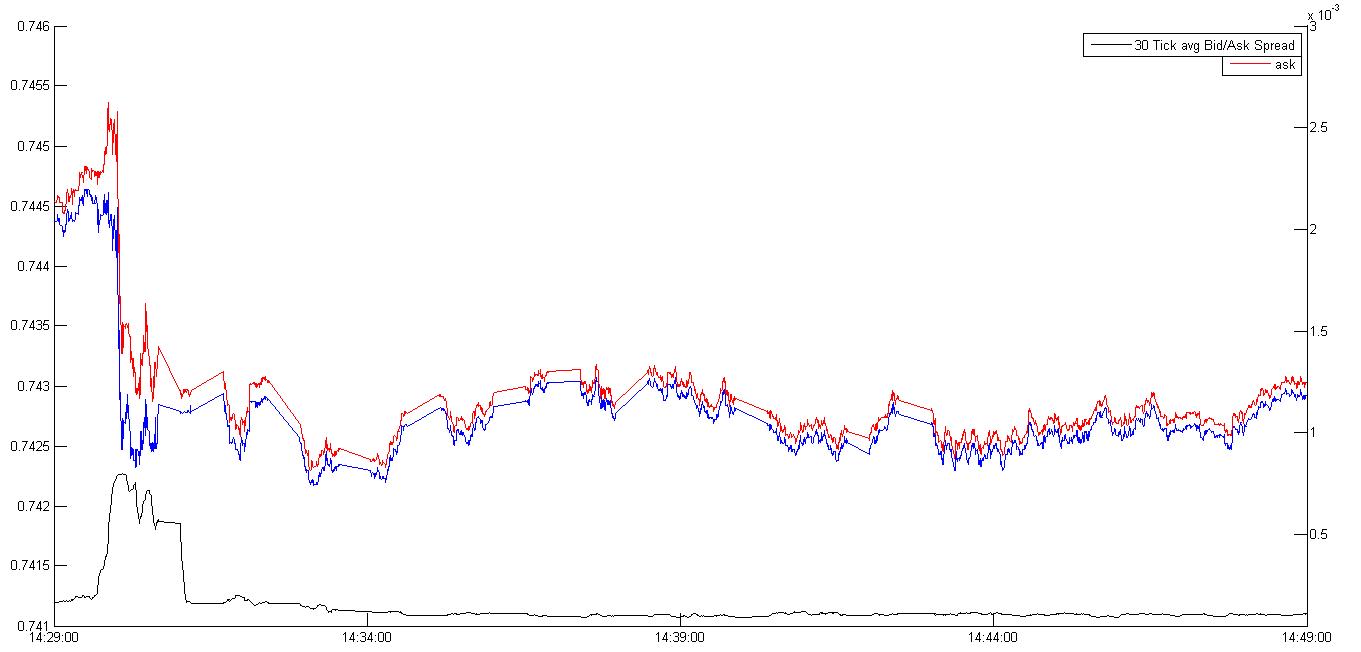

The last currency pair for which I gathered data was EURGBP. It gives access to a cross that should be liquid, and tends to have good bid/ask behavior. Following is the chart:

No need to label it. Just by inspection the conclusion is clear: utter drivel.

So in summary though EURUSD and USDJPY were the most impacted, they were also the currencies with the nicest behavior during this episode. EURUSD was especially well-behaved in terms of spread stability, frequency of quote outages, etc.) No surprises either as these are the most liquid pairs. EURUSD of course is the one that people stare at, and play the USD against, but USDJPY also has strong implications for risk on/off scenarios, and tends to be a clean expression of perceived USD strength or weakness.

What is interesting is the initial obvious reaction: USD strength, almost immediately. It makes sense: good employment, leads to strong GDP, leads to higher rates, and therefore spot needs to be re-adjusted to take the new information into account. However, shortly after the shock, EURUSD moves all the way back to its starting point while oscillating wildly.

There are strategies that will exploit these oscillations. But recall: this is a fast market, and a latency of 2 seconds allows price sufficient time to move by several pips. You need sophisticated equipment and fast connections for this game.

One thing that is apparent in a situation like this: market makers will get hit hard, since one side of their book will take a loss as it builds up inventory on the way down; against them. They will, however, make all that money back on the oscillations afterwards, which allows them to capture the spread for some time to come after the event.

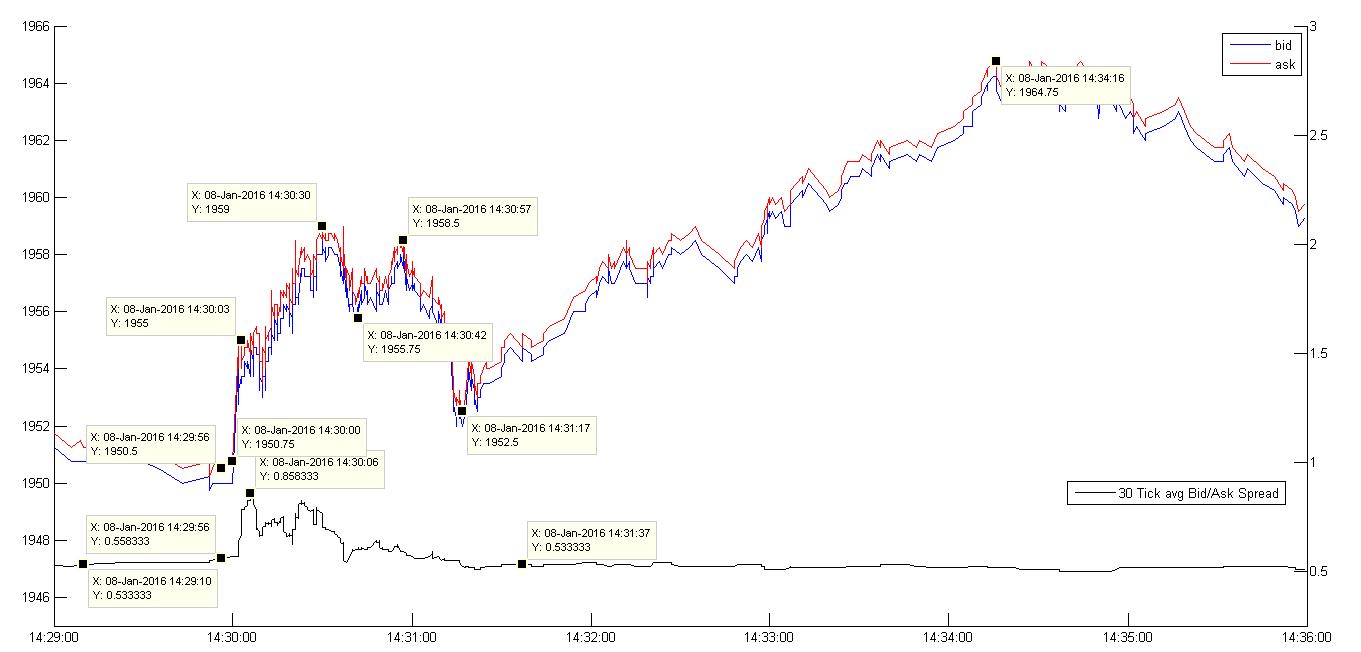

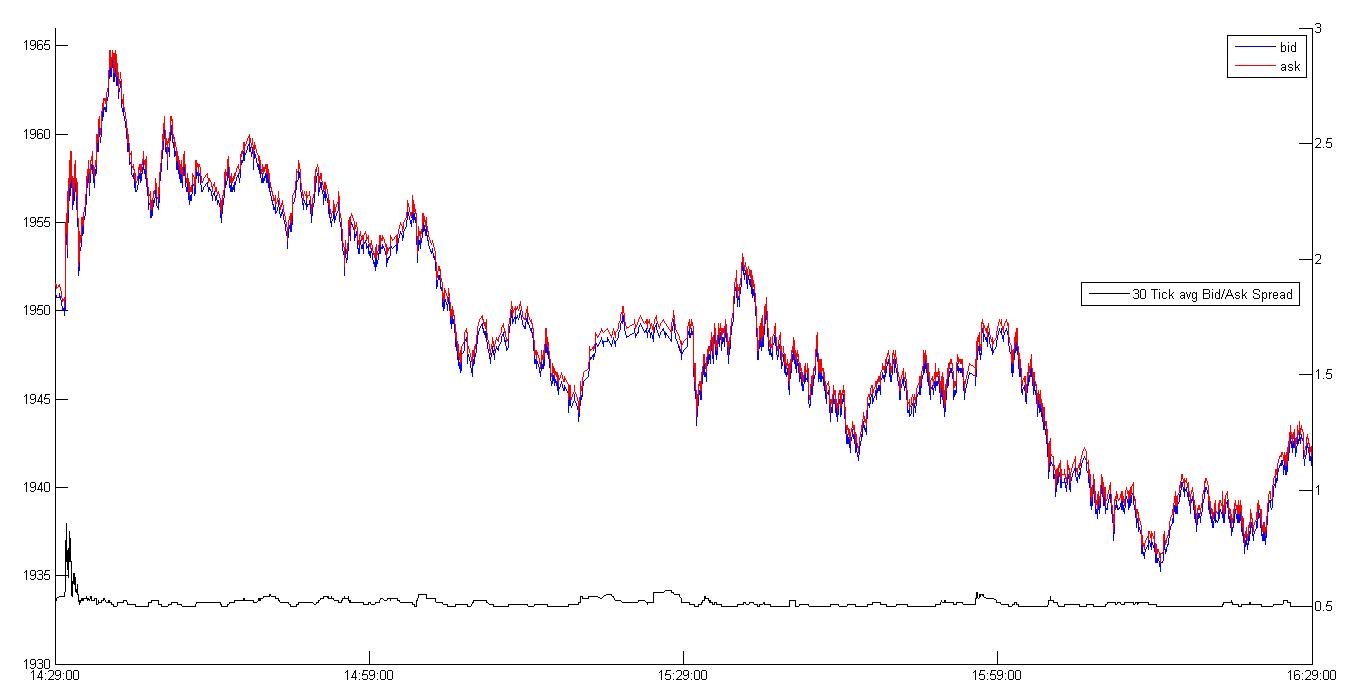

Moving on from currencies, here is the data during the same period for the S&P 500 March future as streamed by the MT4 platform.

For starters, there are no quote outages. Regular Pit Trading Hours start one hour after the NFP is announced, so it isn’t surprising that the market is flat. After the announcement there is a two minute flurry in which all hell breaks loose. The interesting thing is that the market keeps streaming prices during exactly those periods that the currencies above stopped quoting. Also the initial and follow-through reaction to the news announcement is in-line with expectations: strong employment is good for the stock market, since it’s a risk-on signal.

The joy, however, is only fleeting, as together with a general USD sell-off the equity market sells-off as well.

Lessons learned? Trading the news is a mugs game. Especially on big announcements. Wait at least 15 minutes on the majors before deciding to participate; otherwise too much slippage can lead to uncontrolled losses. There are other markets that don’t stop quoting during these news events, and the next step would be to use information from these markets to infer what the currency markets are doing. This is a theme to be generalized: most models that people tout out there look at simplistic time-series models applied to the price of one currency, and completely ignore information to be had from other markets.

I’ll be looking at that in the near future, so stay tuned. Until then, stay profitable and sane.

Leave a Reply