Doors Closing On 31st October 23:59 ET

Stop Guess-Trading.

Start Thinking Like a Quant

A step‑by‑step framework for analytical traders to build, test, and run evidence‑based strategies with confidence. No fluff. No luck. Just logic.

Build a system you can trust

Replace indicator soup with a rigorous hypothesis‑driven process that survives contact with real markets.

Engineer diversified edges

Harvest risk premia, test for robustness, and combine strategies like a professional PMnal PM.

Code → Test → Deploy

Python notebooks, production‑grade patterns, and IB API walkthroughs to take you live.

A Fully Functional Systematic Portoflio

Start running the core portfolio right off the bat

You don't need more indicators. You need a system

You're a smart, analytical person who knows there has to be a better way to trade. You've tried to piece it all together yourself: reading books, scouring the internet, maybe even taking a few online courses. But you’re left feeling overwhelmed, with a collection of disconnected ideas and no reliable framework to tie them all together.

You’ve got Python chops and market sense, but no cohesive framework. So you test something, cherry‑pick a backtest, and pray it holds. That’s not trading. That’s statistical roulette.

You're tired of the "indicator spaghetti" and the black-box systems peddled by gurus with no verifiable track record. You're juggling a demanding career and family, so you can't afford to risk your capital on unproven methods. You crave a a robust, evidence-based system you can understand, implement, and trust.

The calm, killer way to trade

Wake up knowing exactly what to test next, how to size positions, and how your edges fit together. No FOMO. No "maybe this time." Just a structured engine that compounds capital and confidence

Why Most Smart Traders Still Fail

Imagine Instead...

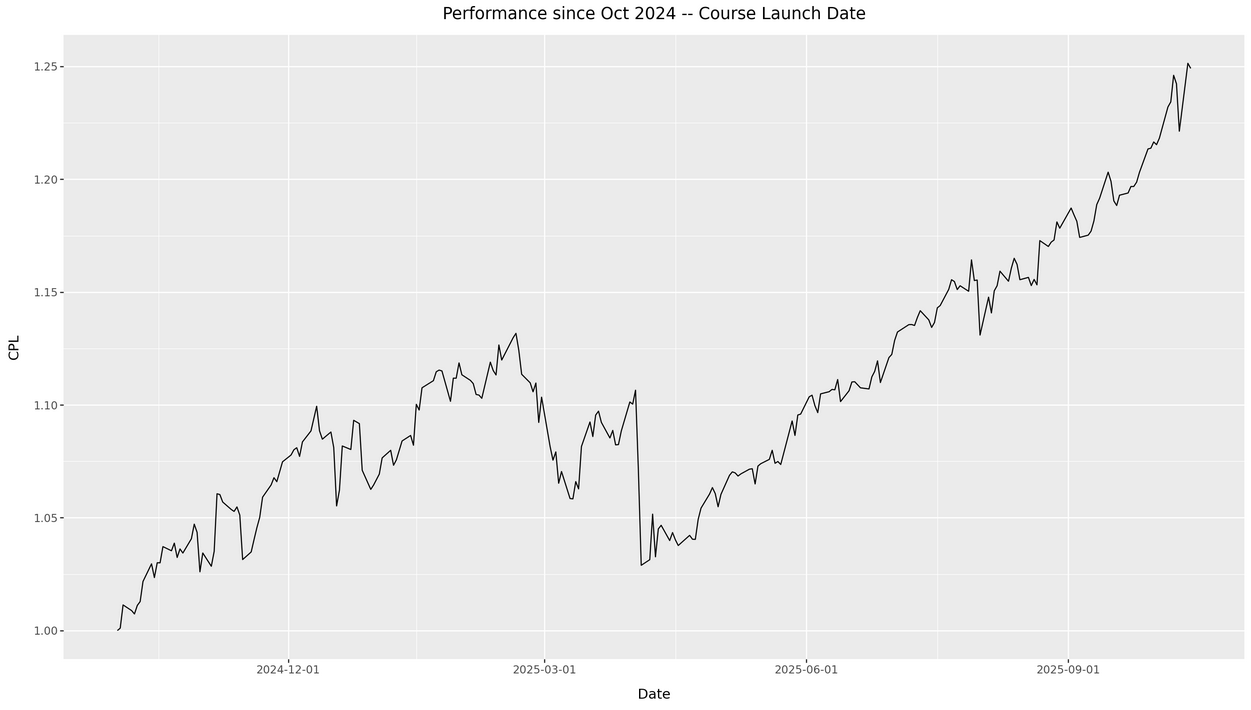

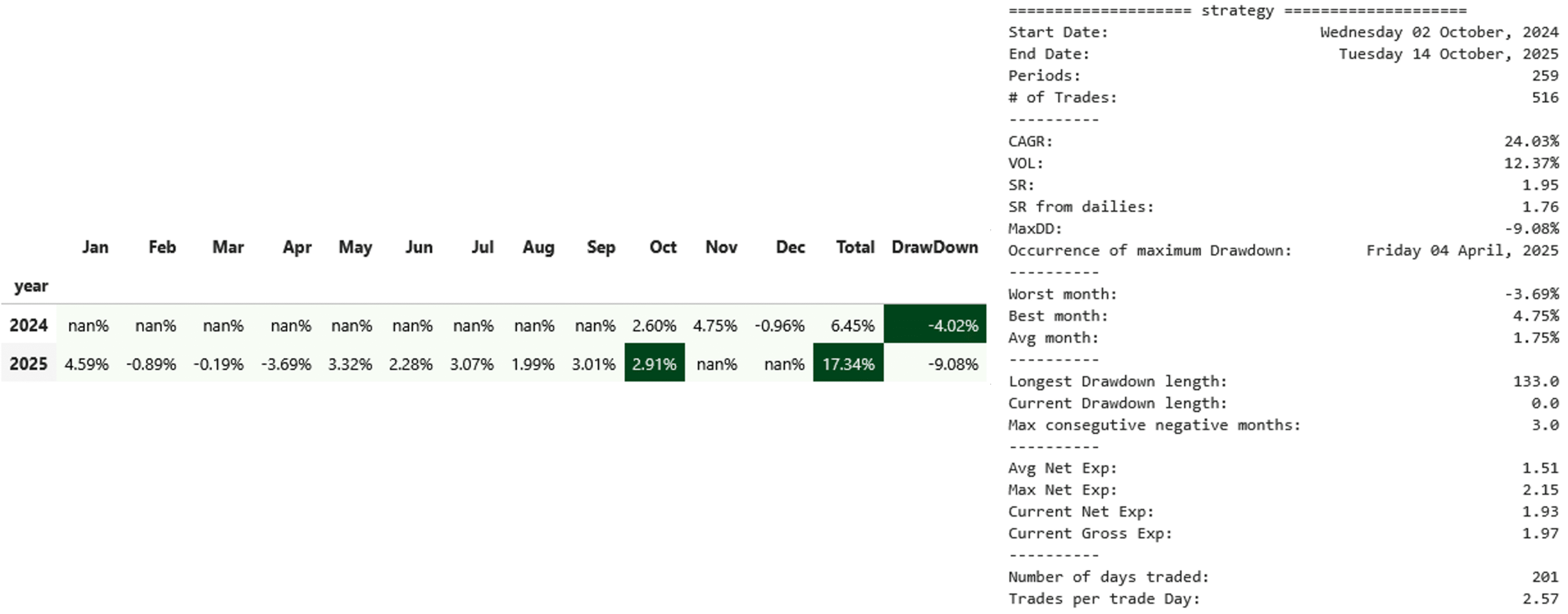

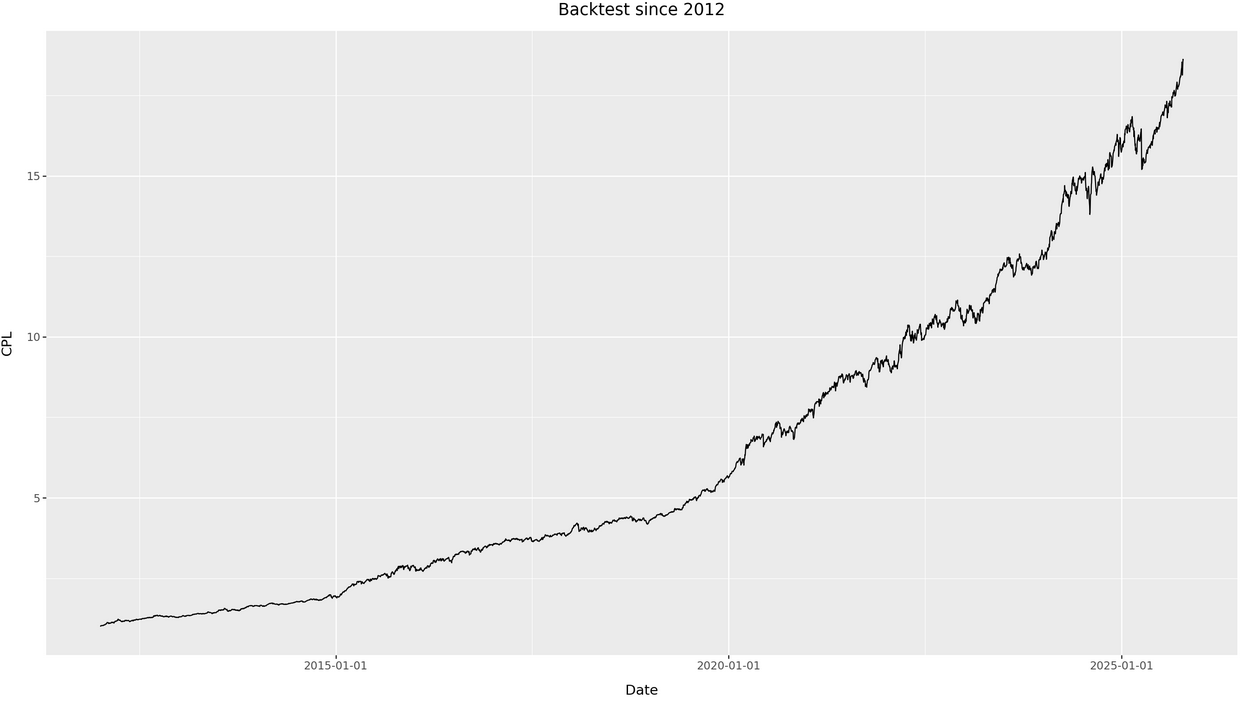

What's Been Happening Since we Launched?

Just a quick look of how the material in this course has performed since the original launch in October 2024.

This is the exact Core Portoflio that you will learn to implement and monitor in this course. It survived TACO, commodity whisapws, and US-China tensions.

And remember in addition you'll have access to the growing strategy library together with a robust framework of merging these strategies with the core portfolio.

This is always the biggest stumbling block and least talked about topic by online educators! I'll teach you how to really diversify!

Get the Program — and Every Future Strategy We Add. For Life.

Before I detail the modules, I want to be very clear. When you enroll today, you are not just buying a set of videos. You are gaining lifetime access to a living, breathing research platform designed to end the tapping-in-the-dark experience you've had until now.

By the End of the 6 Core Modules You Will Have a Fully Functioning Systematic Portfolio

You Will Have Access to All the Code and Data

Receive lifetime access to all Jupyter Notebooks, transcripts, and data to replicate every backtest.

You Will Receive a Continual Stream of New Strategies

The market evolves, and so do we. Get lifetime access to all new strategy modules, released monthly. And not just any strategies. But those that work. And learn how to combine them to the core portfolio.

Here is a teaser:

You Will Have Direct Access to Me

One 1-on-1 call with me where you can get any of your questions answered

This Course is For You If...

This Course is NOT For You If...

Here's the Complete Framework You'll Master

This is a comprehensive, six-module journey that takes you from foundational principles to live execution

You also will be part of a thriving community of highly motivated traders, have acess to Bi-Monthly Live Q&A Sessions as well as ongoing system publications

Foundations

Module 1

Learn the core principles of systematic trading and map out your personal journey to profitability.

Factor & Risk Premia

Module 2

Stop chasing random assets. Build a robust Risk Parity portfolio—the "all-weather" foundation of our system.

Systematic Trend-Following

Module 3

Go beyond simple moving averages to build a powerful, multi-asset trend-following engine.

Volatility Harvesting

Module 4

Have you heard about the selling insurance for income? Buffett does it! But you have to know how to avoid the blow-up! Here you dig into a real-world robust implementation

Seasonality & Events

Module 5

Seasonality, or better said: regular, calendar-based, price-insensitive flow, is the first rung on the ladder to developing edge. Here we develop new ways to diversify our core portoflio

Practical Execution & the Core Portfolio

Module 6

Here we move from stand-alone strategies to the full core-portfolio. We perform stress tests, robustness checks, and finally integrate it with the IBKR API to semi-automate the full process

Ongoing System Publication

Ongoing

Each month I'll provide new statistically evidenced strategies that you can bolt onto the core-portfolio. The only free lunch in trading is diversification, so here we take the core-portfolio to the next level

What's Inside: Your Guide

How to Trade: A Beginner's Roadmap

Foundational Systems: How to Make Money

Constructing Portfolios

Real World Execution

Python for Trading

A Fully Functioning Systematic Portfolio

Ongoing System Publications

Master-Your-Own-Pace Learning Hub

Quantitative trading doesn't have to be overwhelming or mysterious.

With "Quant Trading with Python," you'll gain a clear, structured approach to trading that is backed by evidence and practical experience.

Join this community to Transform Your Financial Future and Career.

It's the course I wish I had when I started out.

The Transformation Is Real: Here's What Founding Members Have Achieved

"Being able to see how an expert, with extensive industry experience, develops his strategies and systems, and implements trading, was 'mind blowing'. This changed my perspective..."

- William F.

This is where the course truly stands out... All the content is integrated directly into Python code that participants can run and apply immediately... It's as practical and implementation-ready as it gets."

- Andy B.

"It brings some 'peace' in the execution. No more guesswork for long term trading."

- Wouter DB.

"Your course has given me a deep understanding of how professional traders and hedge funds think and operate... This course offers a real chance to become consistently profitable and also to really understand what we do and why."

- Joseph S.

"It flipped the way I see risk—from something to fear to something I can engineer. Vol targeting gave me control, and drawdowns stopped feeling like personal failures and more like parameters to respect."

- Gines G.

"The understanding of combining non-correlated strategies together to obtain an overall better trading portfolio [was my biggest takeaway]... it allowed me to learn on how to run/build my own."

- Ricardo B.

“I really feel like I've learned a lot and it has definitely changed how I think about the markets and made me more confident going forward.”

- William K.

"If there was a word to describe the course, I would use 'comprehensive', as it is both a theoretical and and a very hands-on course, so much so that one is eventually able to nearly become a 'walking hedge fund' and their own fund manager as well as risk manager, leveraging off Dr Codirla's experience in the financial markets and his contagious enthusiasm for the field. Plus, some of the sessions have been absolutely mind-blowing. Really good value for money."

- Pablo C.

"Well worth the investment of time and money, and Corvin is approachable and always willing to offer advice, answer questions, and generally help with ones understanding and trading."

- Chris M.

“... a master-class in presented by an active fund manager with experience at the highest level in the industry.”

- Jehan J.

"This has been a fascinating course which has created a very solid framework for trading. It is the most academically rigorous trading course I have done and is made accessible to all. Amazing insights on volatility targeting and sources of ideas for creating portfolios, backtesting and automating calculations. Corvin has an incredible weatlh of academic and industry experience and an infectious enthusiasm for sharing his knowledge and creating a community for sharing ideas."

- Richard T.

"Extremely practical I can better design ny trading strategies based on ideas and backtest them. The content of the course is awesome"

- Guillermo G.

"For me it was to really understand the fundamental concept of why should someone make money by trading an asset class, and what really are the risks you are being paid for taking."

- Marti C.

Why Should You Learn from Me?

I’m sure that you will have come across a lot of sales hype. I want to make sure that you understand that you have the real deal here, with access to thousands of hours of experience and applied knowledge that has made investors some serious money.

So here is my CV:

Here's Everything You Get When You Enroll Today

This is more than just a course; it's a complete, lifetime toolkit for your trading career.

Lifetime Access to All 6 Core Course Modules

A fully functioning systematic portfolio ready to go

All Jupyter Notebooks & Source Code

Access to all Market Data necessary for the Edge development

Access to the continuously growing strategy library

Lifetime email support from me

Lifetime Access to All Future Course Updates

Value: $2,997

Value: $2,997

Value: $997

Value: $1,800 per year

Value: $2,000 per year

Value: $2,000 per year

Value: $Priceless

TOTAL VALUE:

Over $12,791

Your Investment

Join today and lock in the limited-time re-opening price

For Members

$897

$597

Frequently Asked Questions

How is the course material delivered?

Every module arrives in two flexible formats: a full one-hour “deep-dive” video and a series of 10-minute bite-sized clips, so you can binge on weekends or learn in quick weekday sprints. Each lesson comes with word-for-word transcripts, plug-and-play Jupyter notebooks, and all the necessary market data pre-loaded—just hit “Run” and start exploring.

I have a demanding full-time job. Will I have time for this?

Absolutely. The course is self-paced with lifetime access, and the strategies are designed for busy professionals who cannot watch the screen all day. The entire framework is designed to be managed in the 1-2 hours per day that most of our members can realistically dedicate to this venture.

I'm not a Python expert. Is this too advanced?

No. The course is designed to be hands-on, and every analysis is accompanied by a complete Jupyter Notebook you can run and adapt immediately, making it the perfect antidote to "information overload." You don't need to be an expert; you just need to be dedicated to learning the process.

There is also a growing Pyhton Intro course included in the material which focuses specifically on the tools and methods required for this course

How is this different from your free blog content?

The blog provides the *what*; the course provides the complete, step-by-step *how*. It's a structured learning path with exclusive content, detailed case studies, hands-on Python projects, and personalized support through live Q&A sessions that you simply cannot get from standalone articles.

What makes this different from other trading courses?

I'm already trading. How ill this help me?

This course will give you a professional-grade framework to enhance your existing approach, add new uncorrelated strategies, and dramatically upgrade your risk management.

I'm busy. How much time do I need each week?

Plan on 3–4 focused hours per week to watch the lessons and run the notebooks. Because all code is plug-and-play and each module ends with a clear checklist, you can move at your own pace and still finish the core roadmap in six weeks.

Do I need advanced math or a PhD in statistics?

No. If you’re comfortable with high-school algebra and can read basic Python, you’re set. Each concept—factor models, walk-forward testing, volatility targeting—is explained visually first, then implemented line-by-line in Jupyter so you see the math come alive.

How much trading capital do I need?

Strategies are designed to work on accounts as small as $5 k by focusing on ETFs, Shares, Micro-Futures, etc. Position sizing is volatility-scaled, so the same code adapts automatically when you scale up.

What makes this different from other trading courses?

ETFs, Futures, FX, Crypto, and single‑stock factors. The frameworks are asset‑agnostic—swap in your data, keep the edge.

Will the strategy work in live markets?

Each system is stress-tested with walk-forward validation, out-of-sample data, and crash scenarios (2008, 2020, 2022). You’ll learn how to replicate those robustness checks yourself before risking a dollar.

How do I get help if I'm stuck?

Is there a refund policy?

Yes — 5-day no-questions-asked guarantee. Go through Module 1, run the first notebooks. If it’s not a fit, email us and we’ll refund you in full.

What ongoing updates will I receive?

Every month you’ll get a new ‘Micro-Module’ (e.g., VIX calendar spreads, crack-spread strategy, pairs trading) complete with code, data loader, and performance commentary.

What if I'm just curious about makerts and not a finance pro?

Perfect. The course is built for analytically minded people—engineers, data scientists, or the simply curious—who love evidence and want a rigorous framework without Wall-Street jargon. If you enjoy tinkering with data and solving puzzles, you’ll feel right at home.

Your Future as a Trader Starts Now

Keep piecing it together, or follow a proven path with expert guidance. Doors close in a fw days and this launch offer won't return.

Core Concepts of Quantitative Trading

Proven Trading Strategies

Interactive Online Learning Environment

Copyright © FXMasterCourse, 2025. All Rights Reserved.

Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures, stocks, commodities and forex markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures, stocks, commodities or forex. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. Past performance of indicators or methodology are not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

All information contained herein is purely for educational purposes only

For further information on Terms&Conditions please refer to: T&C