You can buy-and-hold Foreign Exchange just like any other asset class! Indeed investment banks have been trying to ram this notion down investors’ throats for at least a decade, and I myself have been involved in creating Foreign Exchange Benchmark Indices, and even trading them at hedge-funds.

You’ll now ask: how is this possible. How can you even think of FX as a tangible thing that partakes in long-term growth? The usual counter-argument to Foreign Exchange as an Asset Class relies on the relative exchange exchange of two cash notionals, without any underlying tangible. “Zero Sum Game” is the usual phrase that even investment professionals start to use when confronted with Foreign Exchange, and most have only seen an FX transaction when travelling oversees. You’d be surprised how confused people get when they get confronted with expressions such as “long EURUSD.” Long what? EUR or USD?

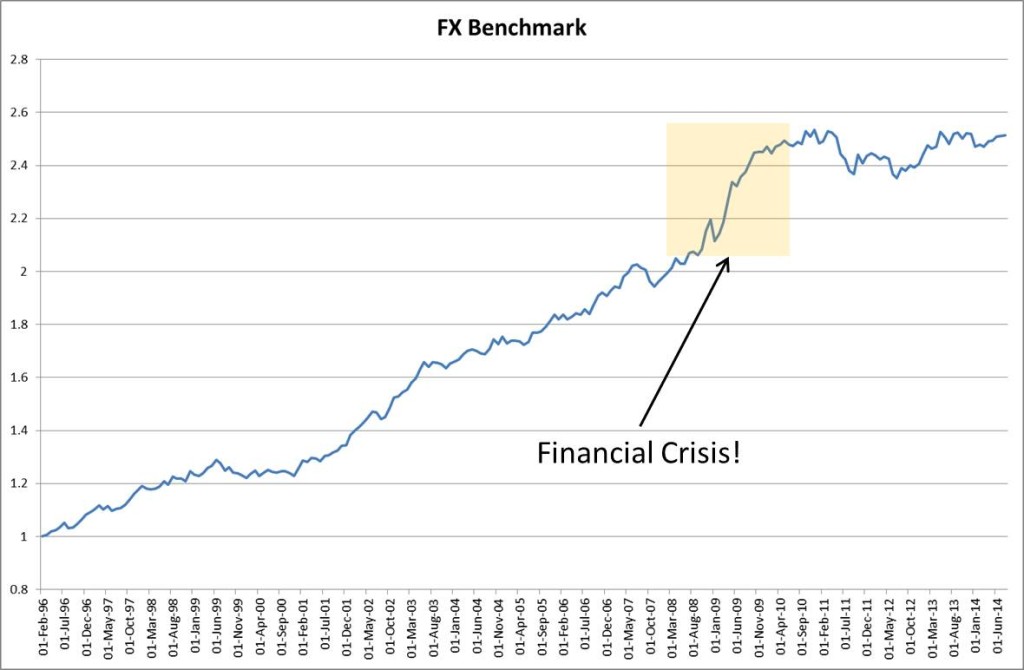

So first off, let’s actually take a look at what I mean by and FX Benchmark. This one is quoted in USD (and you can create various others, which are quoted in whatever currency is convenient for you):

Ever since the collapse of the Bretton Woods regime in 1974, the G10 currencies have been freely floating against each other. Their value is set by market forces (supply and demand driven by speculators and hedgers). So how does this growth come about? Well, the FX Benchmark is constructed by taking three factors into account which drives the relative value of currencies:

- Carry: the interest rate differential between the various countries.

- Value: the Law of One Price

- Momentum: short term price dynamics

All three factors are well documented in the academic literature, and many have made fortunes exploiting the them. The whole point, however, is the continued persistence of these factors over the last 30 years.

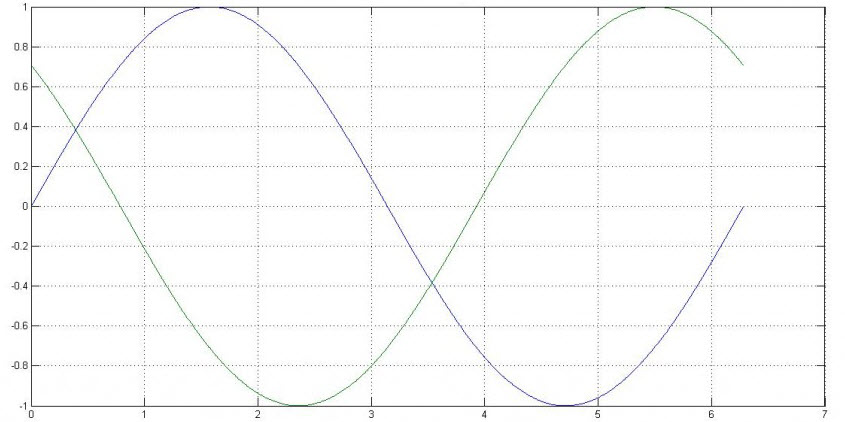

So what’s a possible cause for what drives these factors and the relative value of currencies against each other? A simple long-run economic growth model, such as the Solow model, would tell us that the current G10 economies are closely aligned, with the developing economies still having to catch-up by a long distance. However, these G10 economies are not so perfectly aligned: one economy can show signs of growth while the other stagnates, viz. the current situation between the US and the Euro Area. These fluctuations aren’t as wild as you find them in Emerging Markets (just look at the movement in ZAR on the back of the replacement of the South African Financial Minister!). These relative cycles between the G10, allow for the purchase of the undervalued and sell of the overvalued. This is analogous to two sine wave out of sync:

The FX Benchmark, comprised of these three factors, does exactly that: it determines when an economy, and hence its currency is starting to get out of favor compared to the others. These oscillations are fairly stable and exploitable, and presumably will end exactly then, when all economies converge to one, which is unlikely, given the political / fiscal / monetary difference between all of them.

So how does this compare to any other benchmark for other assets? If you compare the usual stats to that of the S&P 500, it performs twice as well:

- Sharpe Ratio: 1.23

- Sortino Ratio: 2.58

- Annual Return vs Maximum Draw Down: 0.7

So how do you trade and create such a portfolio, and can you even outperform it? Sign-up to my newsletter, for updates and more information on how to exploit these strategies.