“Greed is good”, but one shouldn’t always assume that the counterparty won’t notice. Last Wednesday, 27th January 2016, was FOMC day, news event day, and the markets went ape. Following on from the previous articles the idea was to continue to exploit the observed quote outages and extract value.

Turns out that (presumably as expected), brokers aren’t that slow on their feet. I was moved from B-book status (i.e. rookie / loser status) to A-book status.

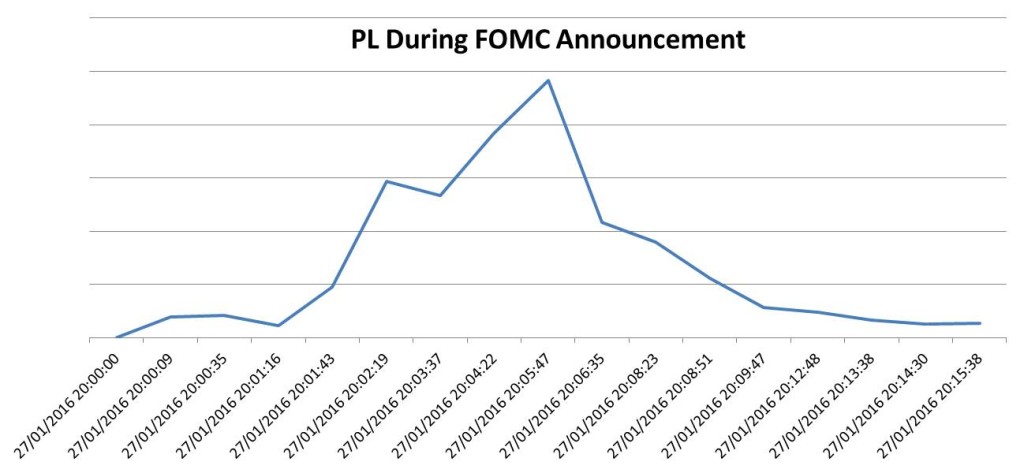

Let’s just say that excessive leverage and excessive positive returns in a period of 5 minutes must have alerted their internal systems.

Not surprising, given the leverage I was using on the trades.

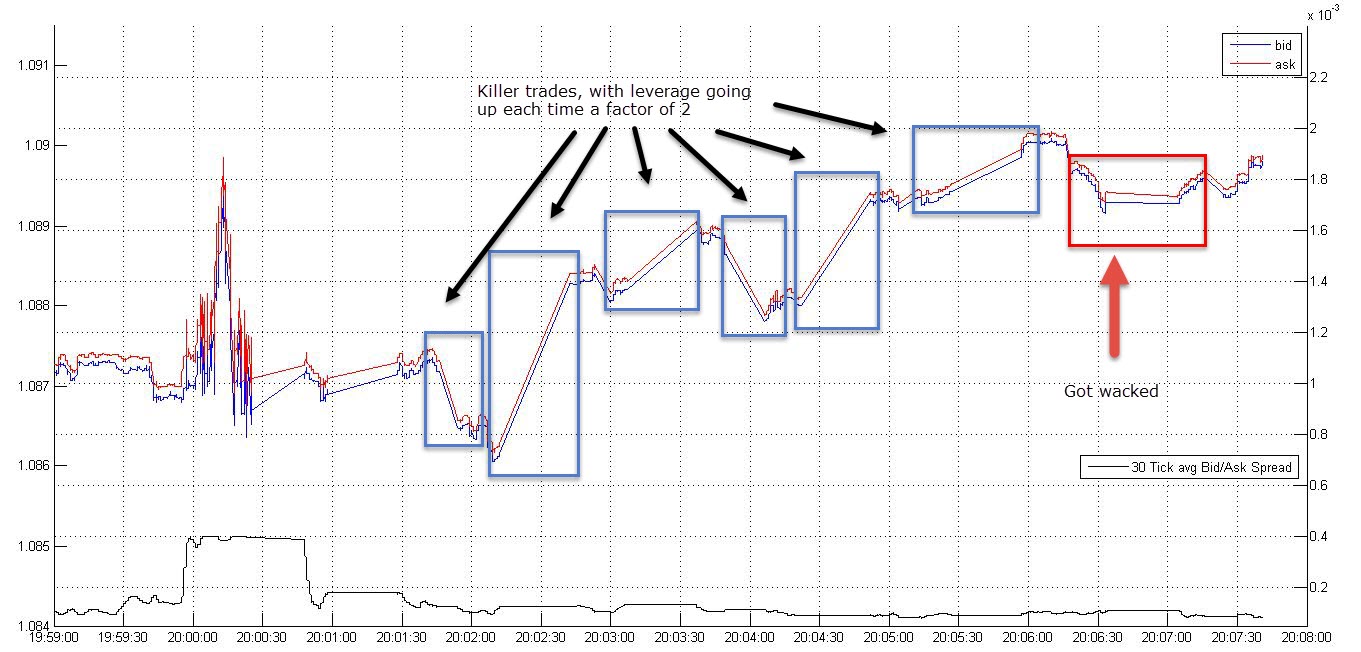

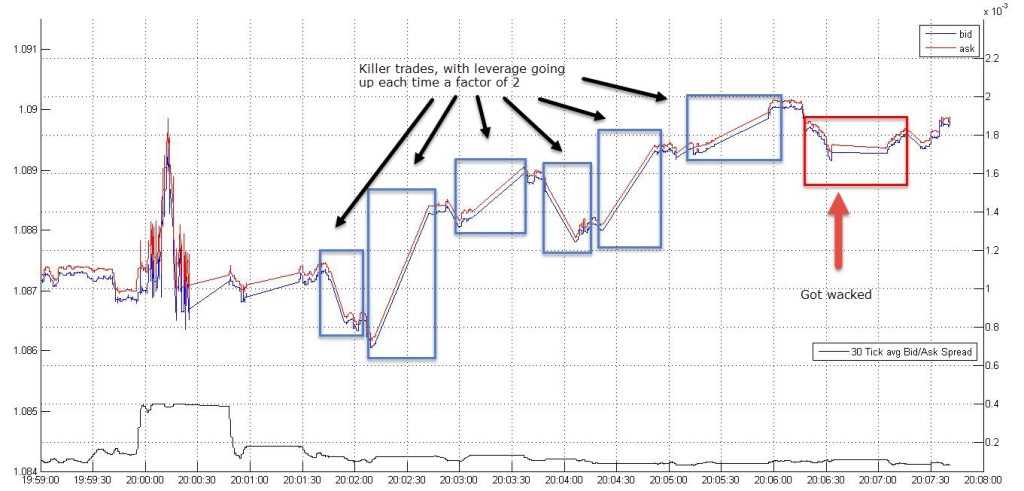

Here are some examples of the post-FOMC announcement market outages. In particular where I got discovered, and the big losing trade that alerted me:

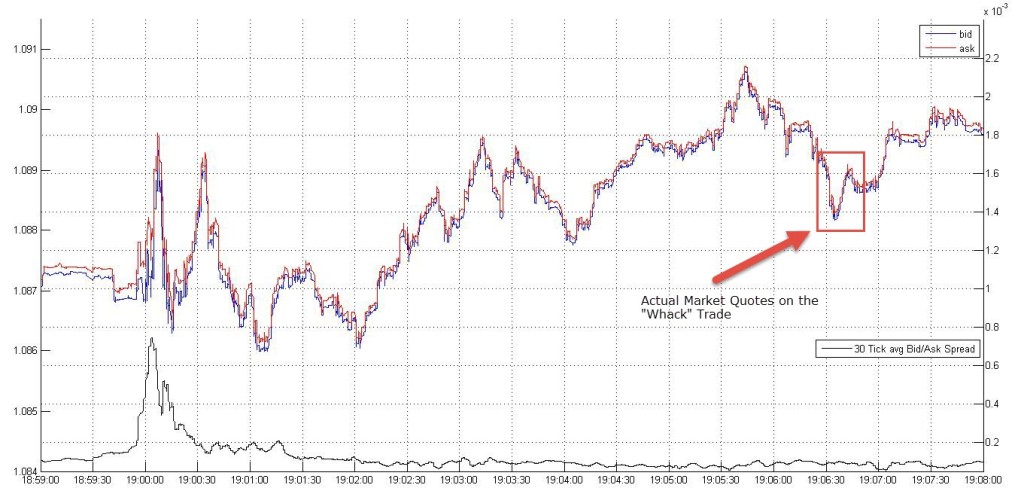

And, as a sanity check the actual market quotes from another, institutional source:

The killer trade, in the red square, should have executed at 1.0892, but instead got filled at actual market prices of 1.0882. As you can see that was the bottom of the dip, with a 13 pip rally following quickly. Not too bad you might say, but don’t ask me what the leverage on this was! In any case the loss was completely out of the statistical norm. I got my leverage back to normal. However, this was too little too late. I was “discovered.”

So what does that mean? It means that during the previous pricing outages, where I was filled on stale prices, I was now getting filled on actual market prices. These could be, given fast markets, and the duration of the outage (30 seconds), very far (see the 13 pip loss above) from the stale price shown on the screen. In essence where previously I would see stale prices, and be able to trade on them, I am now seeing stale prices, but trading on live prices in the market.

So what is the purpose for this?

Other than immediately jumping to nefarious presumptions about the ulterior motives of the broker, I would rather say that these circuit breakers are in place to exclude MT4 EAs from algoing their way to money.

So why would I say that? Well for starters, an EA is only activated on the arrival of a tick. This means that if you stop streaming ticks, the EA just doesn’t function. You’ve neutralized it, in particular only for the currency whose streaming prices have been stopped. All other messaging still works.

So the broker has protected himself from any ‘algo’-mongering (though not sure that is necessary on his side). However, that still leaves him open to manual trades. If it looks like the manual trades start to aberrate from the usual pattern, which presumably is easy to identify: heavy winnings in short time, you get switched over immediately to the live market place.

Why?

Easy: B-Bookers face off to the broker, and tend to lose. It makes sense for the broker to take the opposite side of the trade. A-Bookers are dangerous, and rather than face-off to them, it makes sense to just pass their flow through to the big market place. These people are probably a loss-maker for the broker any way. The spread currently offered is so tight, and the commissions are at $0, that it does not seem apparent how the broker would make money on these clients. On the other hand remembering the statistic that 90% of traders end up losing their capital, the 10% that do make money, are a nuisance. Since the broker will never know who belongs to the 10% he just has to make sure that he can protect himself.

With this series of articles we’ve managed to pick apart some of the underlyings of fast markets, news driven trading, latency arbitrage, and how the market adapts to your behaviour.

The most fascinating part was that it can happen even if you’re on the retail side of things! It’s not necessary to be on the inside of the professionals to uncover such anomalies.

In the meantime I’ll keep a look out to see if my relegation is a permanent one, or if I get moved back to B-book status soon.

If you have enjoyed this post follow me on Twitter and sign-up to my Newsletter for weekly updates on trading strategies and other market insights!

Leave a Reply