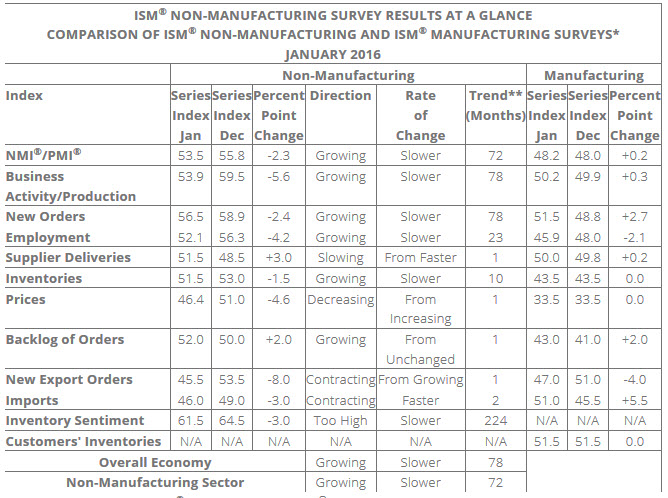

An upcoming recession in the US is on everybody’s mind (at least that’s what Google Trends shows):

And with that bad news for the rest of us.

To put that chart into context the last official recession according to the NBER was between December 2007 and June 2009. And the average duration between recessions since World War II has been five years, with the longest period being 10 years: between 1991 and 2001.

So is it going to happen soon? Probably yes. And most likely by 2018.

In this article we’ll provide an overview of the current evidence, and then look to answer the question: what’s the best way to trade this?

What do the fundamentals show?

For starters a recession is defined as two consecutive quarters of negative GDP growth. So let’s define GDP:

GDP = Consumer Spending (71%) + Business Investment (12%)+ Government Spending (20%)+ Net Exports(-3%)

where the percentages in brackets indicate the contribution to US GDP.

Let’s figure out what the Consumer and the Business Components currently show us.

The Business Side of the GDP Equation

On the business side, the Markit Manufacturing PMI has been steadily declining since its high of 58, in 2014, to a current reading of 52.4, with a note on the slowing of job creation, due to manufacturer’s heightened uncertainty about the economic outlook. The ISM’s manufacturing PMI has gone down the drain as well with a current reading of 48 indicating a contraction.

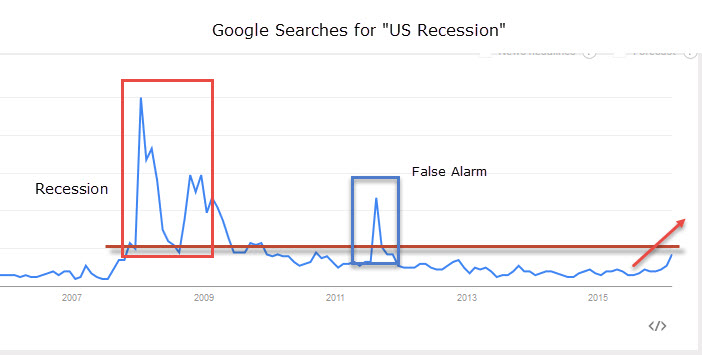

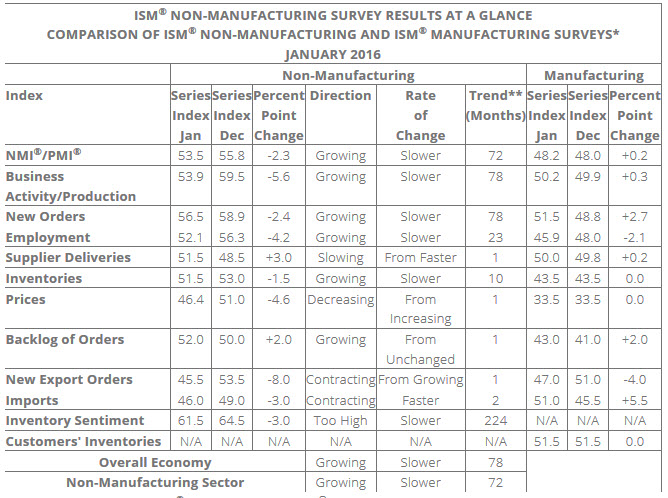

The recent ISM Non-Manufacturing PMIs reading showed 53.2, i.e. growth, but that masks slow-down of the underlying components:

The PMI’s index was above 60 back in 2014.

Also, Industrial Production has fallen off a cliff with regular decreases in monthly growth since 2014.

So from a business perspective GDP growth is at a tipping point, probably leaning more to tipping over at present.

What About the Consumer Part of the GDP Equation?

Consumer confidence has come off the 100 level in early 2015 and is now hovering at 92.

Retail Sales also decreased in a straight line down since 2011 and are currently at pre-2008 recession levels.

Building permits have also started to gyrate wildly, rather than the smooth climb they experienced post the GFC. These permits are important as they indicate bullish / bearishness of developers. And if houses aren’t built developers don’t expect prices to go up. This has an impact on the wealth effect of housing on the consumer. In line with this the Shiller house price index has flat-lined for the last six months.

Verdict: recession likely in the next 12 months.

What are the markets saying? – Equities

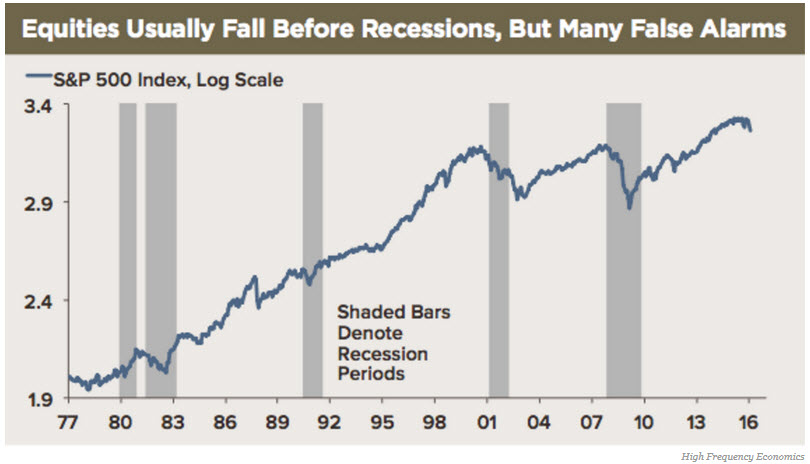

Two pieces of market lore get taken into consideration to anticipate upcoming recessions. The first comes from the stock market and the second from the yield curve.

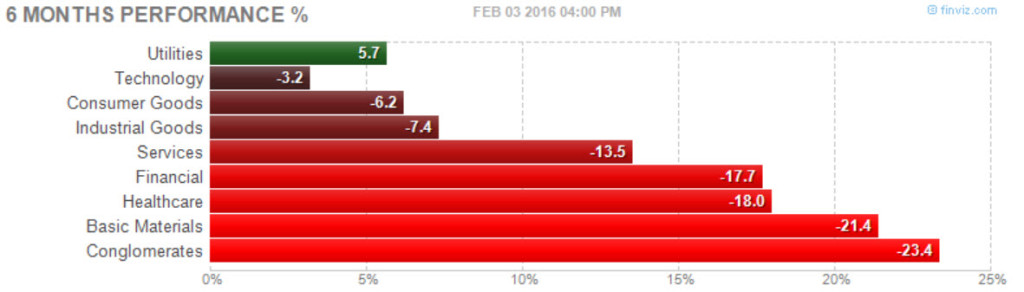

The stock market picture is not too rosy:

with a bear correction averted on the 15th Jan.

Unfortunately, as Paul Samuelson quipped, the Stock Market predicted 9 of the last 5 recession. The primary reason is that the relation between stock growth and GDP growth isn’t that strong statistically.

On the other hand we have only had two bear market corrections (over 20% decline) without a recession since 1990. So as long as the S&P500 stays above 1704, we should be fine.

What are the markets saying? – Interest Rates

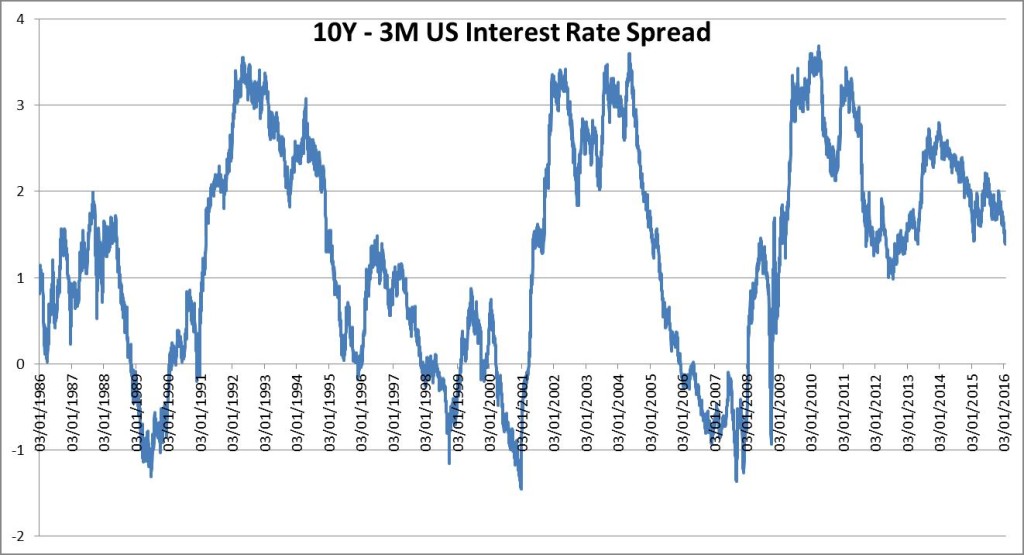

The second piece of market lore is the 10Y – 3M interest rate spread, going back to a paper by Reuben Kessel at the NBER in 1965. The idea goes that with a flat or inverted yield curve, inflation and growth outlooks are low, and so might be a good indication of an upcoming recession. Usually the outlook is over a 12 month period.

Here is the current chart:

The 1990, 2001, and 2008 recessions are clearly indicated. At present the spread hasn’t’ fallen off a cliff yet, though it looks like it might want to over the next 12 months.

So from the Market’s perspective it is still a wait-and-see game. Given the S&P 500 is below its 200-day moving average we’ll have some fighting to get through to the other side.

What do the Banks tell us?

Alan Ruskin at DB states that the ISM Index in the US has fallen more than any other country’s in the last year.

On the other hand Aneta Markowska of Soc Gen puts the probability of recession at 3% n December, with a downturn in 2018 (10 years after the previous one, and the longest distance between cycles experienced to-date!)

The banks are equally divided on the outlook, but recession is definitely seen on the cards over the next one to two years.

Short term outlook for USD and the upcoming NFPs on Friday, 5th February

The fundamentals are clearly deteriorating, though the markets are not quite yet convinced. Furthermore the GDP numbers are lagging indicators. We won’t know we’ve hit a recession until we are usually out the other side.

Summarizing: we definitely will hit a recession in the next 12 to 24 months. That much is certain.

So what to do in the meantime? The current uncertainty is not just on the minds of investors, but also on the Fed officials’ minds, as evidenced by Dudley’s comments on Wednesday (sending the dollar on its first leg of its tailspin for the day).

This indicates that policy decisions aren’t presently fully priced in by the markets, and according to the Fed’s own admissions future policy will hinge crucially on upcoming economic data.

The first such piece of data will be the NFPs on the 5th February. Given the dollar unwind we’ve started to experience the question is how much can it continue to the downside?

It is interesting to note that the ECB meetings since December, as well as the surprise liquidity injection by the BoJ and the rate rise by the Fed in January, have only led to a dollar sell-off to-date. The dollar wants to be sold. As always, buy the rumour, sell-the fact. And dollar hogs have had enough after one and a half years of buying in anticipation of a Fed hiking cycle. Time to dump the inventory.

If the NFPs come in disappointingly on Friday, there won’t be much for it, and whatever hiking cycle the Fed advertised will go out the window. EURUSD will continue to rally to its upper boundary of 1.15, and USDJPY could drop below 116.

As always trade after the news and let the markets tell you which way they want to go!

If you’ve enjoyed this post follow me on Twitter and sign up to my newsletter

Leave a Reply