Following from the previous article HFT from Your Livin Room I’m going to show you what the EURUSD price data from the 21st January, 2016, looked like post the ECB interest rate announcement and press conference.

The focus will be in particular on the consistency of the price streaming of a retail broker, and how that led to the profits in the previous article. More importantly how you can follow along at the next news bonanza, the FOMC.

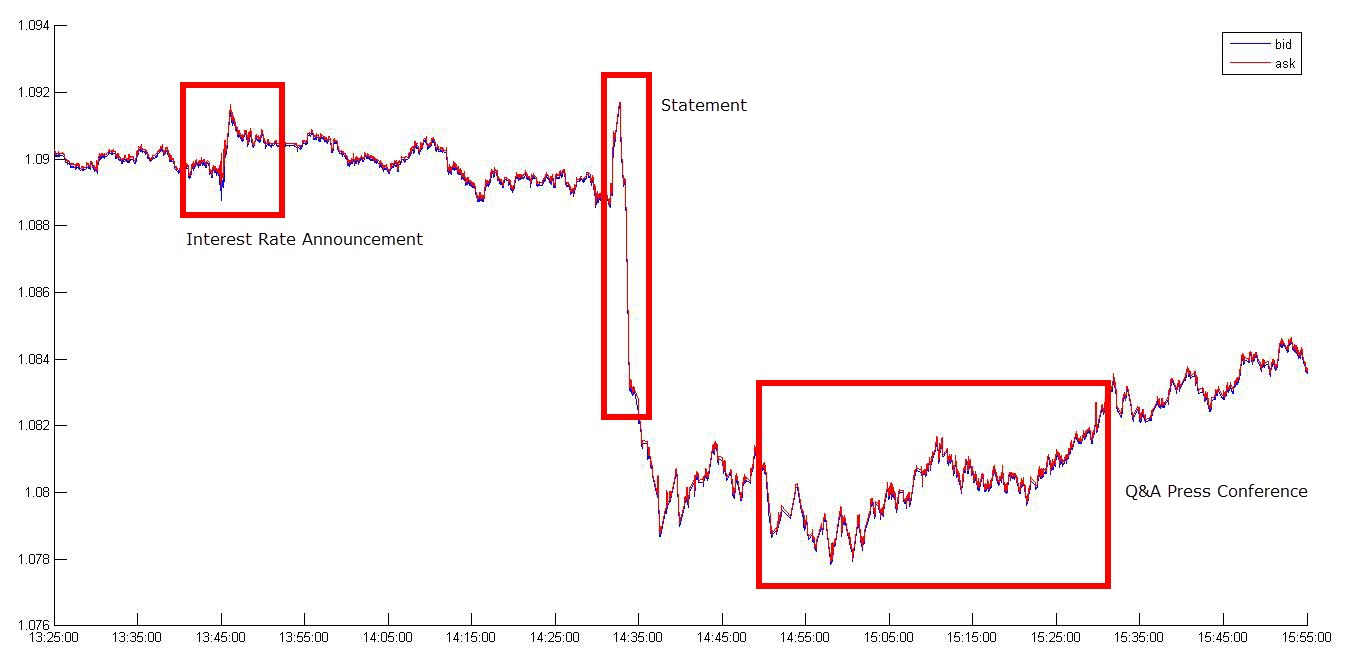

As always the ECB circus comes in two acts. First is the release of the interest rates at 13:45 CET, with a press conference starting at 14:30 CET. The press conference starts out with a prepared statement followed by a Q&A session. Both statements and Q&A sessions can be downloaded from the ECB site at this location: ECB Press Conferences.

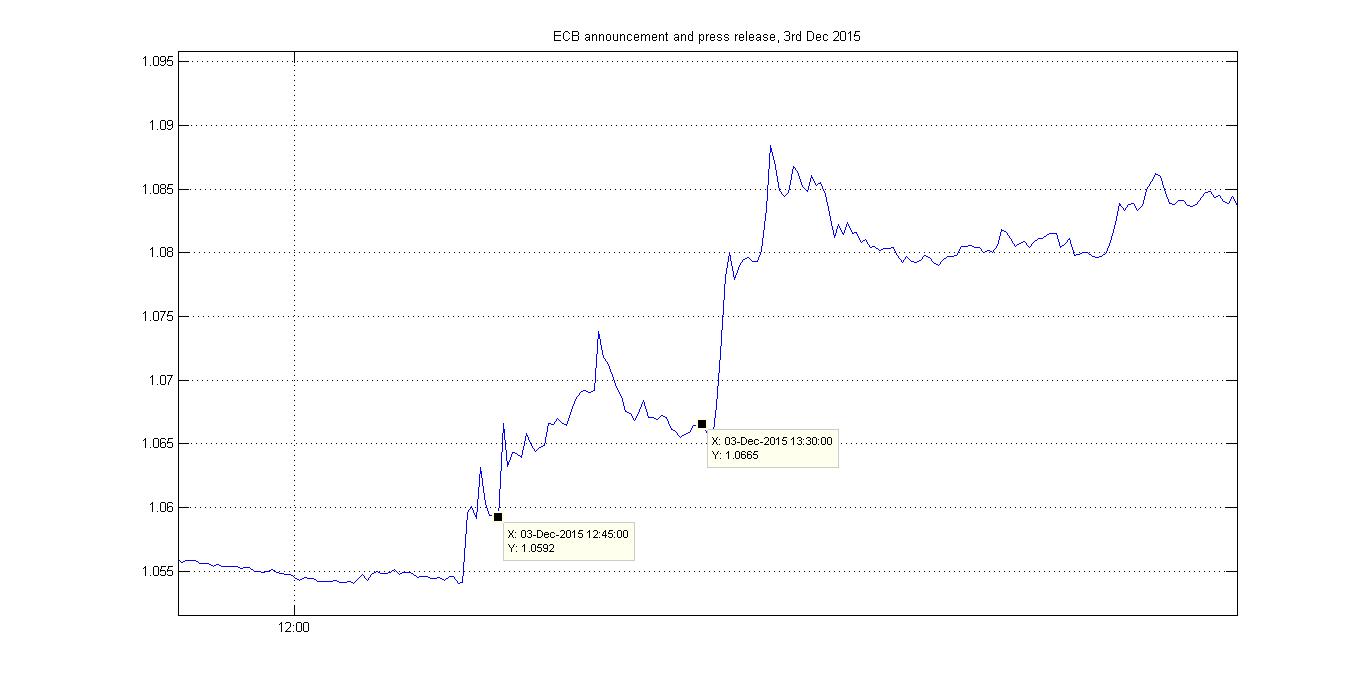

Interest rate setting can always surprise, either in the weakness of the Central Bank action, as compared to market expectations and demands (as seen on 3rd December 2015), or in being too strong. However, it’s not the interest rate release that usually unsettles the market. It tends to be the press conference afterwards. The 3rd December 2015 provided excitement on both fronts, initially with a wrong leak by the Financial Times a couple of minutes prior to the interest rate announcement, followed by below expectation rates and then by Draghi’s press conference. The result was a 400 pip move up on that day.

On the 21st Jan, 2016, the EURUSD finished the day nearly unchanged, though it did experience wild swings in-between. The majority of it stemmed from the statement release, with recovery during the press conference.

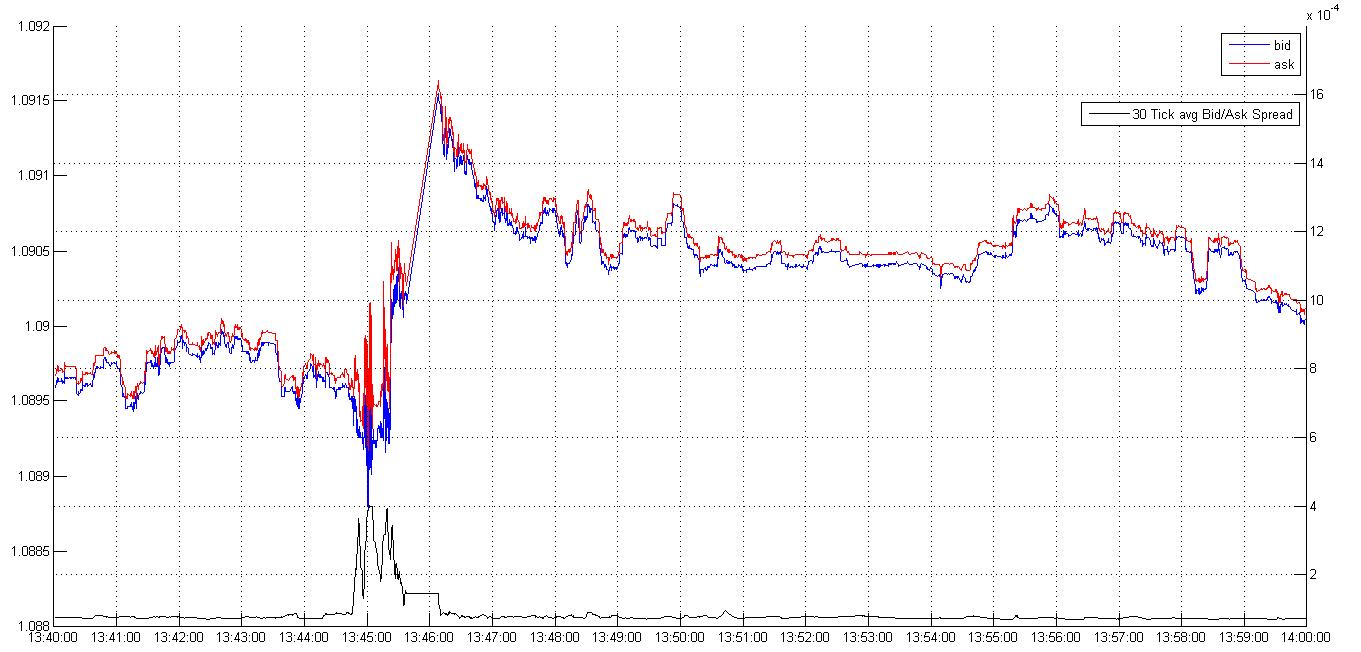

Let’s now have a look at these events, starting with the interest rate release.

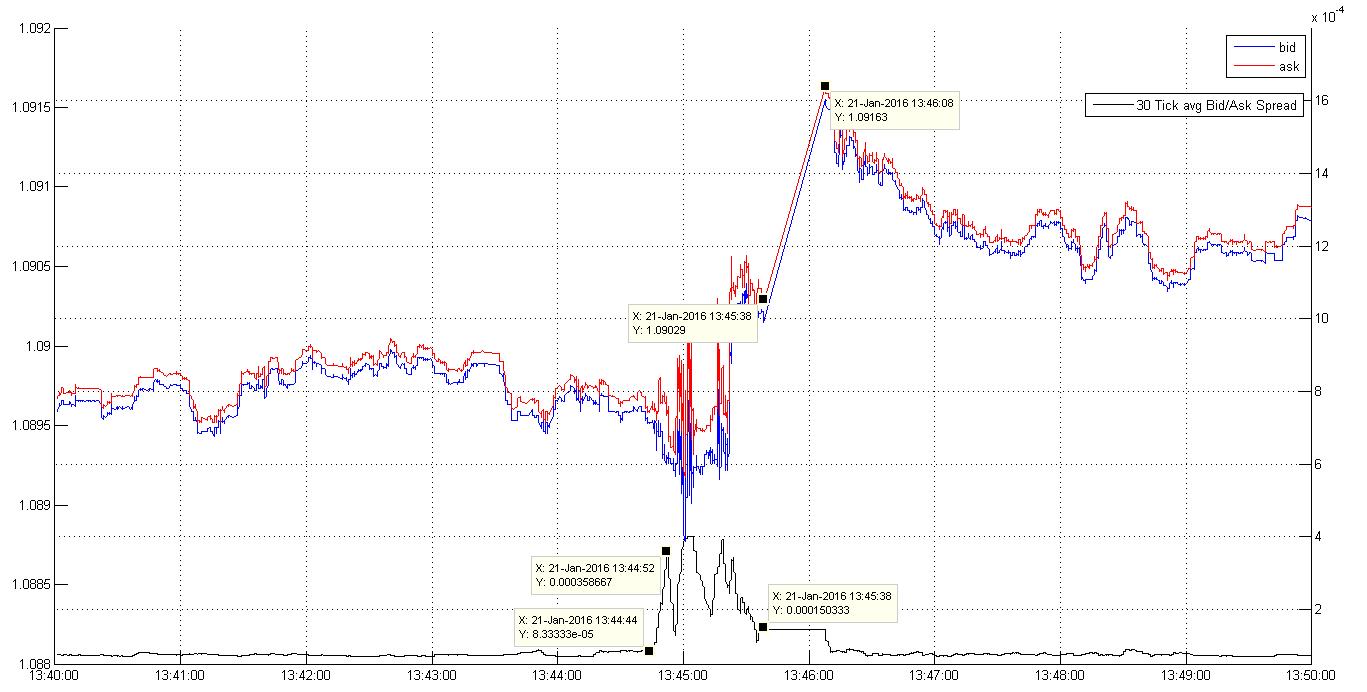

As always, the bid/ask widens out, and maxes at 4 pips. What’s interesting is that even though price had a 10 pip range, it appears that circuit-breakers kicked in at 13:45:38 CET, and you get the usual 30 second outage. The EURUSD, however, is not massively impacted by the release, given it is in line with expectations; normal operations resume shortly afterwards.

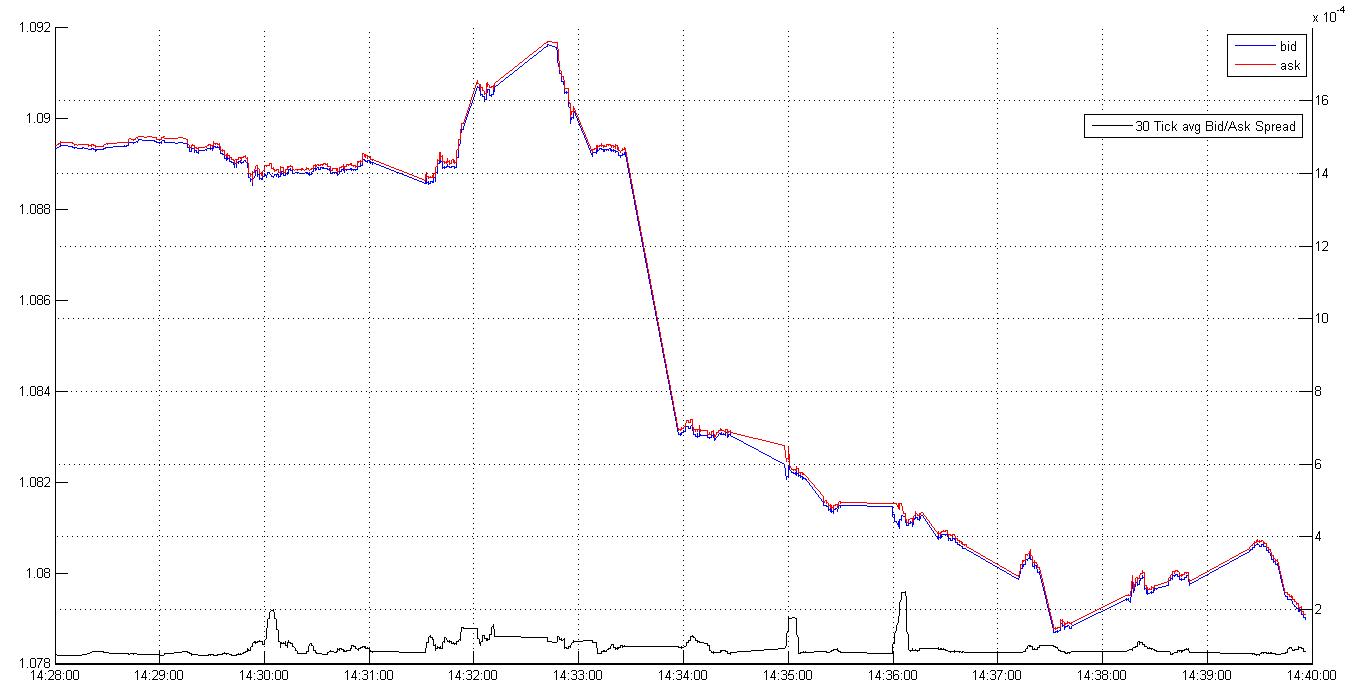

So what about the big drop right on the statement release?

The bid/ask spread did widened out, but not to the usual max of 4 pips. It appears that similar to the previous PBOC impact on AUDUSD, a statement like this is unpredictable, and is not really accounted for. I would interpret the widening in spread, as pass-through from the liquidity providers the broker is sourcing.

However what is interesting, in the ten minute period that follows, is the frequent occurrences of price outages.

Let’s dig deeper into the mechanics of this. In essence what this means is that the MT4 platform is not receiving any streaming prices from the broker. Does that mean that connection is lost? No. Why? For starters, the log clearly shows that no connection outages occurred. Secondly, and most importantly, we can still send messages to the broker, and receive acknowledgements. What kind of message? Ha! Trade messages of course. And what kind of acknowledgements? Fills in this case.

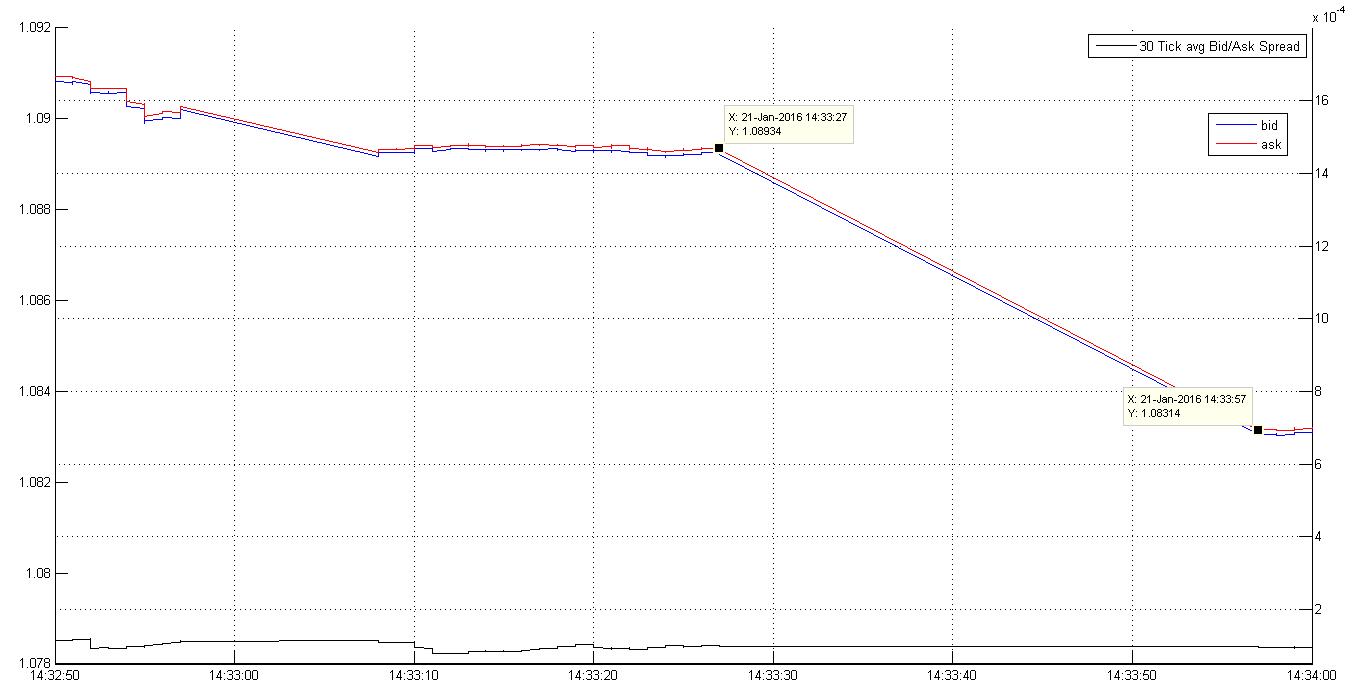

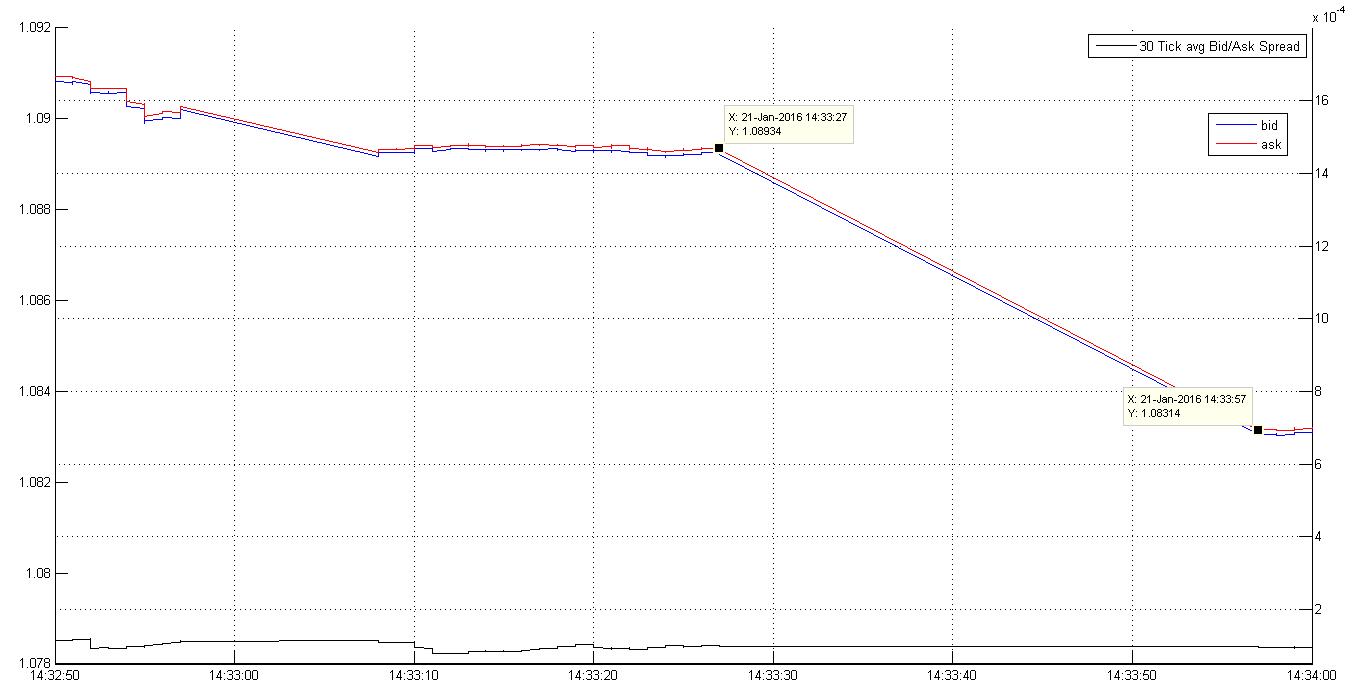

So let’s investigate it: 14:33 to 14:34 (CET).

That’s a whopping 60 pip move.

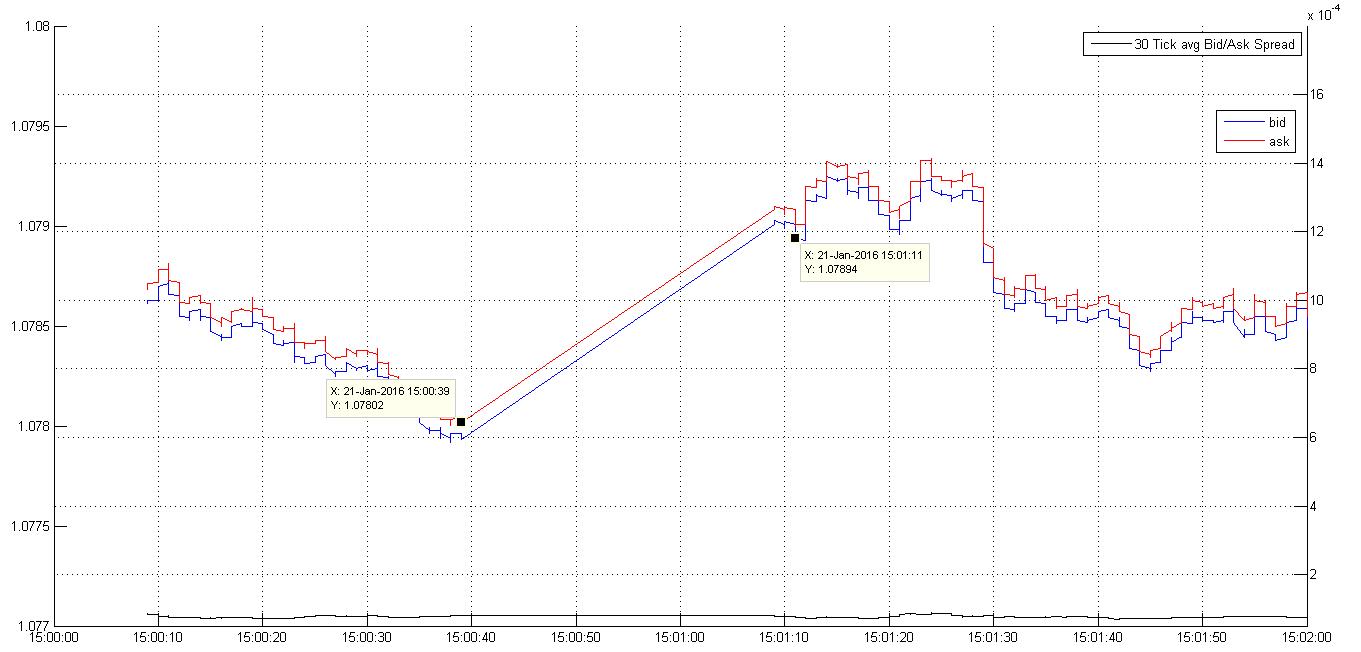

Ok, ok, so maybe you don’t think this would really work. Well I didn’t expect it to work either, and clocked on rather late. So here is one that did:

This is one was for a 10 pip profit. Just to recap: the trade was executed during the outage, at a price that was quoted at the start of the outage. During the price outage price moved up. So the trade, in essence, occurred “off-market.” But, since the currency market is de-centralized, there is no official price to benchmark against. The trade at the start of the outage period therefore stands. Again note that the bid/ask stays pretty much at its usual price.

Now you, if you’ve managed to follow me up to here, you should have one burning question. How do I know which way the market moves during a price outage? How do I know to buy or sell?

The answer is easy: get yourself an uninterrupted price feed.

In essence you are playing the game that many hedge funds, and even banks play: exploit the speed at which information flows from different venues.

What was striking about this particular example was that in the ‘professional’ world, these kinds of games require million dollar investments, and sophisticated software as well as hardware. This particular example was a manual trade, executed at the speed of a blinking eye. Much like a first-person shoot-‘em up game.

The obvious question: will this last? Presumably not. But while it does, play around with it. Of course this set up requires heavy market moving news, and Canadian retail sales ain’t going to be it. The next one up should be this Wednesday’s FOMC rate announcement and statement release, though no press conference follows this event.

Over the following weeks I’ll post historic news analysis and price impact related to surprises. The data won’t be my own sourced data, but comes from ForexTester. You can find out more and download from Resources Page.

If you have enjoyed this post follow me on Twitter and sign-up to my Newsletter for weekly updates on trading strategies and other market insights!

Leave a Reply