Following on from the previous post on ADP and slippage I’m writing up this brief note to share the pain, and hopefully get the point across: leave the News Alone Please.

One of my systems that trades the EURUSD currency pairs actively, operates using stop-orders to enter the market and associated protective stops to limit the losses. You might have guessed it’s a momentum based strategy. The issue here is that when the market gaps, or is too thin, the orders won’t get executed. And this happens during nasty market periods, where brokers shut down pricing, markets gap, and a whole bunch of shenanigans are going on.

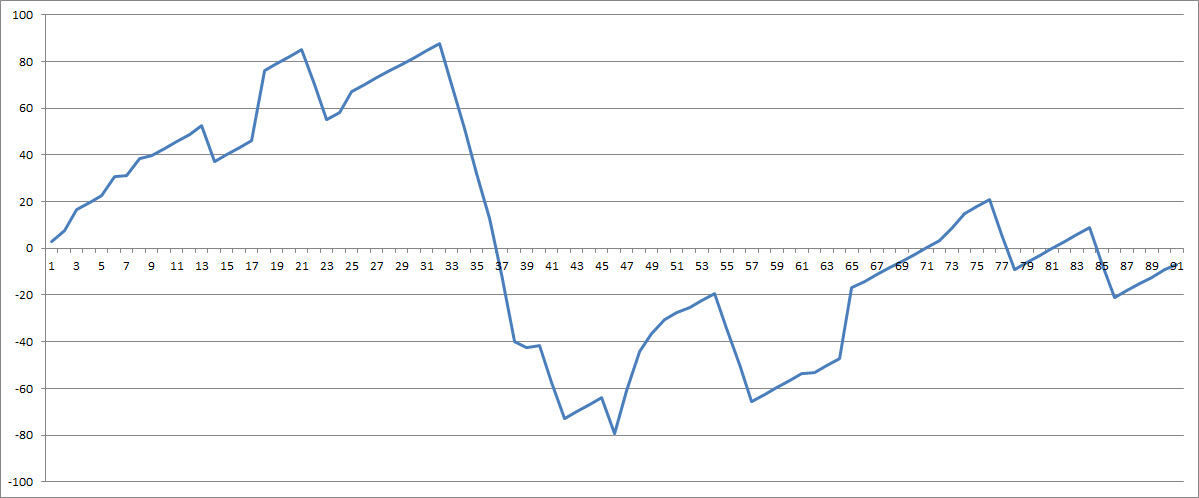

Ok, so here is the P&L in pips of the strategy with all trades (i.e. including the ones triggered at 13:15GMT on 6th of January during the ADP news release):

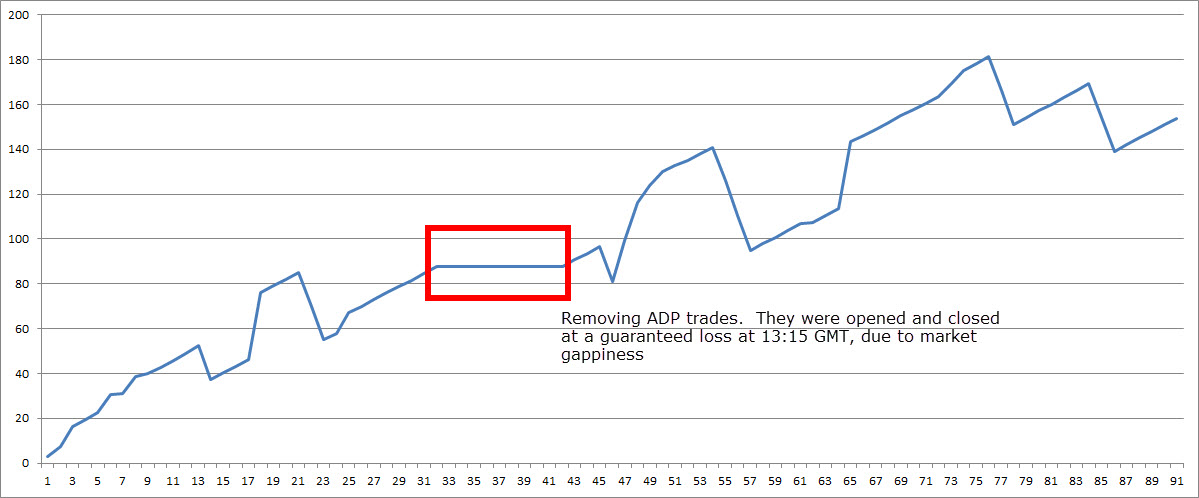

And now with the ADP trades taken out. Is this a realistic analysis? Yes, in this case it is. The trades that got stuffed were opened and closed at 13:15 GMT at the time of the news release. As discussed in the above post, these news announcements have a clear signature that can be tracked: the gradual widening of the bid-ask 30 seconds into the event. Plenty of time to track and kill all orders. By the way, given that the systematic implementation hasn’t happened yet, I just shut everything down manually prior to the NFP announcements last Friday. So here goes the picture of the PL without the “ADP” trades:

Now that’s much better.

Question of course is now to go through the backtests and actually check those days against which we had important news announcements in the past. I will constrain news events to FOMC minutes and statements, ECB meetings, NFP releases, and those US and Euro releases which had big surprises. The check will be: did those days post abnormally high P&L returns? It wouldn’t be surprising since as we pointed out full-bodied candles on the minutely levels can be misleading. Tick data is the required ingredient here.

Of course people who like to have holding periods of four hours to days or weeks couldn’t care less about such slip ups. But the scalper and intra-day trader lives and dies by the sword of the random number generator!

Hi Corvin,

I’ve been looking into price action and trying to research it as much as I can. In my relatively short time of following the fx markets, I’ve noticed a couple of characteristics of price behaviour.

1. Price often runs away in a single direction when there is a surprise in economic news release

2. If it is a central bank meeting or minutes, the price does a sweep in both directions before taking off in one direction.

Is there an explanation for the above phenomenon? What is it about economic news that doesn’t produce this sweeping effect?

Hi Stuart,

In both cases you are talking about an exogenous shock and prices trying to find equilibrium. The time scale over which these big (at least big over the short time scale) oscillations happen is an indication of lack of liquidity, or very strong micro-trends. As you say it’s to do with surprise, or conflicting market interpretations of policy makers.

The actual price formation is a micro-structure phenomenon of the market, with repeating patterns if you have access to the orderbook. However, with the FX market being decentralized and Over-the-Counter (OTC), it’s difficult to get hold of good representative data.

From a trading perspective, however, it turns out if the shocks are significant enough the trend will follow through. Examples of this have been BoJ policy let-downs (at least for the market) this year, as well as the unexpected Brexit vote outcome, with the ensuing USDJPY and GBPUSD trends persisting over days to come.