In this article I’ll follow up from Part I, on using the UK Services PMI to trade the GBP.

The questions we’ll answer are:

- What economic indicators for GBP are out there and which can we use?

- How do you set up a macro system?

- What does it mean to trade a basket of currencies against GBP, or is there a preferred pair to trade?

Let’s cover the main themes that affect the Foreign Exchange Rate:

- Inflation: influences Central Bank behaviour, but also tells us about price increases, and therefore increases relative to other countries, and hence price competitiveness between the UK and its trading partners

- External trade balances: in times of excess can put pressure on currencies

- Domestic Output (GDP): GDP is made up of two main components: household consumption and private investment.

Now that we’ve covered some factors that we think will influence the movement of currencies we need to determine which economic indicators / releases are actually required. Let me list them out:

- CPI: covers inflation

- Current Account: covers the external trade balances

- Retail Sales: covers the private household consumption component of GDP

- Services PMI: in the case of the UK, with a large services sector this covers the other part of the GDP equation (as we saw in Part I)

Now these indicators don’t all come out at the same time. They come out at various times during the month, and also at various frequencies (for instance the Current Account numbers are quarterly whereas the other numbers are monthly).

So before we continue let’s formulate a way of constructing a way of trading these indicators. A very easy way is to create a binary-series of these indicators. It’s easier than it sounds! Start at zero, and if the indicator comes in above the previous reading add one, otherwise subtract one. Since we need to match up readings on the days in between readings, our indicator stays unchanged.

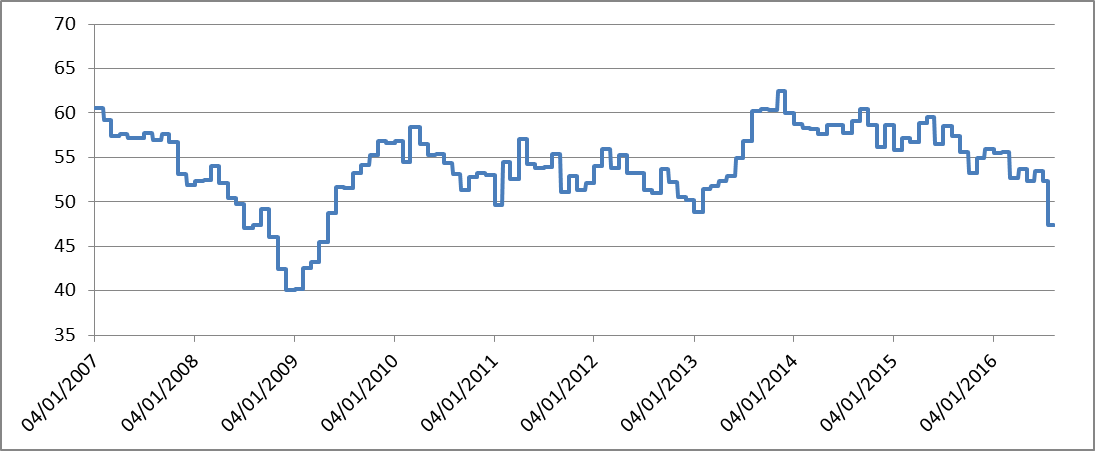

Let’s see how this works for Services PMI. The data we use is from ForexFactory and you can download the python script to extract it from here. The original series on a daily frequency is:

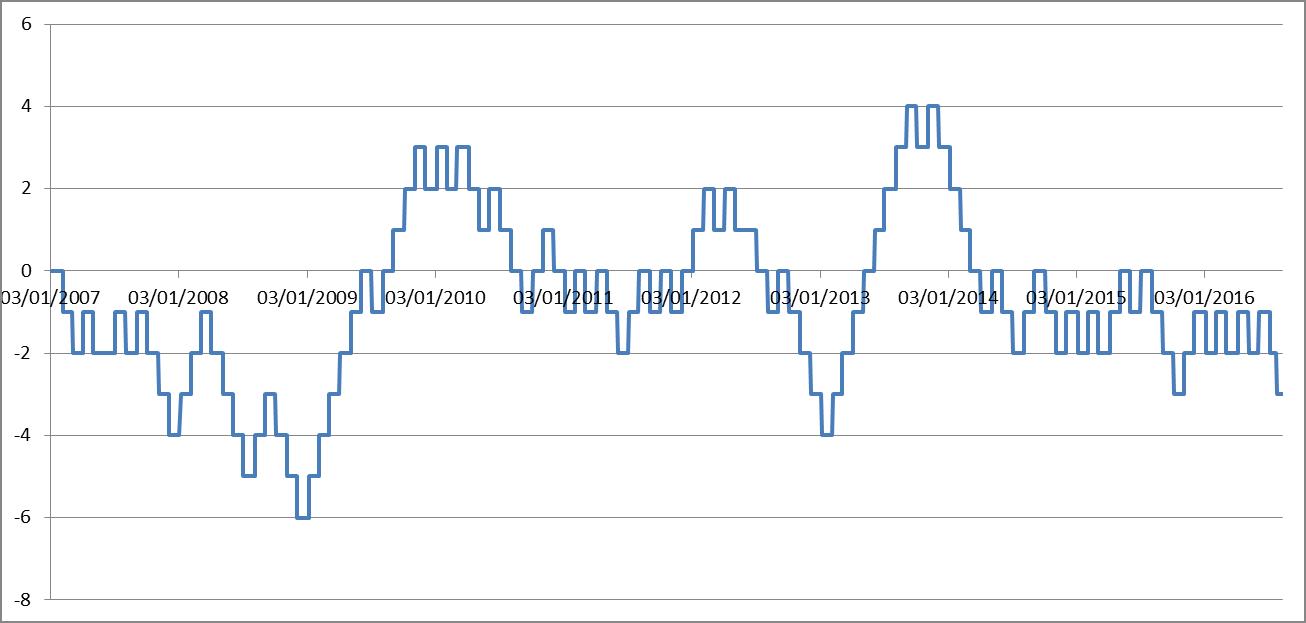

Of course it’s a step-wise graph, since we have releases only at the start of the month. So how does this look as a binary series once we just look at the direction of changes rather than size? Here it is:

As you can see the structure is maintained, however we have thrown out the size of the moves. The main reason for this approach: we will be combining a variety of indicators, each with different units, as well as different reporting timings and frequencies.

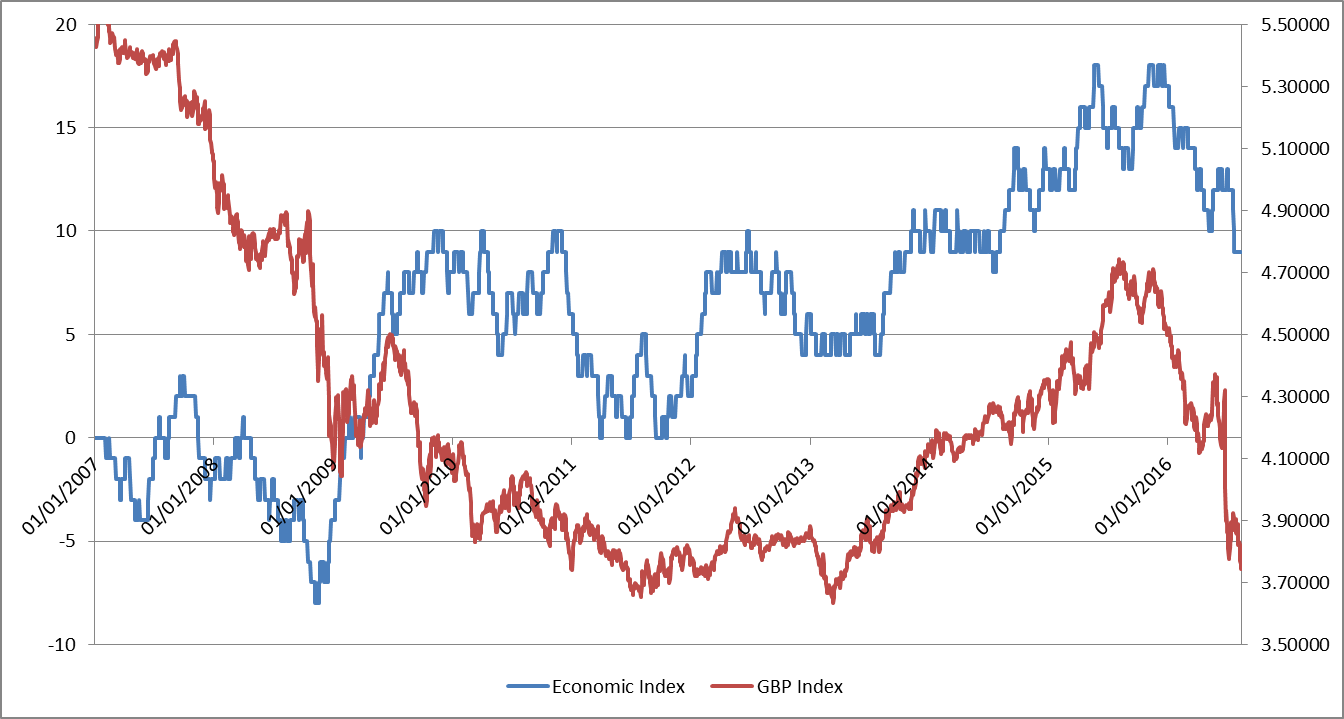

So what happens if we take all our indices and combine together over the period Jan 2007 until present?

We obtain:

As you can see they do track each other.

So what is the trading recipe?

It is actually quite straightforward: If our Economic Index increased since the last observation we buy GBP against a basket of currencies, if the index has decreased we sell it.

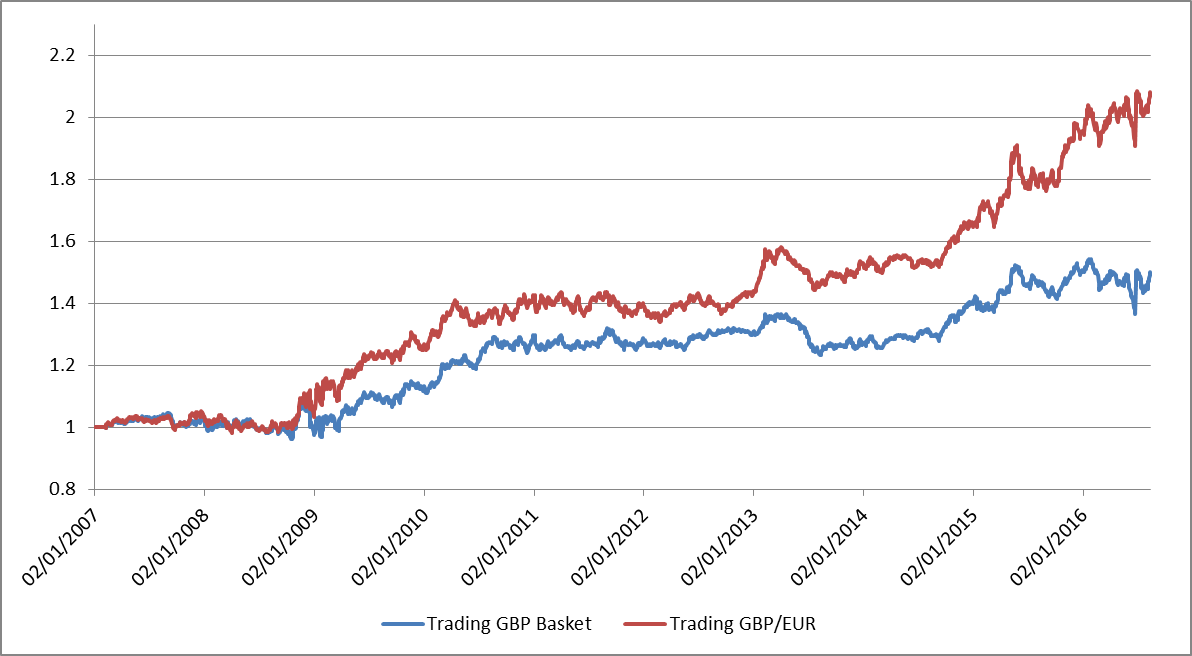

So what does the performance look like over the last nine years?

The results of this simple approach are quite impressive. For starters, reflecting a previous question on how to trade GBP versus a basket, this chart shows that you can get a bigger bang for your buck by picking the right counter currency to trade GBP against. In this particular example it turns out that focusing on the EUR outperforms not only the basket, but all other pairs as well.

For the GBP basket the Sharpe Ratio is 0.57. Good. But for GBP/EUR alone it is 0.90. Even better!

This is quite a remarkable result in the light of other benchmark indices trading at a Sharpe Ratio of only 0.5, such as the S&P500.

To recap: trading an economic index is not that difficult. You keep a scorecard of those economic releases that matter (according to the national accounting identity: GDP = Private Consumption + Private Investment + Government Spending + Net Exports), and you trade in the direction the index tells you to. And which counter currency do you use? Well the one that represents the largest trade partner. In the case of the UK (and hence the GBP) it is the Euro Zone, therefore you should trade GBP versus the EUR.

Of course you can apply this approach to any other country / currency-pair. And I urge you to go ahead and try it out! You now have a very objective approach to trading “macro”-news, other than the usual hand-wavy interpreting, which rarely leads to repeatable results you can test.

Happy trading.

If you have enjoyed this post follow me on Twitter and sign-up to my Newsletter for weekly updates on trading strategies and other market insights below!

Leave a Reply