Most people are familiar with the term ORB (open range breakout). It was popularized by Toby Crabel’s book “Day Trading with Short Term Price Patterns and Opening Range Breakout”, as well as the The Logical Trader: Applying a Method to the Madness (Wiley Trading) by Mark Fisher.

ORB uses the price range set at the start of a trading period to determine the future price moves, using a breakout-style approach.

In this article we’re going to apply this principle to the FX market using a whole year as our trading horizon.

Why is this important? Well, for starters we’ve just completed two weeks of trading in 2016, and the lines have been drawn in the sand. Certainly anybody who’s anybody has come back from holiday biting their fingernails off like crazy, given the risk-off environment we’ve had. Also, we will be having some Central Bank statements from the FOMC (on the 28th January) and the ECB (on the 21st January, and remember the fireworks this meeting caused in 2011!). These announcements could easily tip the balance for several currencies for the rest of the year

Furthermore, we can add these range-levels to our watchlist for any potential setups in the coming weeks and months, which provide us with a long-term view on the currency markets for the rest of the year. It takes the sting out of having to screen-watch. It also provides a strong indication on how to position for shorter time-horizons (such as intra-week and intra-day). In this way it gives a strong grounding in where the trend for the rest of the year might be headed, a valuable insight to have.

The principle for Crabel’s ORB was to take the price range within the first trading period of the day to setup a breakout strategy. For equity and futures markets there is a natural open: at the start of Regular Trading Hours (RTH), excluding the 24-hour trading that some electronic markets afford, since the volume is very thin during those times. Similarly for the 24-hour Forex markets natural market opening times are the London and New York openings when volume starts to surge as the major FX centers open for business.

We can take the notion of ORB and extend to it to timeframes that are super-long: years. We define the “opening time” of the year as the first ten trading days, which is the near-equivalent of two calendar weeks.

It turns out that the ranges set during those two weeks play a crucial role for the rest of the year (or in any case for the first six months, and in July the same exercise can be repeated).

So how do you trade these breakouts? I’m going to follow up with a detailed post over the next two weeks, so keep your eyes peeled. But as a first stab I’m going to provide some rule-of-thumb approaches:

- Give yourself space to follow the breakout.

- If you want to keep risk tight, put your stop-loss to breakeven soon after the breakout (such as in a couple of days, or using a 2 x ATR trailing stop, etc)

- Trade both sides of the range, you don’t know how sentiment will fluctuate

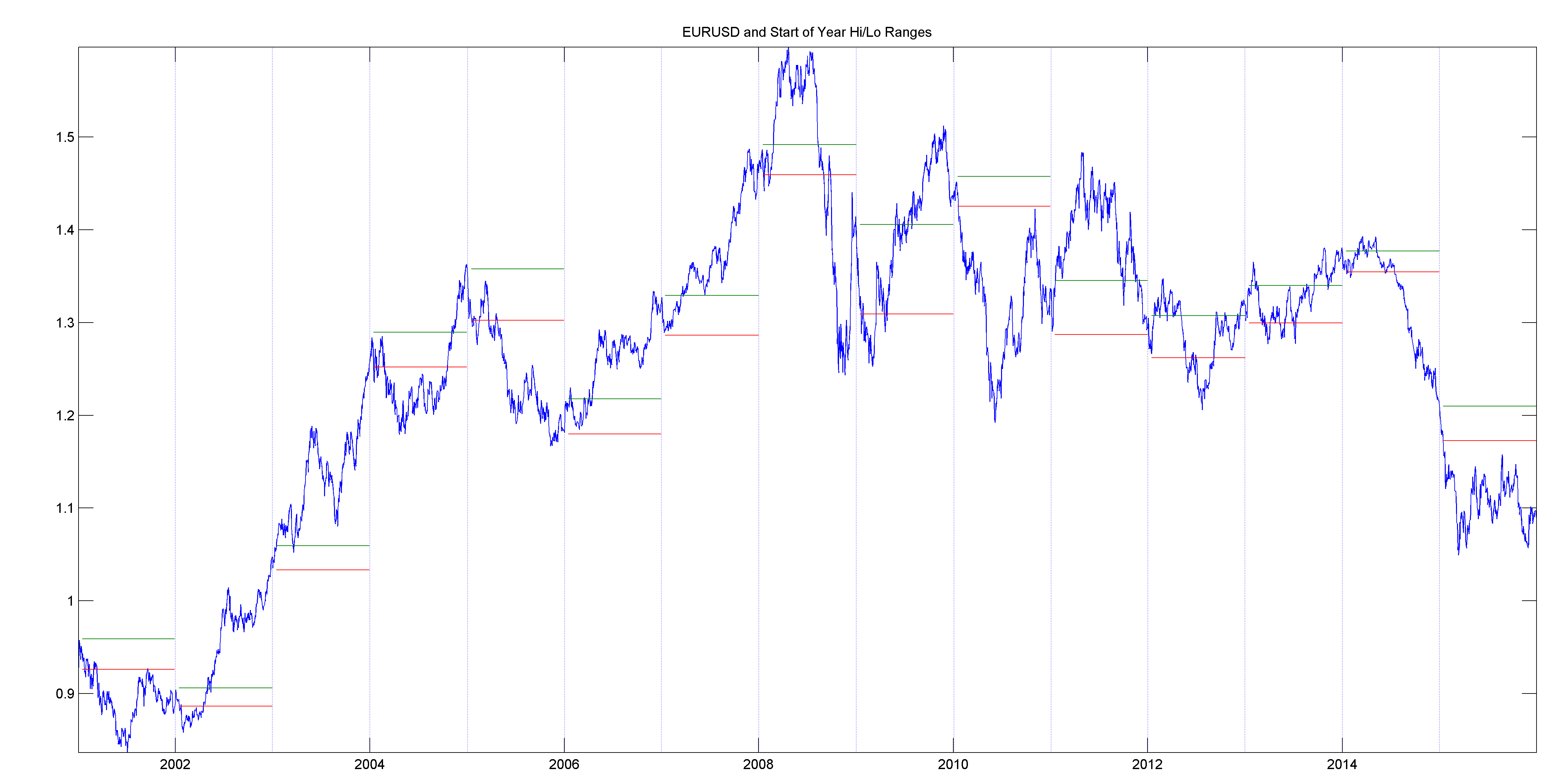

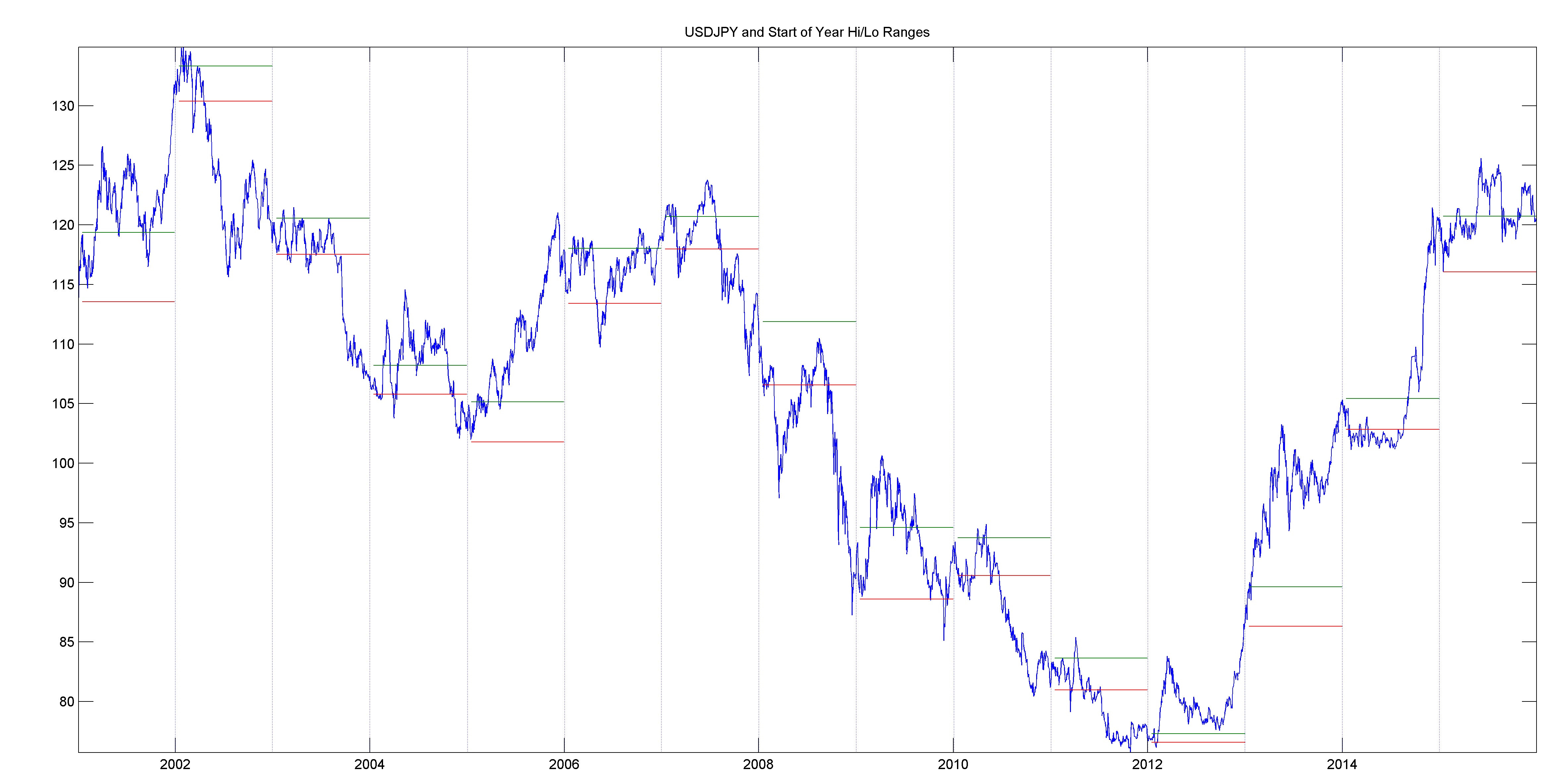

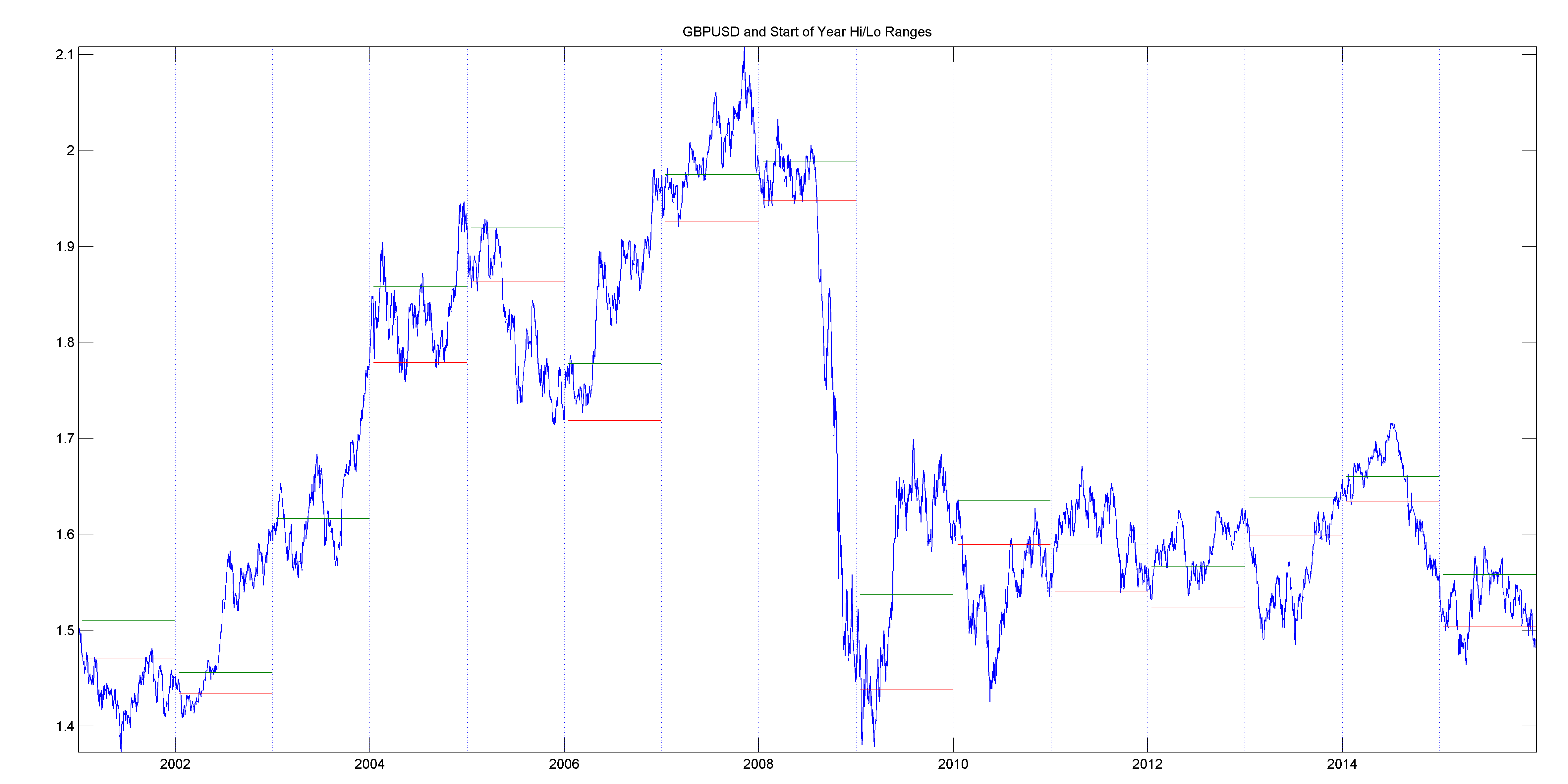

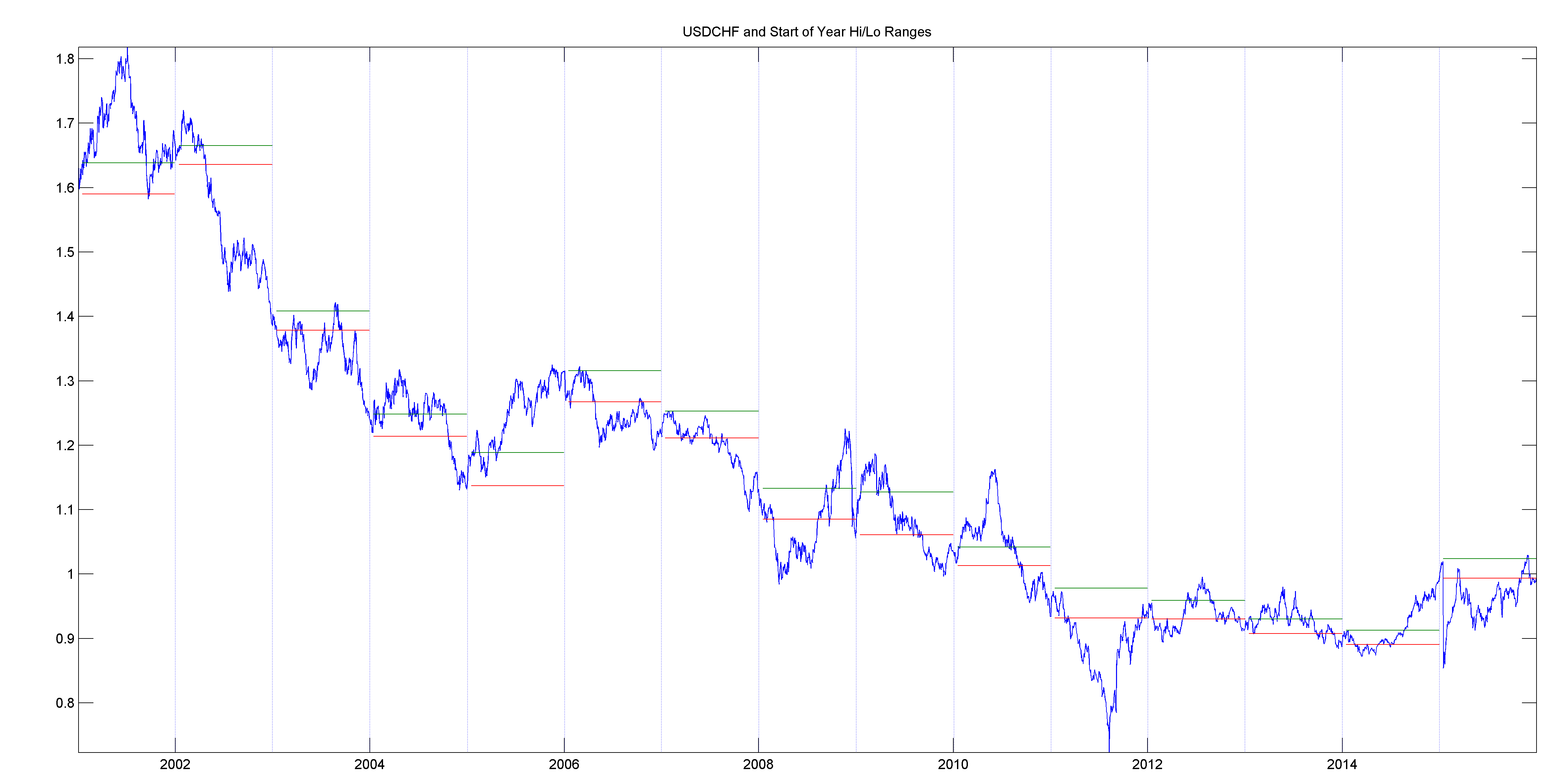

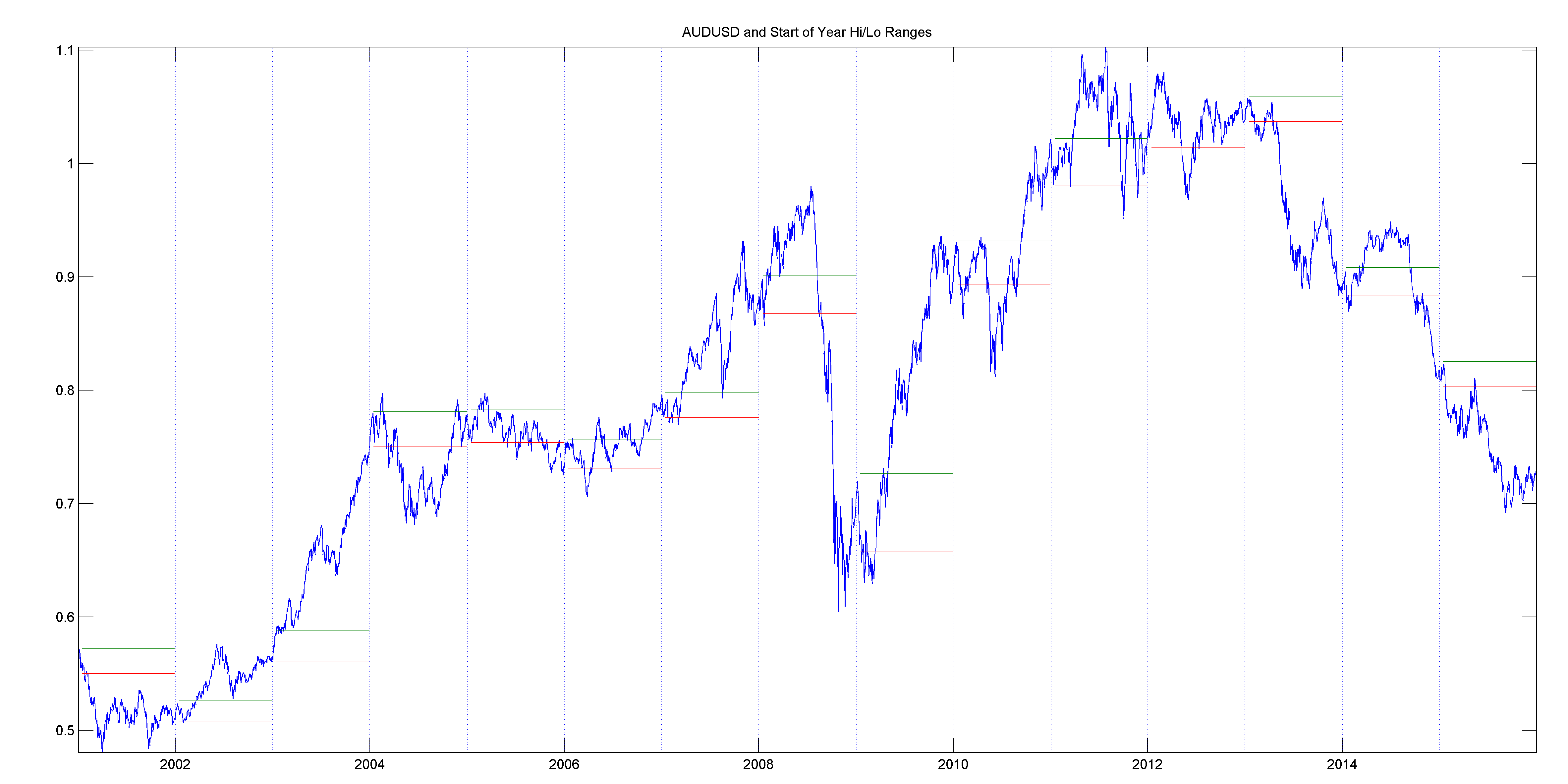

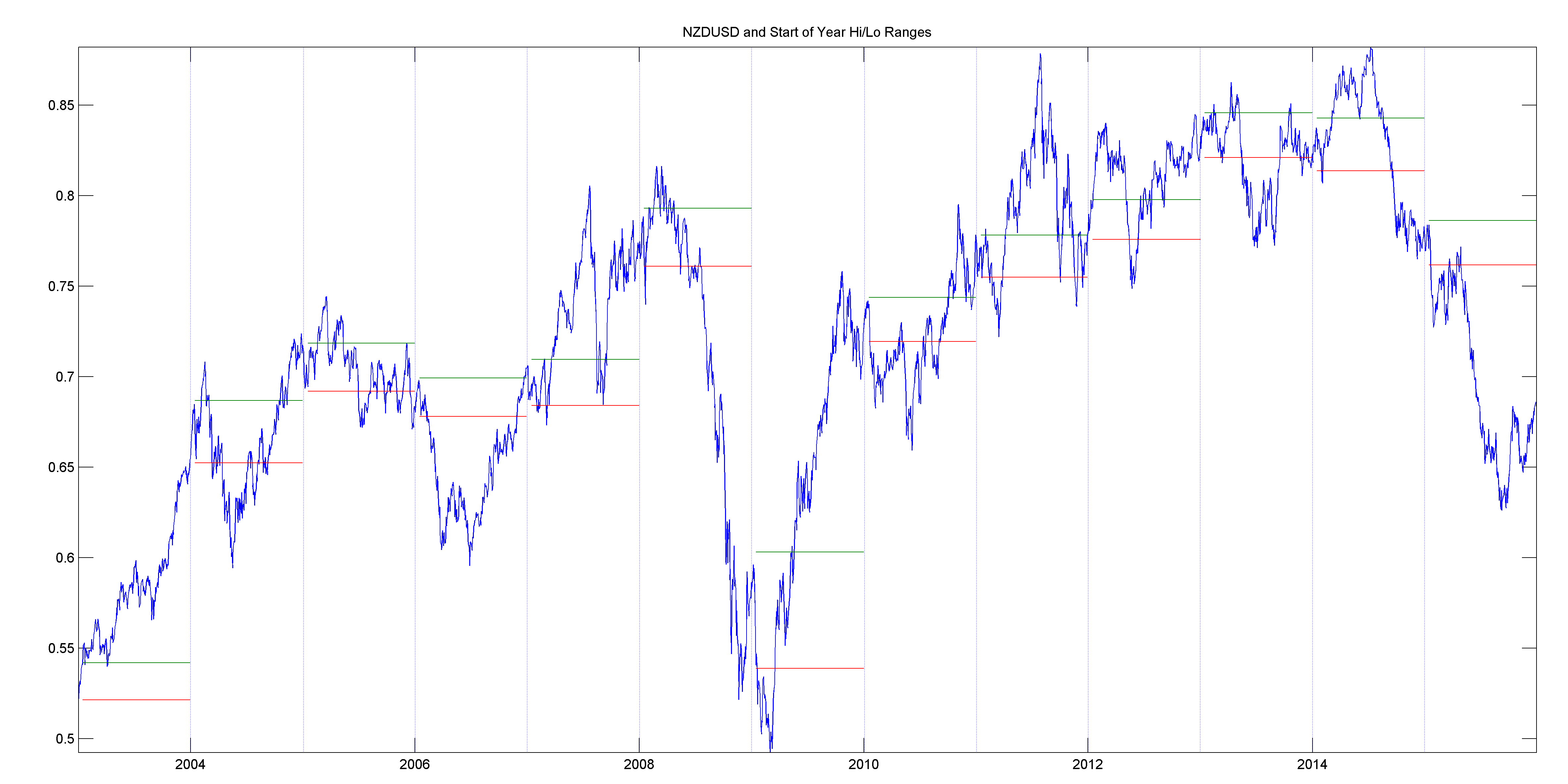

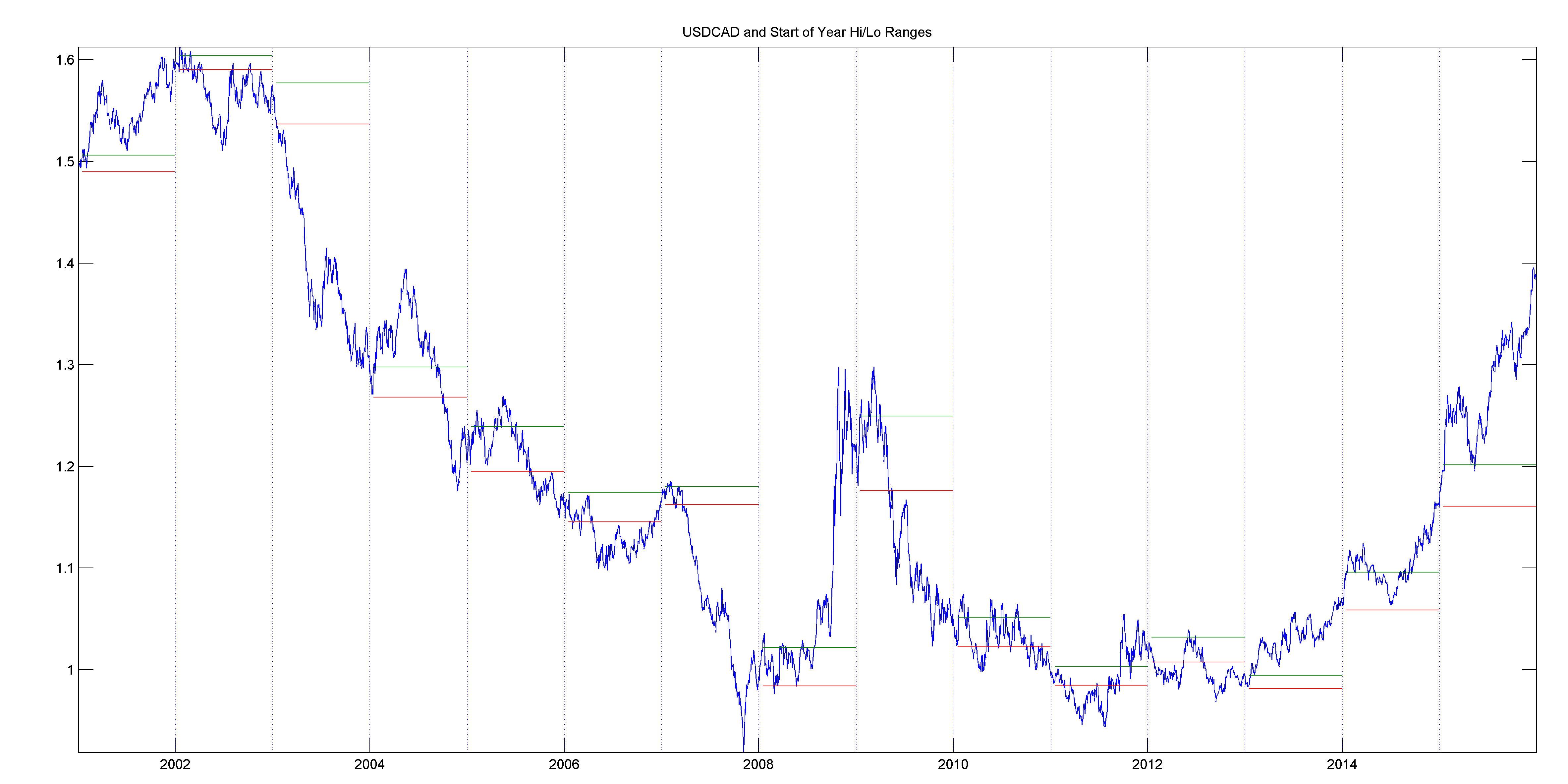

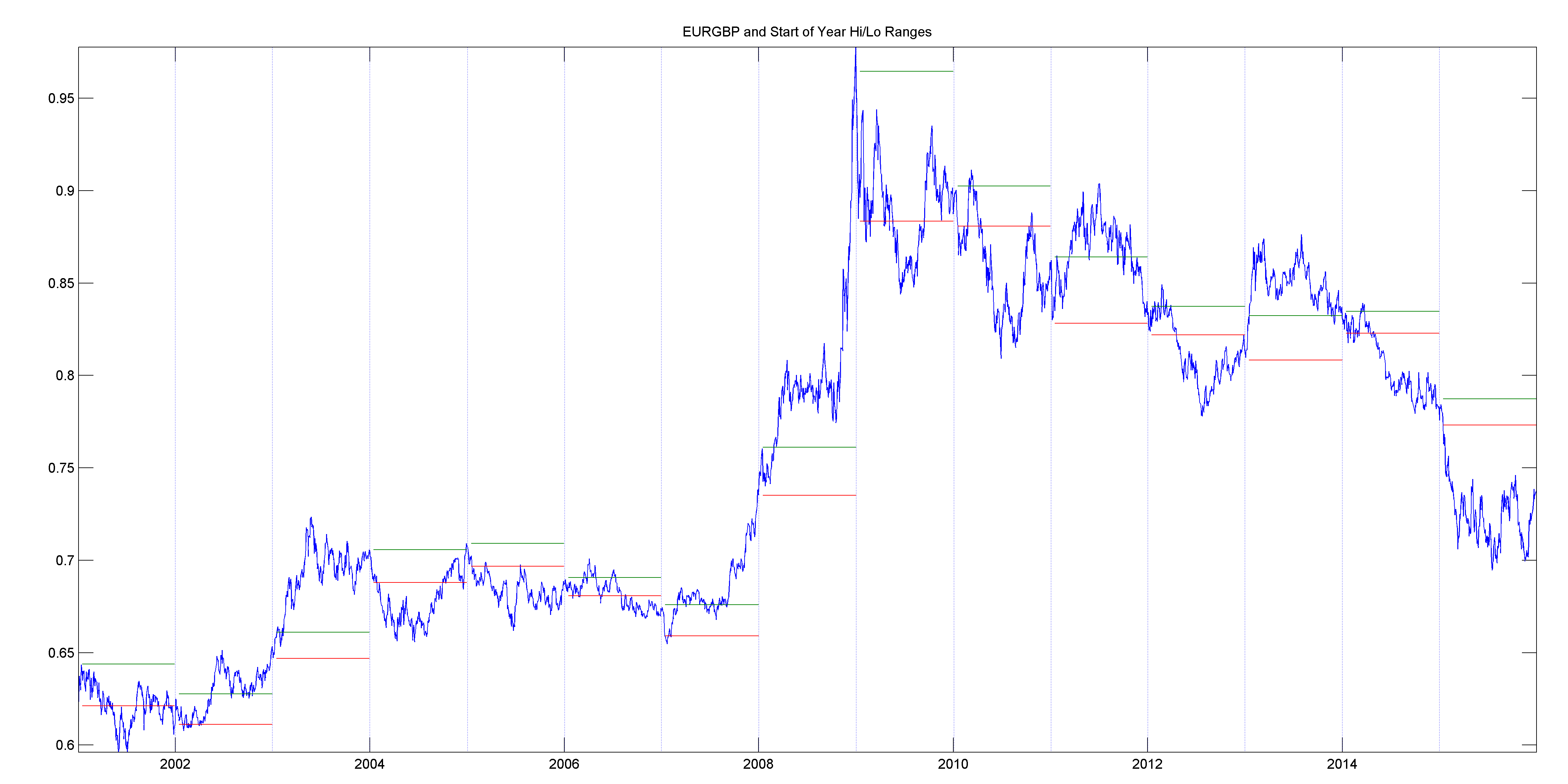

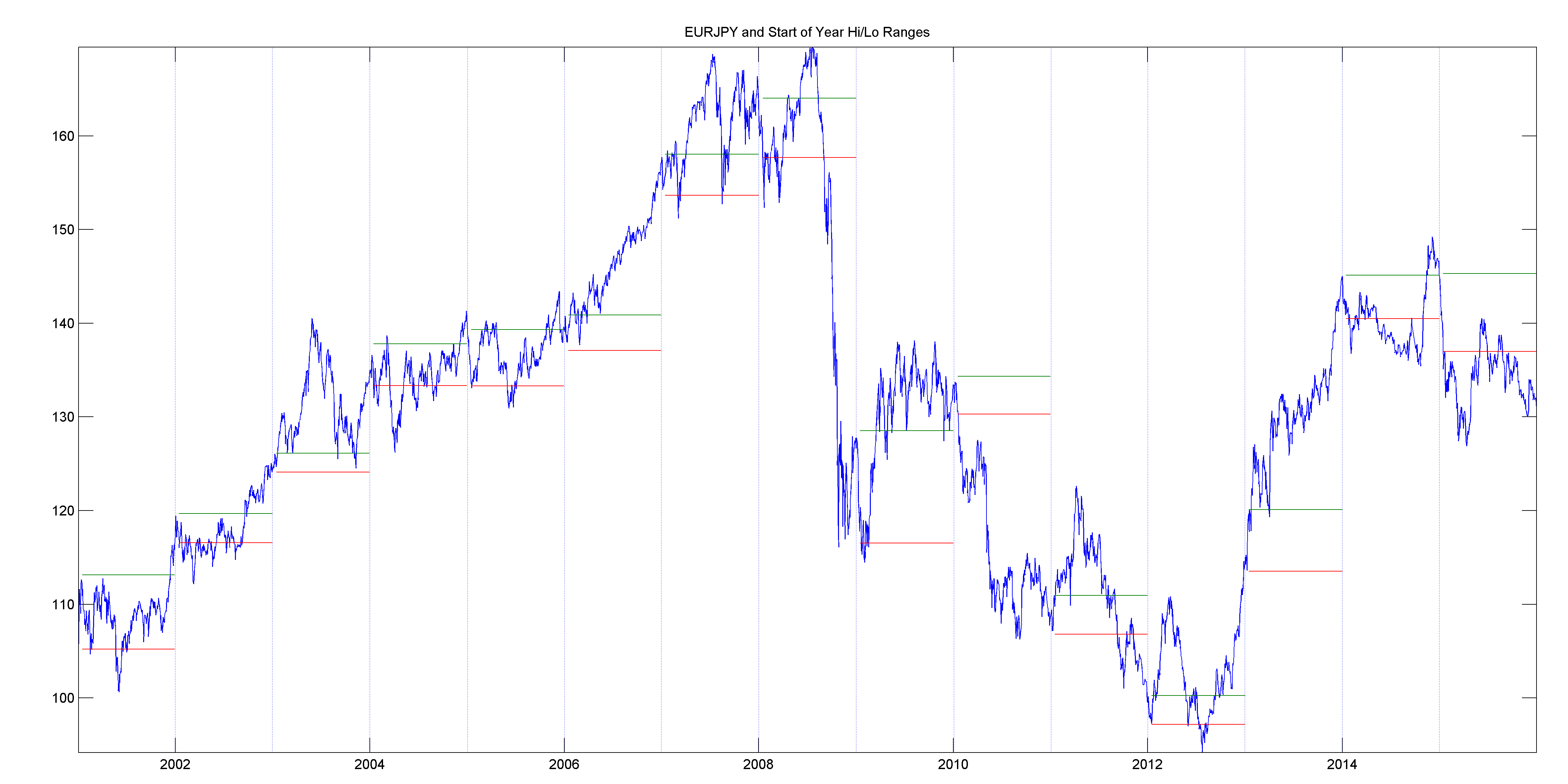

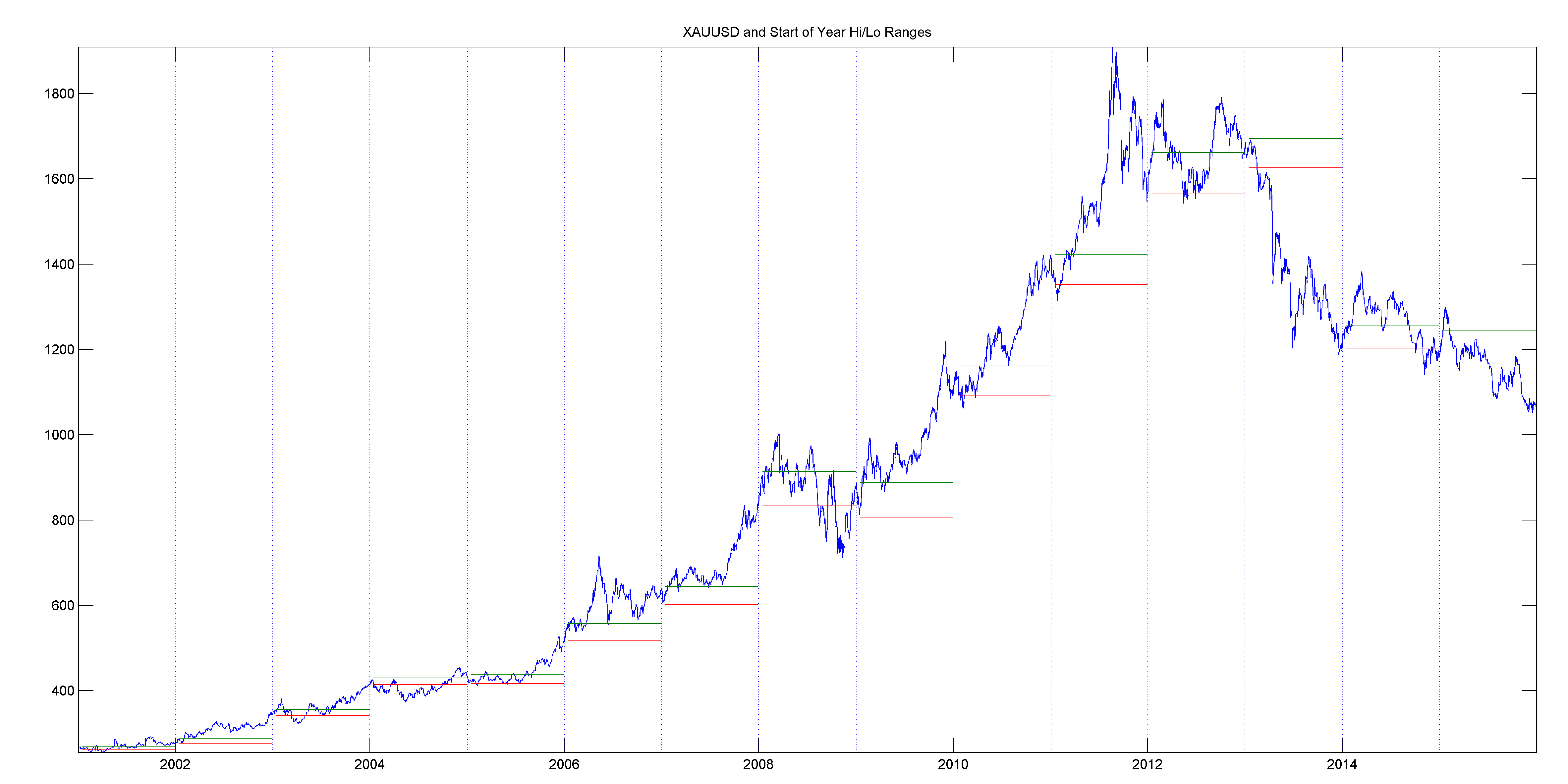

Next, using charts, I will show you how the major currency pairs performed using the initial two-week year-open range over the last 15 years.

The currencies we cover are: EURUSD, USDJPY, GBPUSD, USDCHF, AUDUSD, NZDUSD, USDCAD, EURGBP, EURJPY, Gold.

Unsurprisingly, the biggest percentage movers are the commodity currencies, driven by Oil collapse and China worries. Next up is GBPUSD which has been in a continuous downtrend for the last two weeks, driven by the usual idiosyncratic shenanigans that befalls the currency and probably Brexit positioning as well. EURGBP has benefited from this. The quietest currencies were EURUSD and USDCHF. Given the upcoming Central Bank statements, it wouldn’t be surprising if the action focuses on these next.

We’ll finally wrap the post up with a table of where these ranges have been set. Write these down, and keep track of where the currencies are headed! There is plenty of profit potential here.

| Currency | Start of Year Hi | Start of Year Lo | Range (Pips) | Range (%) |

|---|---|---|---|---|

| EURUSD | 1.0985 | 1.0745 | 240 | 2.2% |

| USDJPY | 120.50 | 116.50 | 400 | 3.4% |

| GBPUSD | 1.4815 | 1.4235 | 580 | 4.0% |

| USDCHF | 1.0125 | 0.9880 | 245 | 2.5% |

| AUDUSD | 0.7300 | 0.6825 | 475 | 6.7% |

| NZDUSD | 0.6835 | 0.6380 | 455 | 6.9% |

| USDCAD | 1.4610 | 1.3815 | 795 | 5.6% |

| EURGBP | 0.7695 | 0.7310 | 385 | 5.1% |

| EURJPY | 130.75 | 126.80 | 395 | 3.1% |

| GOLD | 1112.30 | 1062.25 | $50.05 | 4.6% |

If you’ve liked this post please follow me on @FXMasterCourse or sign-up to my newsletter.

Dear Corvin Codirla,

I would like to thank you for all your efforts to help retail traders approach trading in a soft, systematic and professional way.

I have learned a lot from you even if i am not yet your student !

Amine

Hi Amine!

Thank you very much!