It’s only been the fourth trading day of 2016, but there is no shortage of surprises, volatility, and all round mayhem.

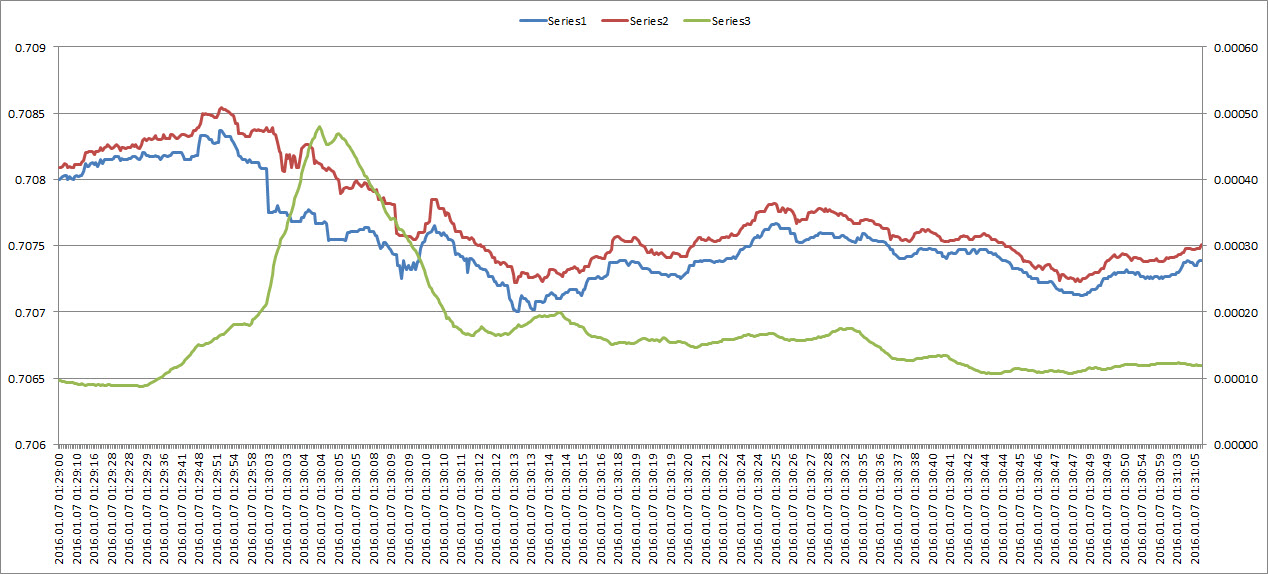

Today the AUDUSD had two announcements which can be considered relevant. The first was at 00:30GMT, the Building Approvals number, and shortly after 01:15GMT the PBOC rate fixing for the CNY.

The first announcement was followed by a slow 10 pip grind to the downside, followed by a retracement to 0.7084. The PBOC announcement was issued at 01:16GMT, on the back of which AUDUSD fell 60 pips over the next half hour.

What did the market do during these two periods? Did Bid/Ask indicate any expected upcoming event? How does the broker deal with such situations?

For the Building Approvals number, as expected we see the Bid/Ask grinding slowly higher from an average of 1pip to an average of 5 pip shortly after the announcement. Though building approvals collapsed the market remained orderly. It dropped 10 pips in 13 seconds but then caught itself. The Bid/Ask spread decayed slowly back to its 1pip average after one minute.

No surprises here, but plenty of time to get out of the market before the announcement. Trading was choppy between 0.7080 and 0.7075, so any orders should have incurred this order of slippage.

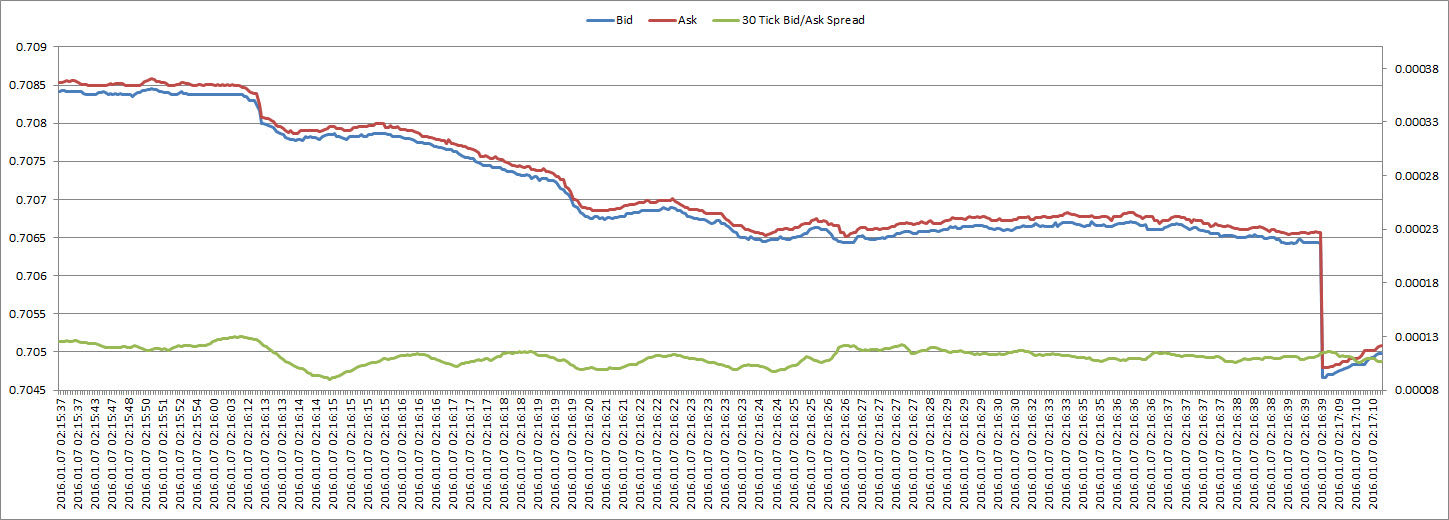

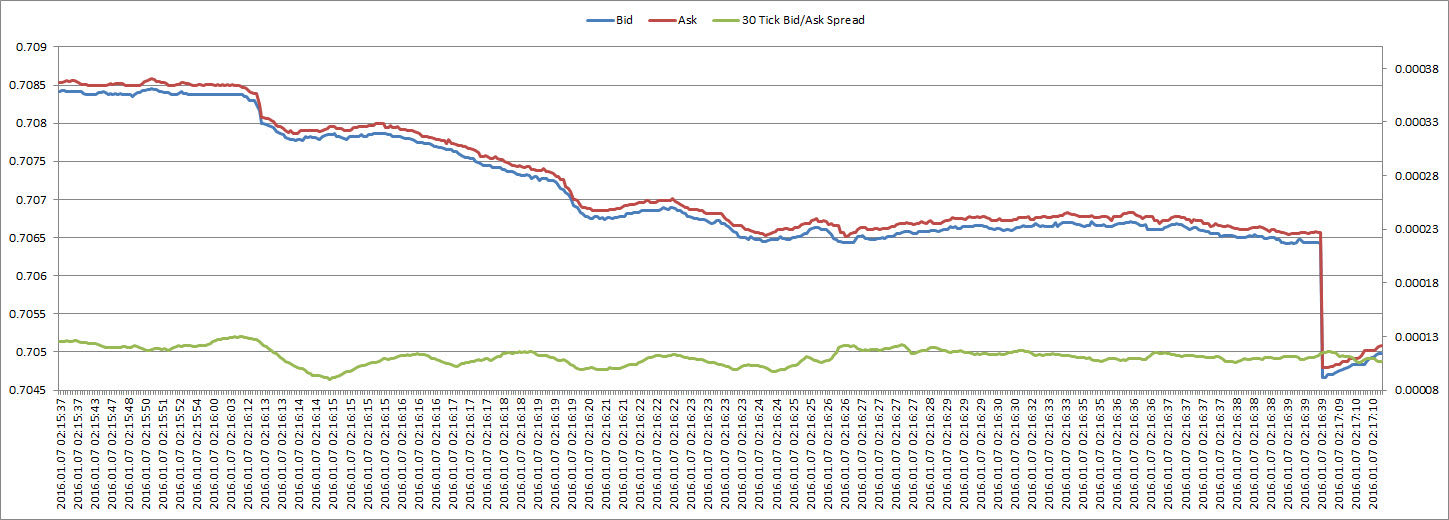

The PBOC was a completely different beast. It appears that the broker had no idea of the upcoming announcement. It certainly isn’t listed on ForexFactory!

The Bid/Ask spread stayed constant throughout. So how did the broker protect himself during what was quite route to the downside for AUDUSD: 40 pips in two minutes. In a similar fashion to yesterday, the broker stopped quoting. Looking at price action the announcement hit the market at 01:16:13 GMT. At 01:16:39 GMT there is an outage of quotes, with price at that time showing 0.70644. The outage was not a connection error the broker which I can read from the log files. Streaming data is re-established at 01:17:19 GMT, and price now stands at 0.70467, a 20 pip drop, and with it the associated slippage.

So, the interesting thing that arises from this picture is:

First: Post the PBOC announcement the market went nuts, but execution still functioned. Tick Volume in the previous minute (01:15 GMT) was at 197. Tick volume between announcement and quote outage was 443.

Second: Is there a way that we can protect ourselves in a situation like this? To answer this question we need some reverse engineering, and the conclusions could be faulty. But: outage stopped after there was 20 pip move in roughly 25 seconds. That’s a pretty large move. So what about raising flags if you get a 10 pip move in 10 seconds? This could be a flag for some crazy stuff going on in the market.

Do we have sufficient time to close and get out if need be? Assuming it takes up to 5 seconds to get out of the usual scalping clip size (up to 5 0 lots let’s say, which $5mm notional), the answer in this case would have been yes.

I find these case studies fascinating because of the protective insights it allows. I.e. protection of capital. My intra-day strategies tend to be implemented via pending orders, i.e. limit and stop orders. The problem with limit orders is that the Forex Market does not have a centralized limit order book where retail trader can participate, and have real resting orders in place. These limit orders (as well as the pending stop orders) tend to be held with the broker and when the market triggers them they are translated to market orders. It’s off to the races then. The idea is to use the above case studies to help avoid market situations where execution of market orders will lead to unnecessary slippage. Remember: if you miss a trade, don’t chase it, there are another 50 years (assuming average life expectancy, etc.) to exploit the markets.

Lessons learned:

- You can do away with economic calendars, and let the brokers do the leg work for you.

- Even with unexpected events, the market shows its hand

Now to implement in MT4. Coming soon.

By the way, the next AUDUSD number is at 22:30 GMT, the AIG Construction Index. It’s given a medium importance rating by Forex Factory. Let’s see how the markets value it. We can benchmark against the red importance rating of the Building Approval last night.

Leave a Reply