Over the last four articles people have been writing in, asking,

“How do you deduce leverage from your backtests?”

“How do you actually implement leverage in your trading?”

“How do you calculate position size?”

“How often do you rebalance?”

So, to keep this series as hands on and close to reality as possible, this article focuses on the practical aspects of implementing leverage on your account (and no, the margin your Broker indicates, such as 1:400 doesn’t count).

In detail for this article:

- How do the results of the backtests translate to actual position sizes?

- How does that translate into day-to-day trading?

- What kind of money-management type is Kelly betting?

- How do you work out position sizes with your MT4 broker?

The take away message is that leverage in and of itself is a very straightforward concept.

The difficulty arises when you have to actually work out the leverage from your systems testing and then translate it into actual position sizes on your trading account.

Deducing Leverage factors from Backtest results

As you saw in the previous articles, all backtests ultimately reduced to percentage returns.

In essence we had an asset, \(A_i\) and we looked at its returns over a period \(R_i:=\frac{A_i}{A_{i-1}}-1\)

Especially for equities this simplifies the view on risk: as the SPY (recall this is the S&P 500 ETF) increases in price, its swings will be much larger in terms of points, but will remain of comparable size when looked at in terms of percentage risk.

Now, let’s say that you have C dollars in your account. A leverage one position would imply that you use your full cash amount to purchase N units of the asset at a price P.

Of course there will be rounding errors, since most of the time you can’t buy fractions of the assets, and \(\frac{C}{P}\) isn’t a whole number. But we’ll gloss over these details here!

With this leverage one position any percentage change in the asset will equate to an equal percentage change in your account value.

This is your base case scenario.

Now, recall that the way we looked at leverage, was as a multiplicative factor on the asset returns!

Meaning that when we set our leverage to two, this actually translated to:

\(R_i \longrightarrow 2 \times R_i\)

And of course to achieve that it means that at the start of the period we had to purchase twice as many units as we did with our original capital, i.e. we must purchase \(2 \times N\) units!

That’s pretty straightforward, no?

But the next time period, after the asset has moved, you have to keep on your toes, since we’ll be facing some market trickery!

How to Implement Leverage in Day-to-Day Trading

To figure out what happens in the next time period after the market has moved, let’s work out some explicit numbers.

Let’s say that we’re going to use a leverage two position. Our asset price is initially at $100. And it moves up 10%.

So in essence to have a leverage two position, we’re going to lay out $200 of cash and purchase two units of the asset. (Where the extra money came from is a question of margin, and we’ll get to that later).

So we started out with $100, bought two units of the asset, which moved up 10%. So we made $20 of profit.

Now here is the trick question. Is your leverage still \(2\times\)?

Think about it before you move ahead.

The answer is ….

…. NO!

You now have $120 in the kitty and the value of your holdings is $220.

If you work out the maths your leverage is now \(\frac{$220}{$120}=1.83\times\).

Your leverage just decreased. This is really important.

This would not have happened had you had a leverage 1 position.

So if you want to maintain a constant leverage, which is of course what we calculated in the previous articles, there is only one thing left to do.

You gotta buy more!

How much more is easy to figure out. Your total holding has to equal twice your cash, which in this case would be $240. So you have to buy an extra $20 worth of assets. (Let’s ignore the issue of fractional asset holdings here for the time being).

Now let’s look at the scenario where the asset price decreases by 10%. You again start out with $100, and you have a leverage of 2 times which means you just purchased $200 worth of the asset.

After the 10% drop in the asset price you lose 20% of your holdings (as expected from a leverage two position), which results in your net worth being $80. However your holdings are now equal to $180.

So what has happened to your leverage?

It’s actually increased.

Your leverage is now \(\frac{$180}{$80}=2.25 \times\).

So it’s obvious what you have to do for the next trading period: you have to dump some of your holdings to get back to the leverage that you were targeting. In this case you have to get rid of $20 of the asset.

Kelly Betting as a Dynamic Trading Strategy

The above section is really important!

You see, most people think of leverage as being something constant that they don’t have to worry about once their position size is set.

That’s not quite true.

The argument goes: your leverage is variable, since it’s a multiplicative concept, however, your P&L changes are additive. This makes a whole bunch of difference.

The end-result: keeping a constant leverage (which is some fraction of your Kelly criterion as we saw in previous articles), requires you to constantly re-balance your portfolio.

But more than that: when you make money, Kelly forces you to increase your position size. When you lose money, Kelly forces you to reduce your position size.

Kelly betting in essence is an anti-martingale strategy, very much in line with what trend-followers apply in their trading. As the markets go in their favour, they pile in and hog out.

Recall Stanley Druckenmiller’s quote: “It takes courage to be a pig. It takes courage to ride a profit with huge leverage.”

How to Work Out Position Size with Your MT4 Broker

To translate form capital in your MT4 (or MT5) brokerage account to lot size is now the final missing piece of the puzzle.

It’s what makes everything real.

To be clear, the calculation presented below applies to any brokerage account. And we’ll see how margin and ultimately the advertised broker leverage comes into it.

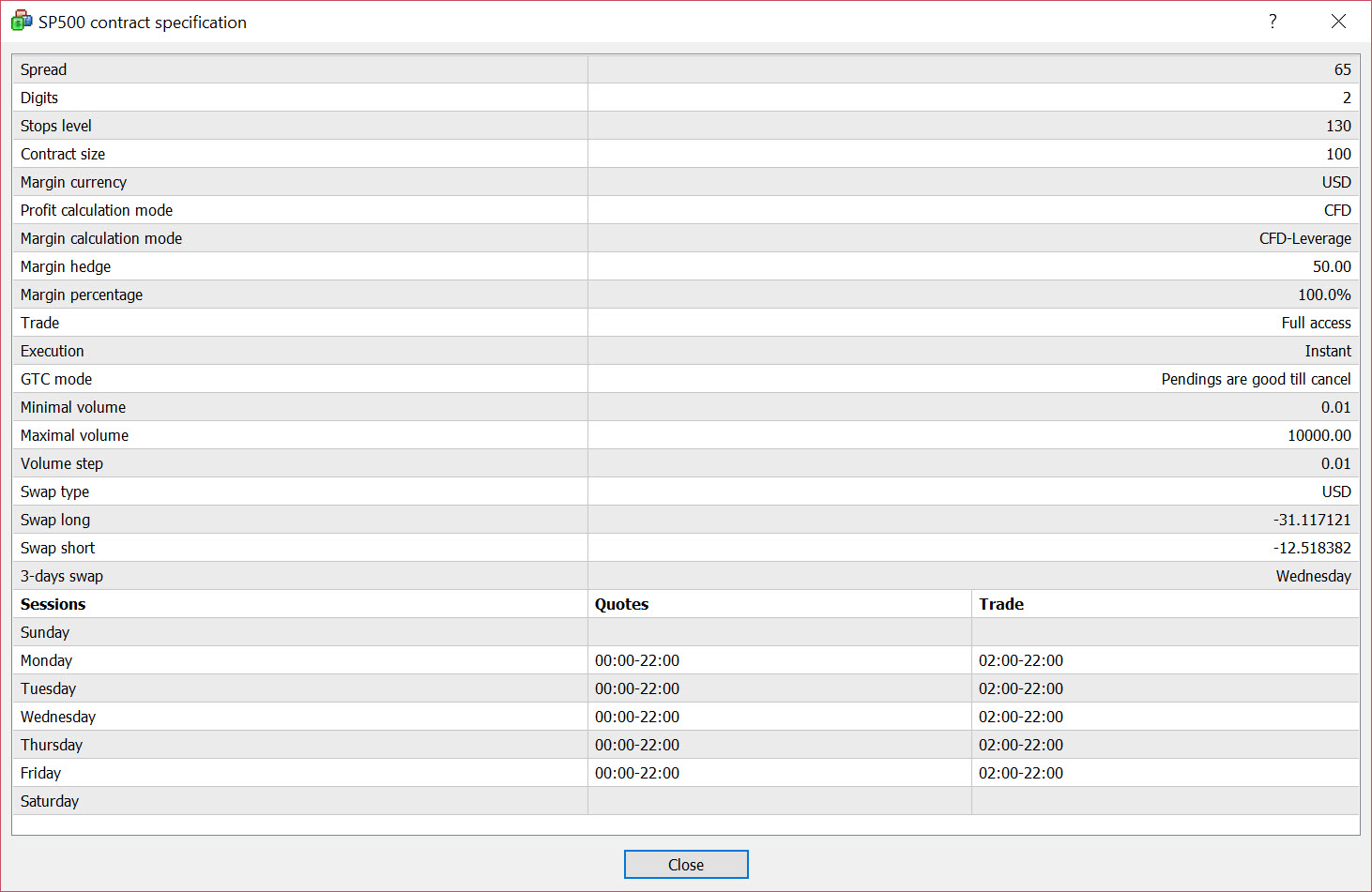

For this article we’ll use a broker who has following specifications for the S&P 500 index:

The important numbers for us are

- Contract size, which in this case is: 100

What this tells us is that for a 1 lot trade, in the parlance of the broker, a one point move in the index is equal to 100 units of the base currency, which in this case is USD.

So quick, if I want to purchase one unit of the index at a price of 2,564 (the current price), what would my lot size with this broker be?

Well, it would have to be one hundredth! Or \(\frac{\mathrm{Lot Size}}{\mathrm{Contract Size}}=\frac{1.0}{100}=0.01\), which is also the smallest unit of volume tradable for this asset.

So let’s say we have $10,000 in our account, and we would like to leverage or holding to three times. What would the lot size be?

Here it is:

\( 0.01 \times \mathrm{Lev} \times \frac{Capital}{Price} = 0.01 \times 3 \times \frac{10,000}{2564} = 0.12\)

And you can see as your capital changes and the price changes so will your position size.

What will be your margin requirement be for this position?

Well, this is where the 1:400 advertised margin from your broker comes in. If you have $30,000 worth of SP500, one four-hundredth of this a requirement of $75. The $30,000 comes from using three times leverage on your $10,00 capital.

This small margin requirement is quite phenomenal.

If you look at the CME where the actual futures are traded, the marign requirement is 3.5%, which at this moment in time for one contract is \( 2564 \times 50 \times 3.5\% = 4,500\) dollars. We have used the fact that one point on the index is worth $50 of P&L.

Now of course such a MT4 broker margin means that theoretically you could leverage yourself up to 400 times. But that’s idiotic, and not what you would do in the first place.

The whole advantage of such margins is that in essence you are trading at almost zero funding cost. There are some caveats, and you will see that in this broker example both short and long position cost you, via the swap long and short. However, there are brokers that CFD the future and not the underlying cash index. Since there the funding cost is baked into the futures contract already, holding the CFD contract incurs no funding cost and is in essence at zero cost to you.

Recap

In this article we took a step back and looked at the practicality of what it means to work out your position size given the broker specifications for the underlying contract.

The calculation for your position size is straightforward.

However, the key concept, which rarely gets mentioned, is that true Kelly betting is a statement about constant leverage, since this is the assumption underlying the optimization equation.

Hence, to truly Kelly bet you will be actively turning you portfolio over, as you constantly try to keep the portfolio leverage close to the calculated Kelly criterion.

If you have followed this far, you probably have following question now:

- Given that my Capital fluctuates every day should I rebalance everyday??

- Or should I only adjust trade sizes on the new trades that I put on.

To maintain your sanity I’d advocate the latter (which I also practice).

Also, to constantly rebalance your portfolio will ultimately result in higher transaction costs, which will erode any benefit from strictly adhering to the Kelly mechanism.

What is really nice about these results is that they conceptually tie together: we’ve been taught to pile in when we’ve got something good going for us, and the maths, in terms of optimal value extraction, points to exactly that.

As Hannibal Smith from the A-Team says: “I love it when a plan comes together!”

See You Next Time…

Next time we’ll return to improving our mean-reversion approach from last time, by looking at some of the favourite indicators. The end result will be pretty impressive.

And equipped with our current knowledge of leverage and its implementation we’ll look at properly combining the various equity strategies, before moving on to bonds.

So, until next time,

Happy Trading.

If you have enjoyed this post follow me on Twitter and sign-up to my Newsletter for weekly updates on trading strategies and other market insights below!

Leave a Reply