Market timing refers to the fact that by judiciously choosing entry and exit methods in a given market you can out-perform buy-and-hold.

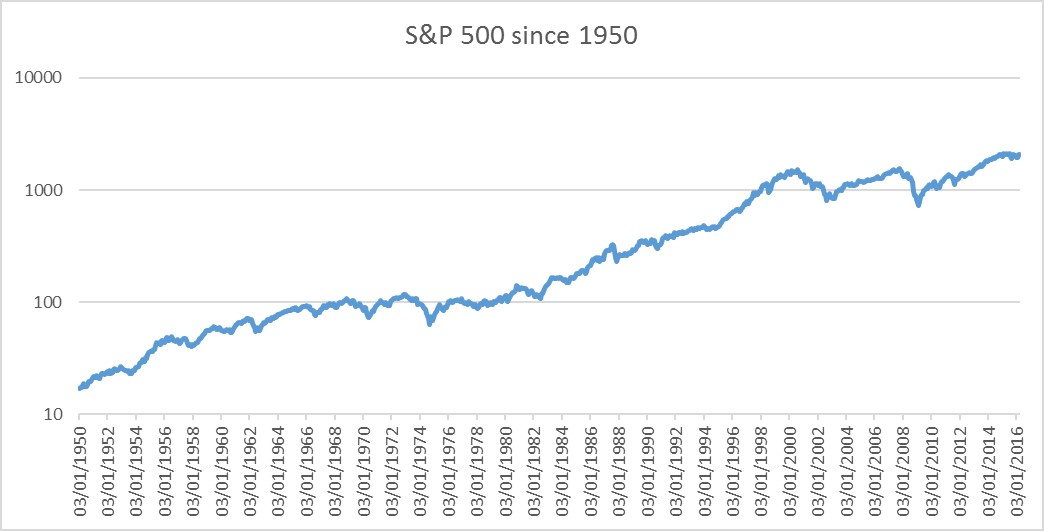

The first question of course is why you should buy-and-hold in the first place.

The idea stems from the equity markets. Historically they have risen. The famous chart of course is the S&P 500 over the last 65 years:

So why should this happen?

Economic reasoning is behind this argument. Long term macro and micro economic growth policy leads to companies and assets to appreciating in value. Furthermore, some assets are riskier than others, and hence should appreciate faster than others, for instance equities have outperformed bonds in the long-run.

Aside from equities you also have indices for other asset classes such as bonds and commodities (see the previous post, Money Growth: Trade it Like a Hedge Fund).

So to come back buy-and-hold: the reason is that it’s not possible to out-perform this strategy. Holding the market to get the market return is the optimal strategy, but beating the market in a consistent basis is impossible. This is the claim that the Efficient Market theoreticians make. Therefore buy tracker funds.

But is this true?

If it were, the hedge fund business would have gone out of business some time ago.

On the other hand if market-timing were some deeply intuitive ability only several traders had, then you wouldn’t have such a large number of people out-performing the markets on a risk-adjusted basis (just look at the equity value traders or the commodity trend followers).

So the truth must lie somewhere in between. In actuality the whole point of making a return is to understand why the market should pay you in the first place.

For equities you’re in essence participating on the companies’ upside, but you will take the pain of economic crashes. You’re getting paid for that risk, by holding appreciating equities.

So are there other shorter-term risks that can be exploited (let’s face it the average time between recessions is 5 years, which is a pretty long time to hang-around timing the market).

In this article I’ll give you two simple methods of timing the Equity markets, and look at an equally simple method for FX, in each case out-performing the equity market on a risk-adjusted basis.

Two of these ideas are centred around momentum, the idea that markets tend to move in a given direction for a period of time.

The third method looks to identify a source of risk for which you can get paid handsomely.

Let’s start out with equities.

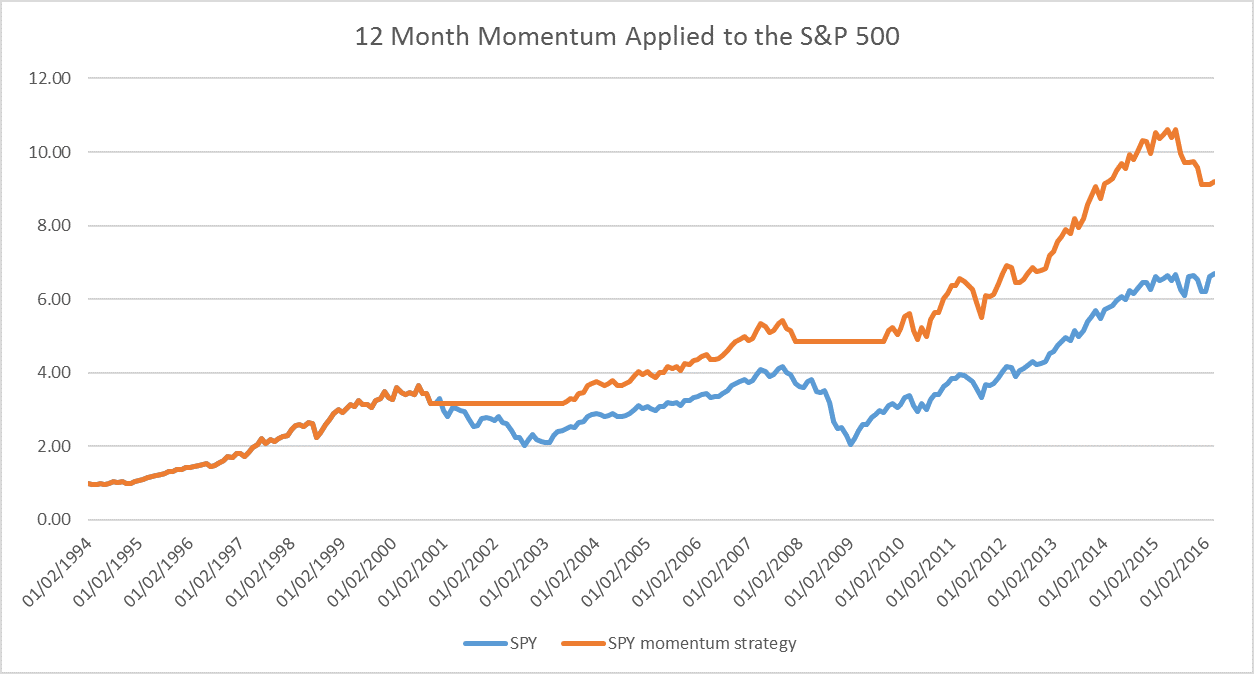

12-Month Momentum in the Equities Markets

We’ll start out by looking at momentum in the Equities markets. In particular, 12-month momentum. The rule is easy. If equities are higher than they were 12 months ago, go long at the start of this month. Otherwise stay flat. Repeat at the start of every month. How does this compare to the equity market itself? Here it is applied to the S&P 500 benchmark:

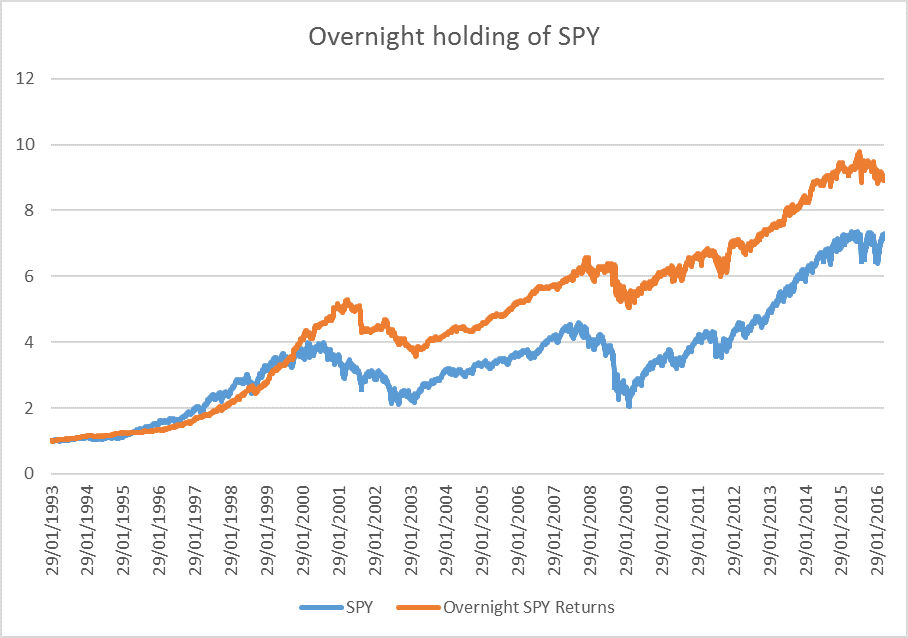

Equity Overnight risk premium

In this section we look at a very short term strategy. It is based on the fact that holding assets through periods where there is no trading, is risky. So being willing to do that, should pay you. In equities you can adopt a strategy of holding the market overnight. How? Buy the SPY ETF at the close, and sell on the open the next day.

Of course, you might say, that now-a-days there is 24-hour trading, etc. But if you look at the volumes outside of regular trading hours, they are a tiny fraction of what actually gets traded during RTH (regular trading hours). So this session might as well be non-existent.

So what does such a naïve strategy look like? Here it is:

It also turns out that the risk is half of the SPY. Adjusting for that, the SPY overnight strategy would have yielded much more.

3-Month Momentum in the FX Markets

3 Month momentum works in and of itself in the currency markets. The approach is straightforward. Buy the currency that appreciated most, and sell the one that depreciated most. However, you can select your currencies even further, by looking at the highest and lowest yielding currency pairs, in essence trading 3 Month momentum on the back of carry. Why should this work? For a simple reason that carry strategies suffer from catastrophic “left-tails.” This is symptomatic for most strategies that seek to gain regular incomes. (It’s actually true for jobs as well: you keep on making a salary, until one day you get fired, and then that’s it, big P&L drop-off).

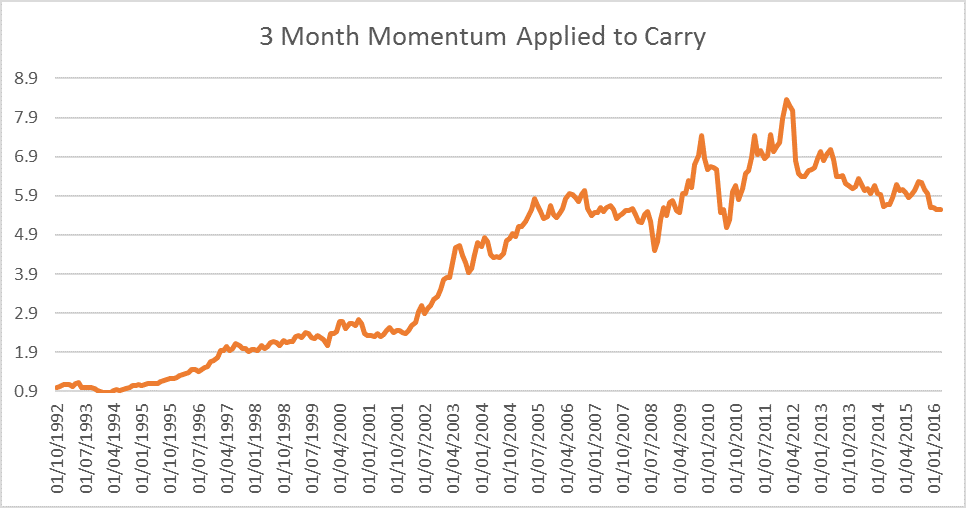

So how does a 3 month momentum strategy look like where you filter for only carry currencies. Here it is:

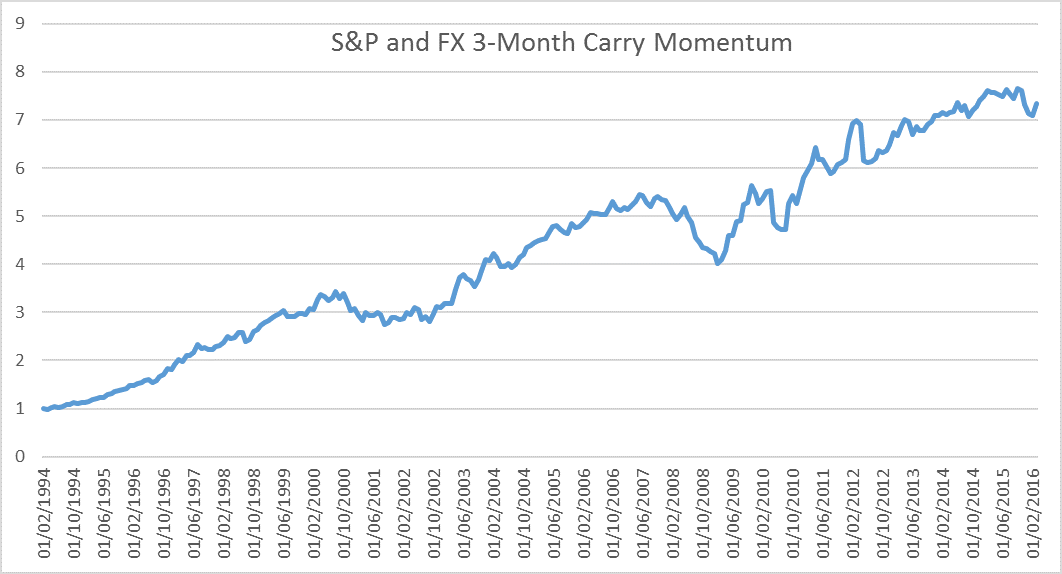

The performance is similar to the S&P 500 over the same period (in terms of overall return). But the big difference is that the FX strategy is not correlated the Equity strategy. When the S&P 500 goes down the FX market makes money, and vice versa. So there is a hedging benefit to be derived. How does this manifest itself? Let’s combine the S&P 500 with our simple FX 3-month momentum carry strategy:

This has a Sharpe ratio of 1.0. And from previous discussions on using Kelly betting, leveraging appropriately leads to an average doubling time of your money of less than 18 months.

Conclusion

Ultimately all trading strategies need to satisfy these two criteria:

- Have they worked for significant time in the past?

- Is there a fundamental reason why they should work in the past?

The beauty about creating these kinds of portfolios is that they satisfy both points. The fundamental reasons they keep working, are basic underlying economic factors that in the long-run will continue to apply.

Of course the issue is always that one asset-class isn’t always going to provide appreciation.

Therefore, diversify across several. In the example above we diversified between Equities and FX.

This can also be improved by adding the Commodity strategy discussed in the previous post.

In essence in this post we have seen how simple timing strategies can produce outstanding results. From the short term (overnight) to the longer-term (3-month and 12-month momentum rebalanced on a monthly basis).

If you have enjoyed this post follow me on Twitter and sign-up to my Newsletter for weekly updates on trading strategies and other market insights!

Leave a Reply