Taking control of your trading numbers is very important. Here is an example of how straight forward it can be to run backtests in Excel. If you want to follow along in the article series, follow the link: Taking Control of Your Trading Numbers

4 Economic Indicators to help your Fundamental Trading of GBP– Part II

In this article I’ll follow up from Part I, on using the UK Services PMI to trade the GBP. The questions we’ll answer are: What economic indicators for GBP are out there and which can we use? How do you set up a macro system? What does it mean to trade a basket of currencies […]

GBP, Brexit, and Fundamentals

I’ve been asked lots of questions as to how to determine the next moves in GBPUSD. There have been many arguments for a bottoming out at the current levels, as well as for a continuation given the strength of the downward move experienced post Brexit. In this article I’ll try to get a handle on […]

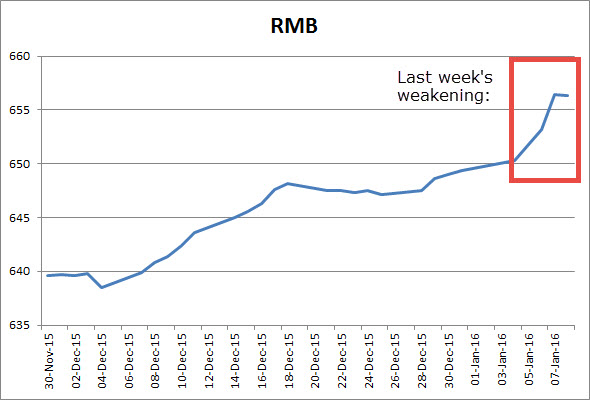

Fishing for Opportunity in New Markets: Chinese Futures Markets and Emerging Market FX

A favorite investment technique that has been publicized widely is trend-following. Everybody has heard of the Turtle Traders, a group of novices trained by Richard Dennis in the art of channel-breakouts, a system developed decades earlier by Richard Donchian. In this article we will look at the current performance of trend-following in the Western futures […]

Trading News Announcements Systematically: EURUSD and Non-Farm Payrolls

I’ve written several articles on what happens during news announcements, and associated quick trading strategies. But from a regular trader’s perspective, surely there must be another way to approach these things. In this article I’ll given an overview as to how to trade these news announcements in a slightly more leisurely way, and see if […]